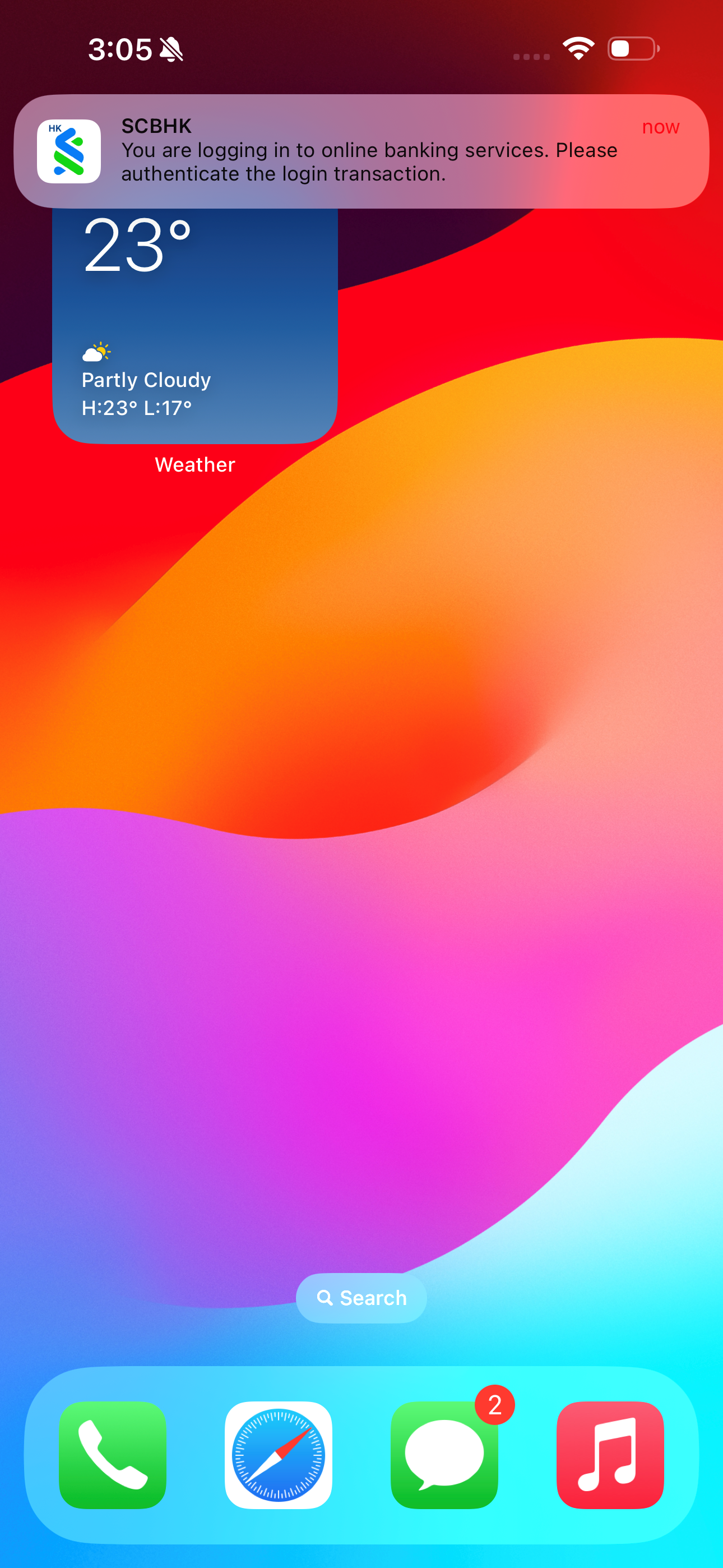

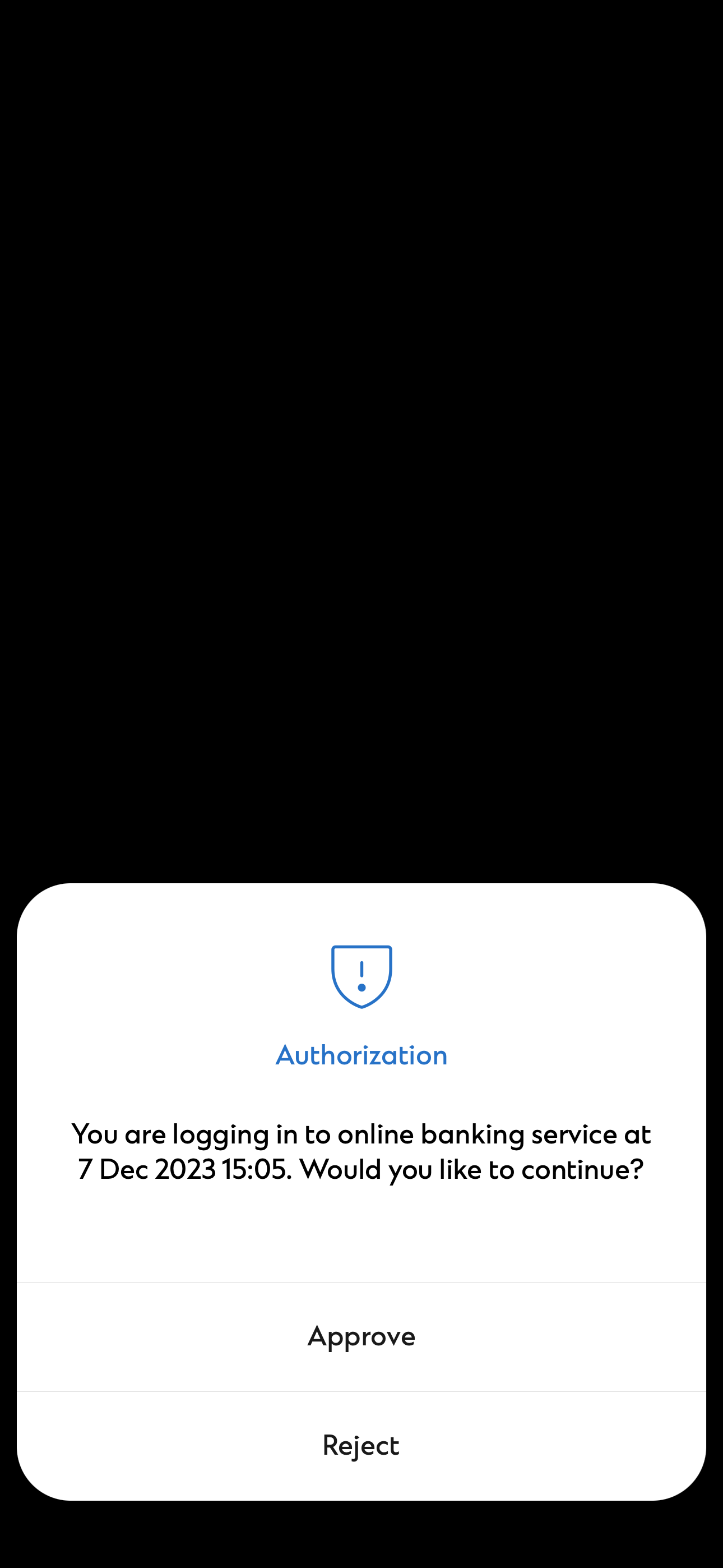

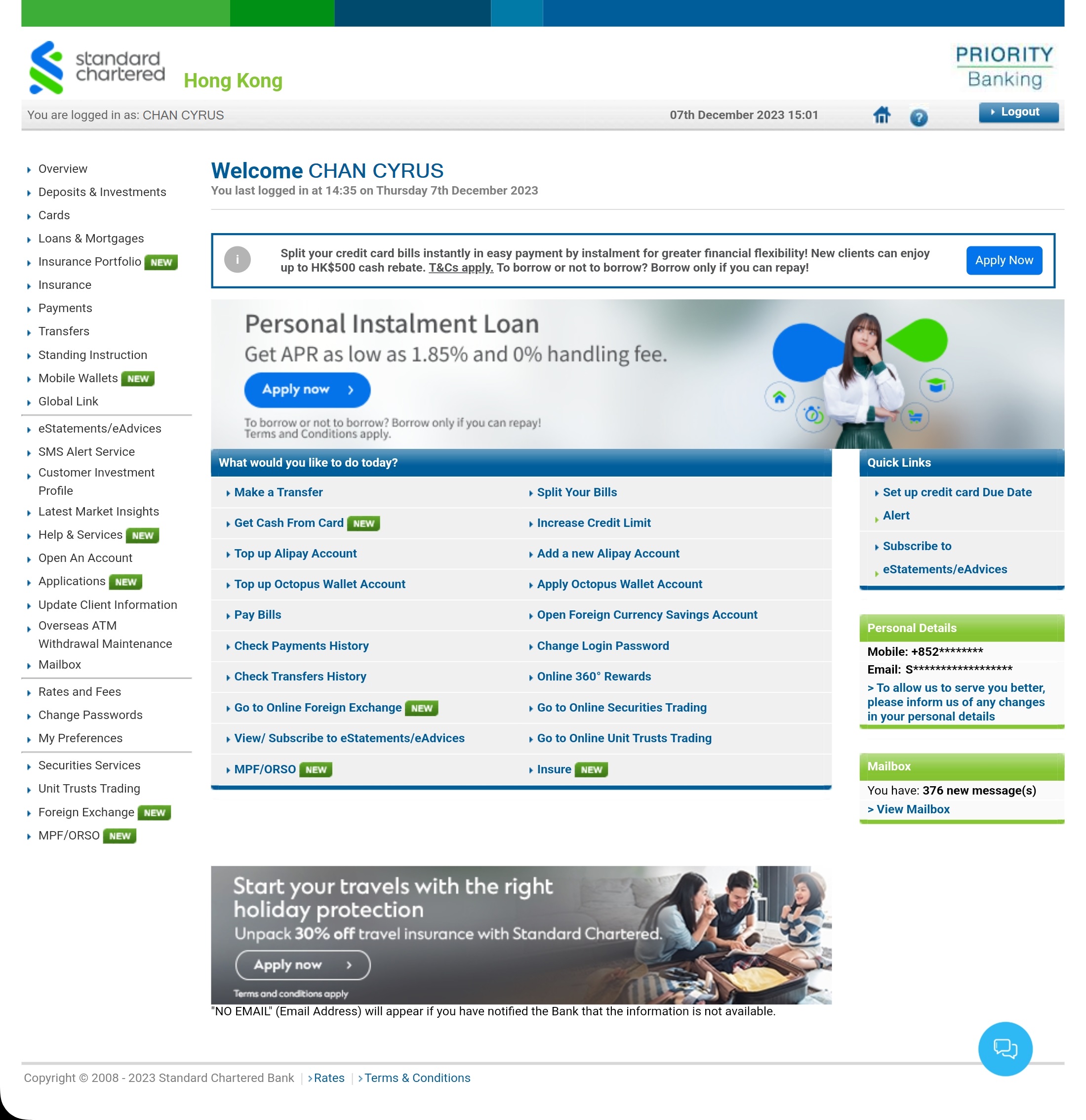

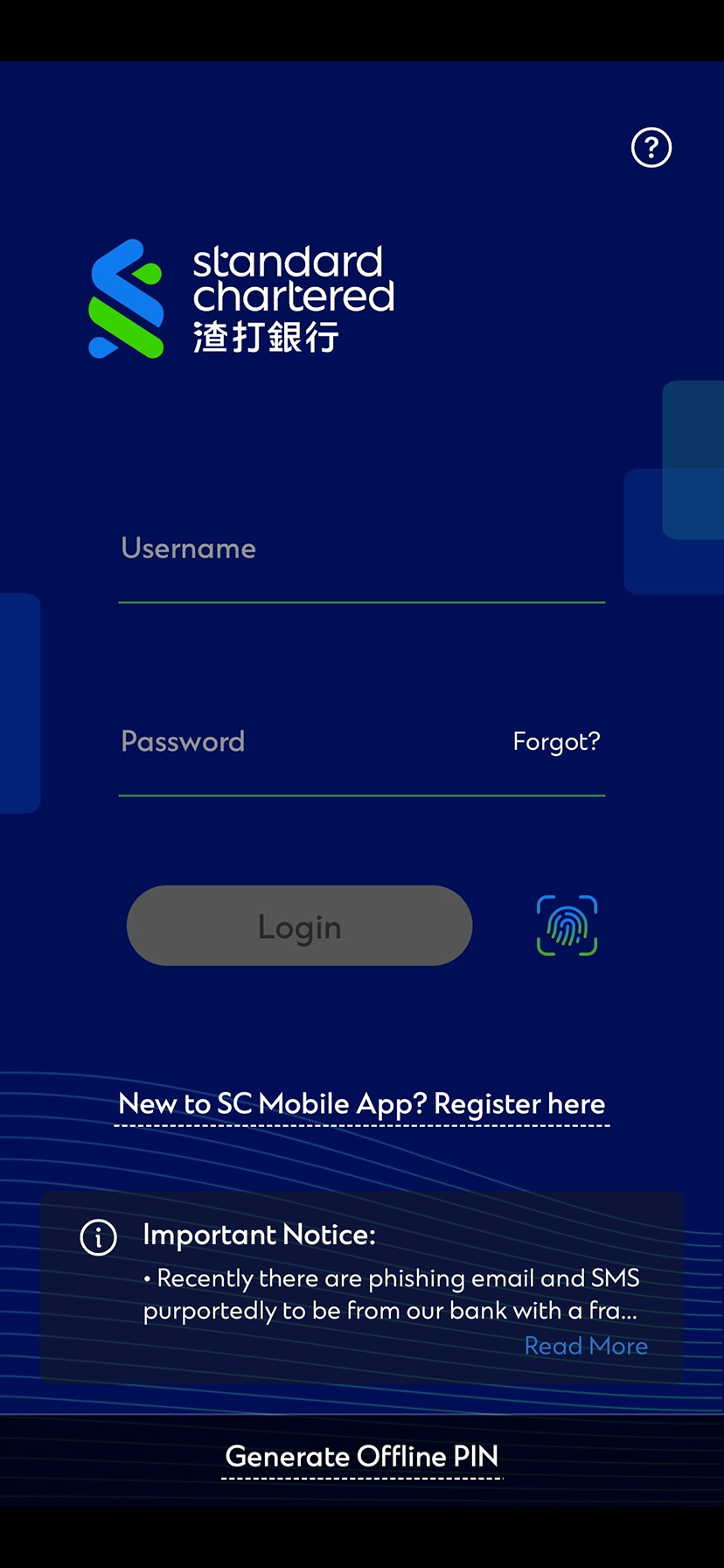

SC Mobile Key – Turn your phone into a security token and makes authentication easy at anytime and anywhere.

HOW TO REGISTERStep 1

Log in to your SC Mobile App and you will be prompted to enable SC Mobile Key.

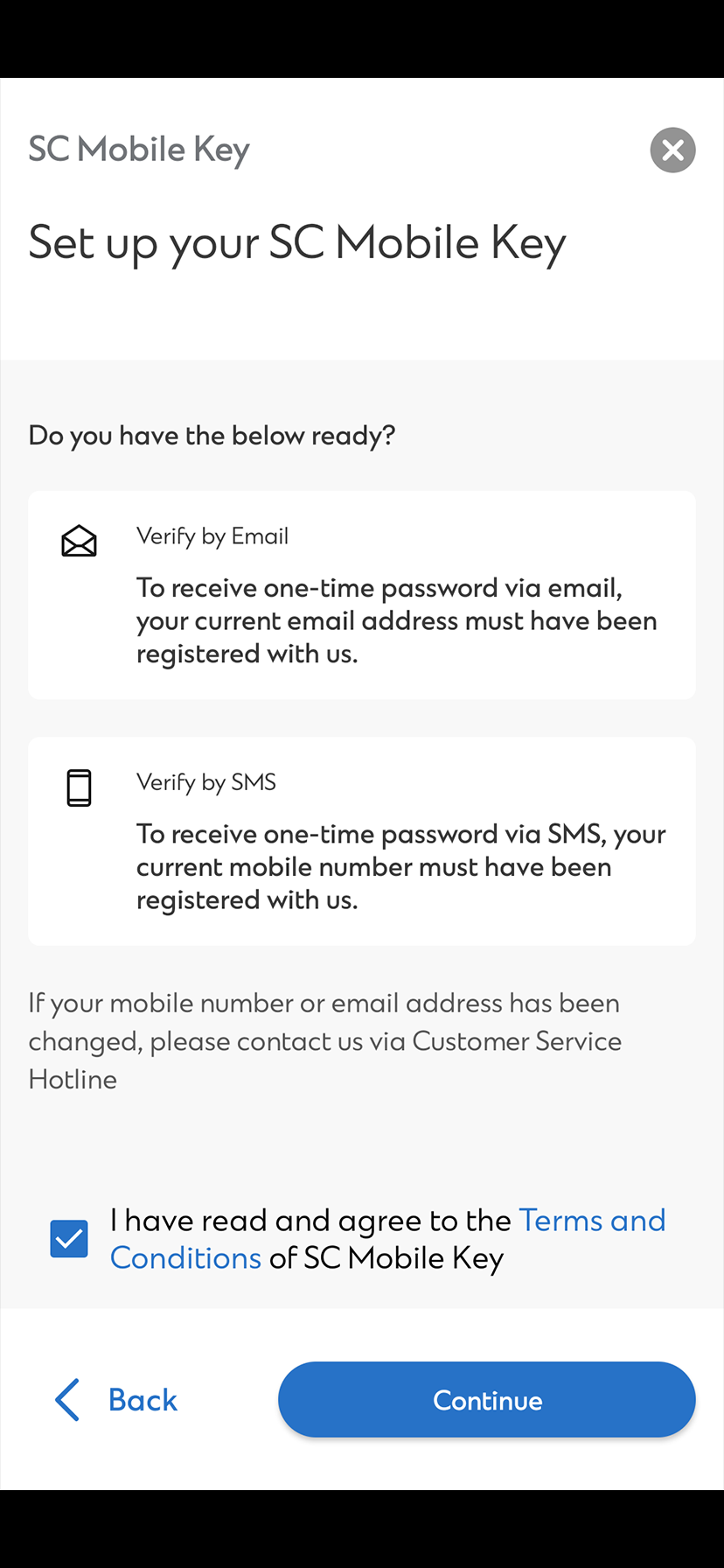

Step 2

Read and accept the Terms and Conditions. Then, tap 'Continue'

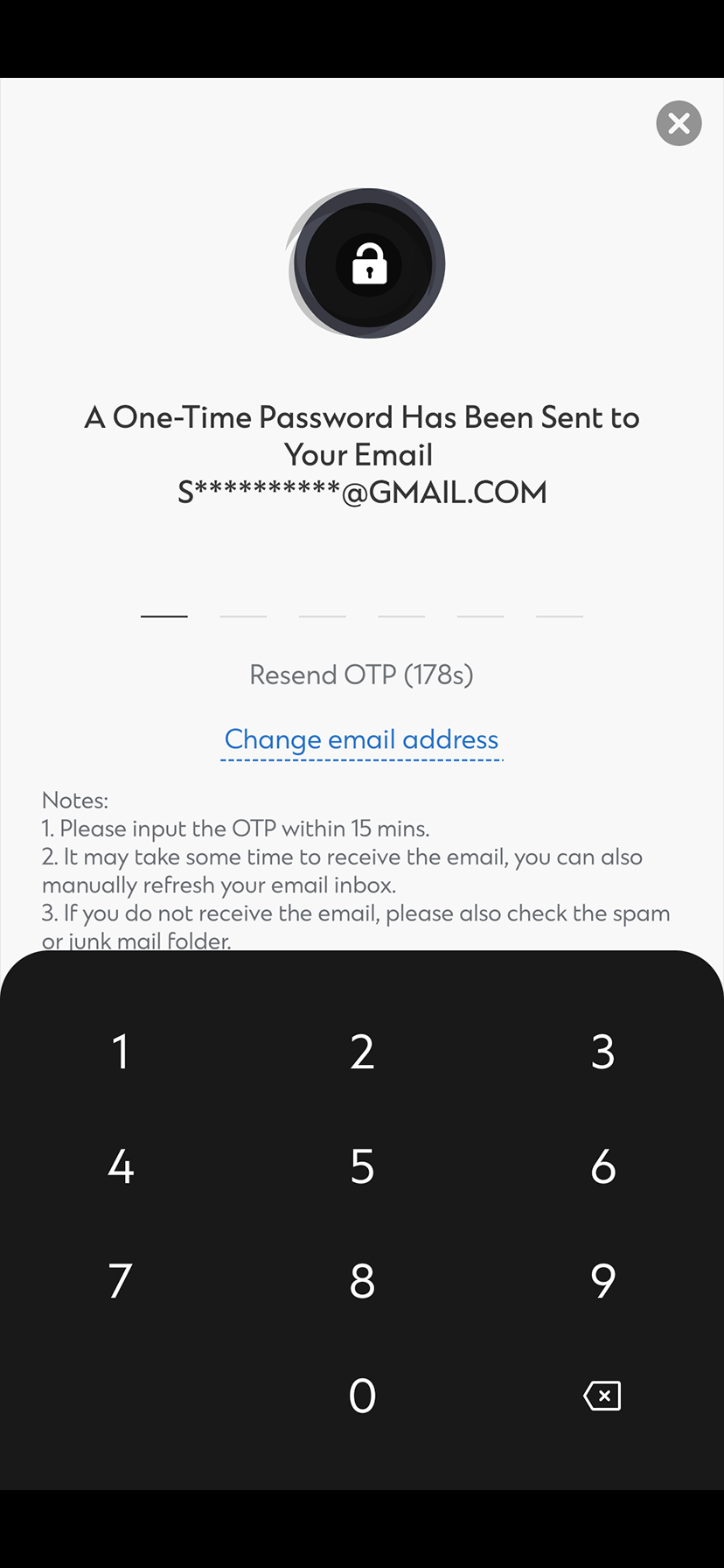

Step 3

Enter the OTP sent to you via email.

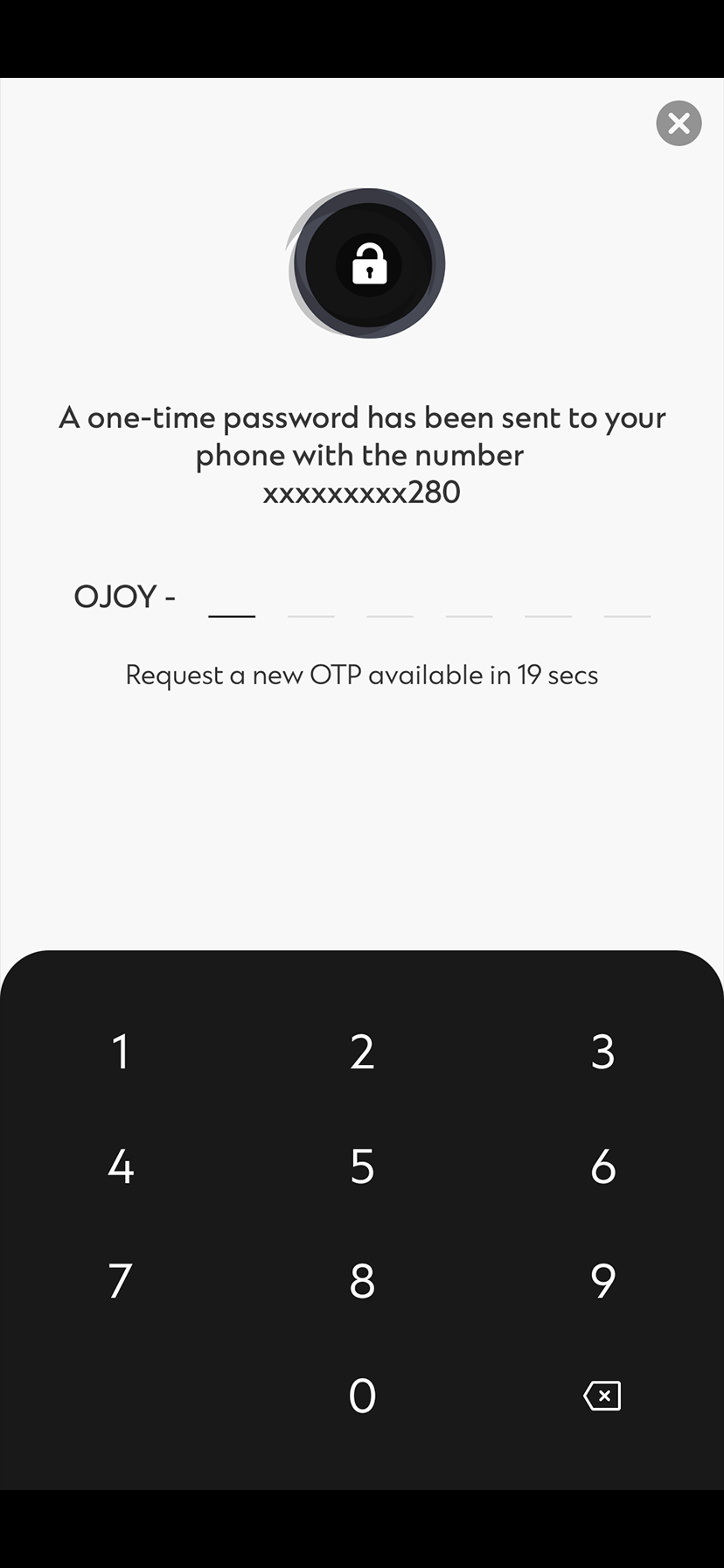

Step 4

Enter the OTP sent to you via SMS.

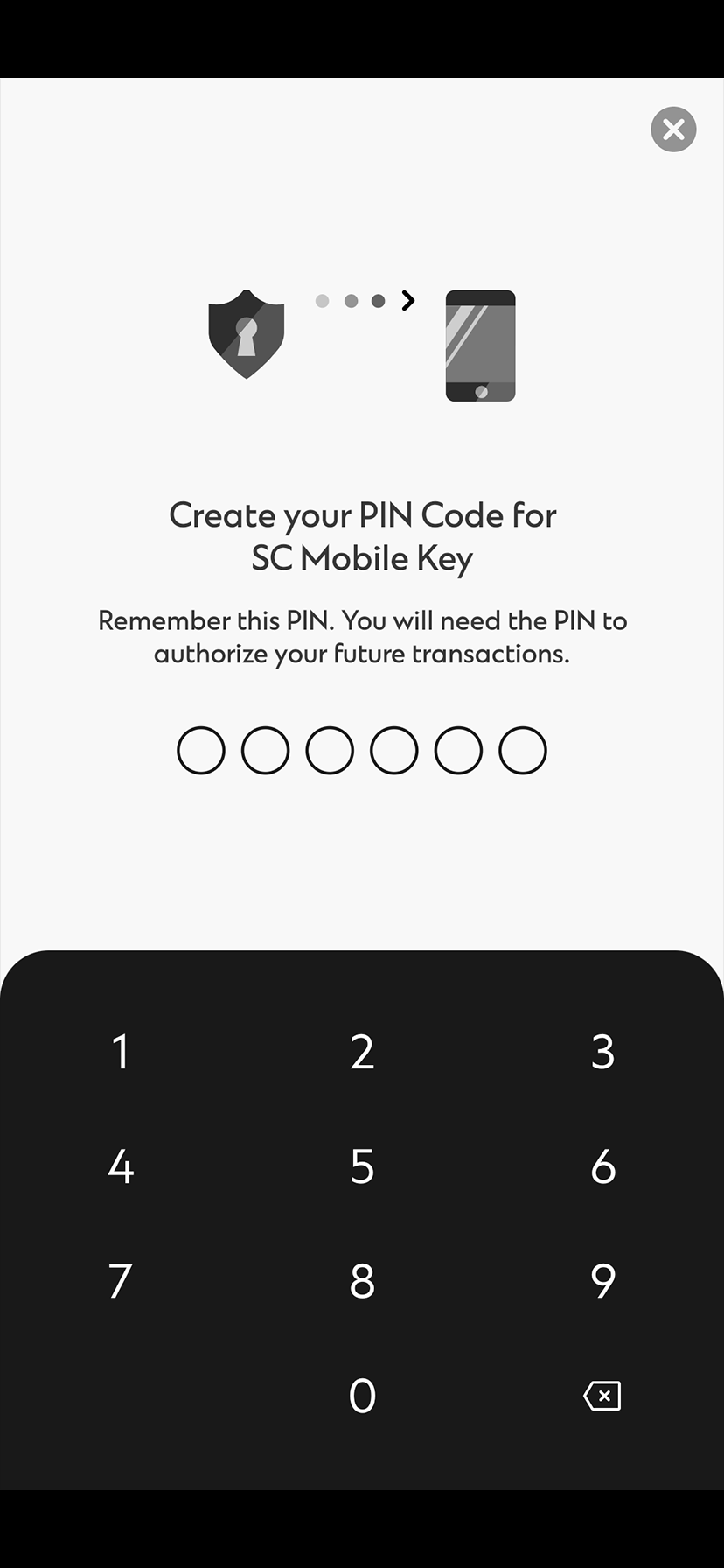

Step 5

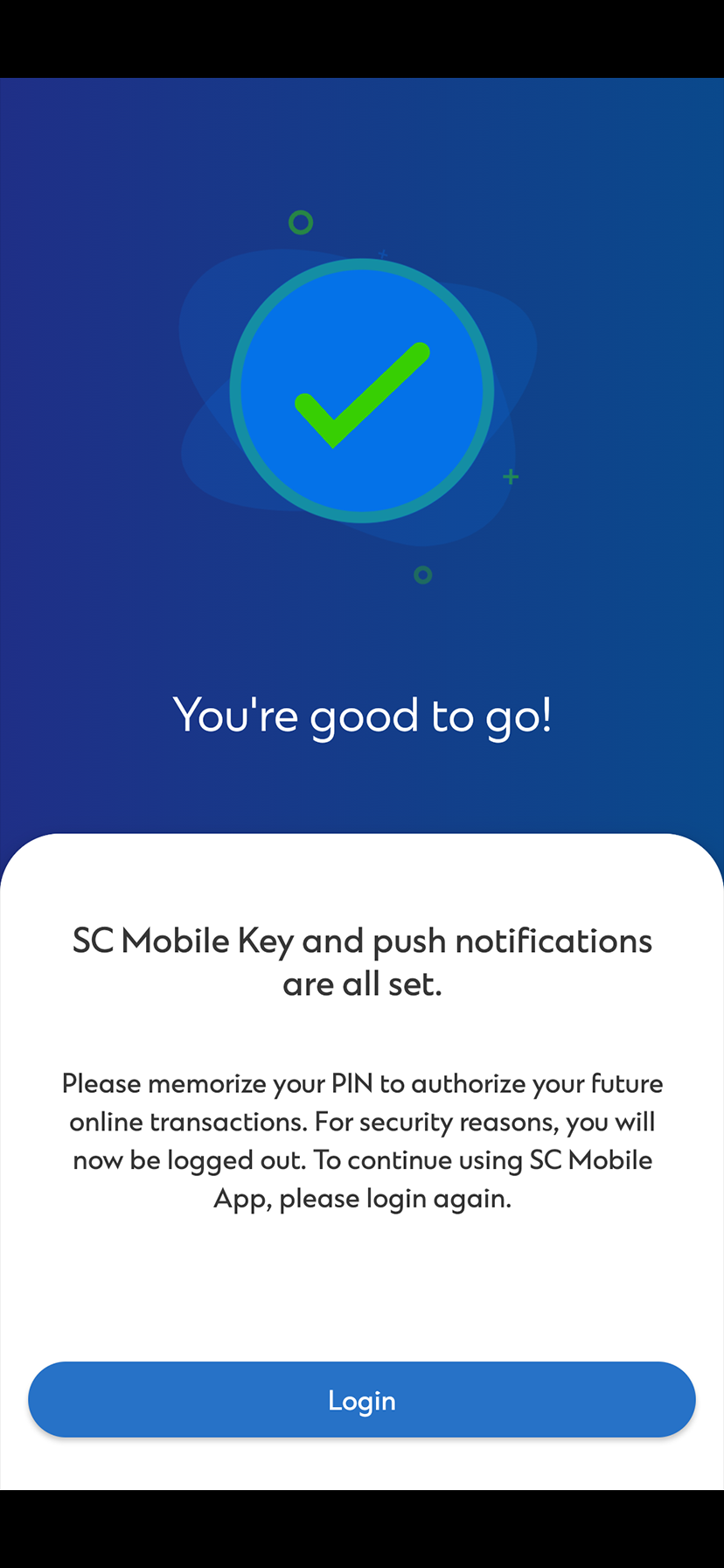

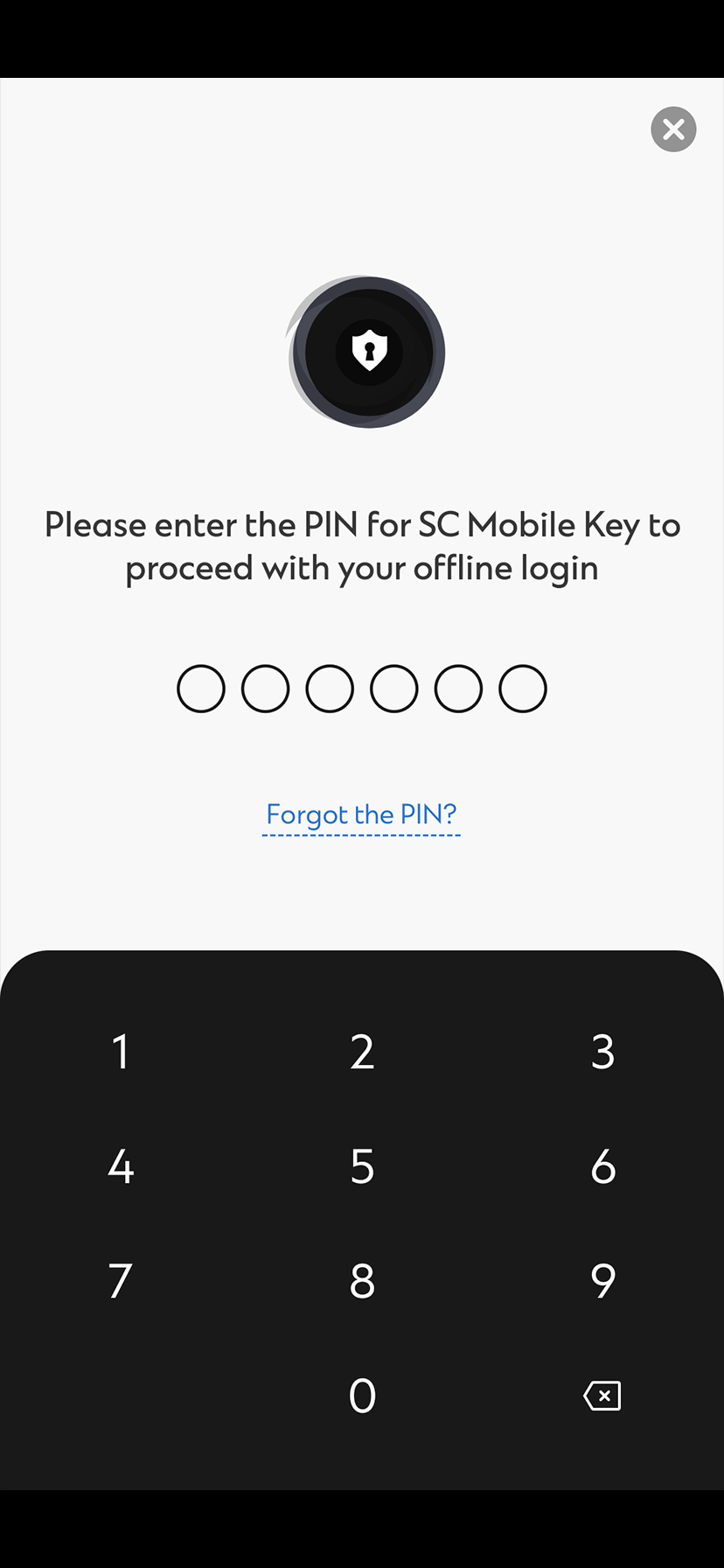

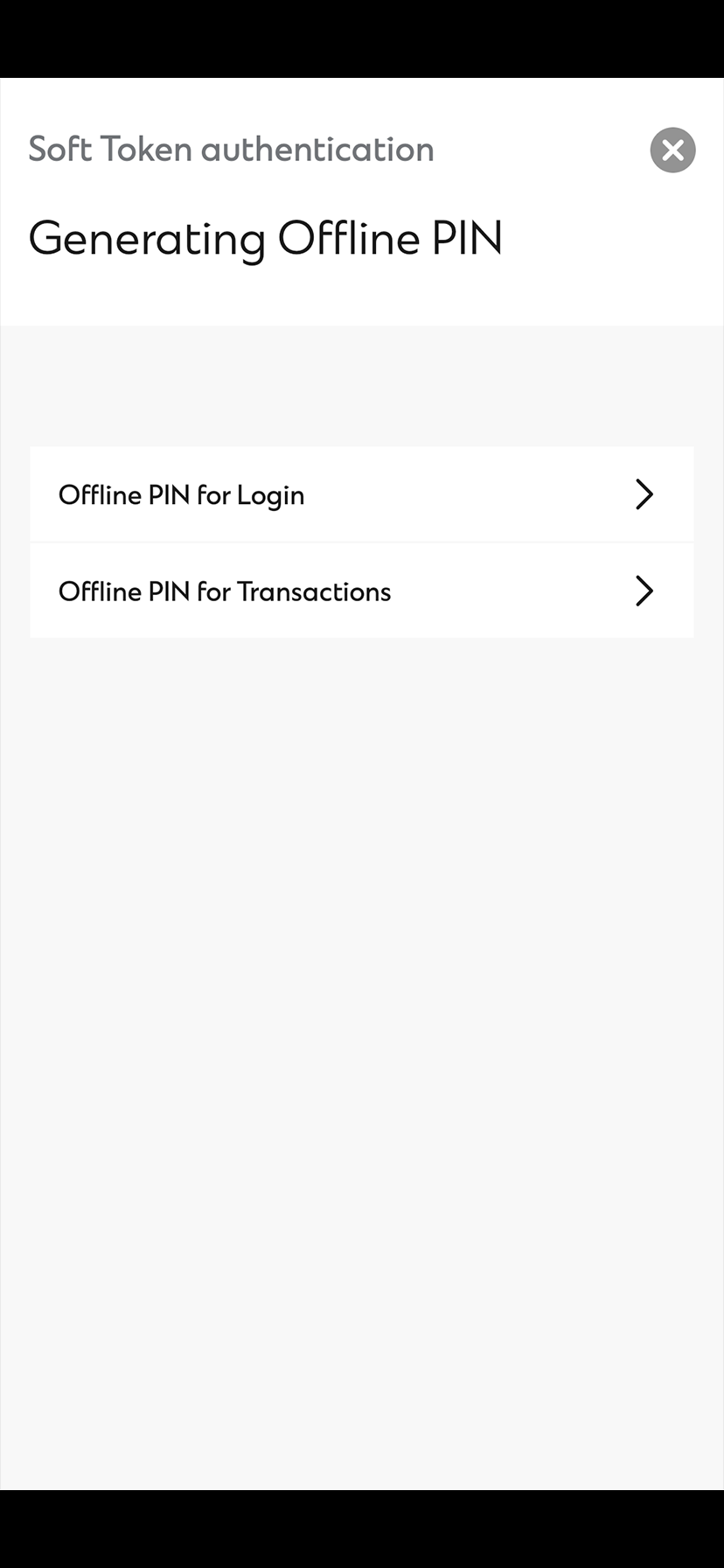

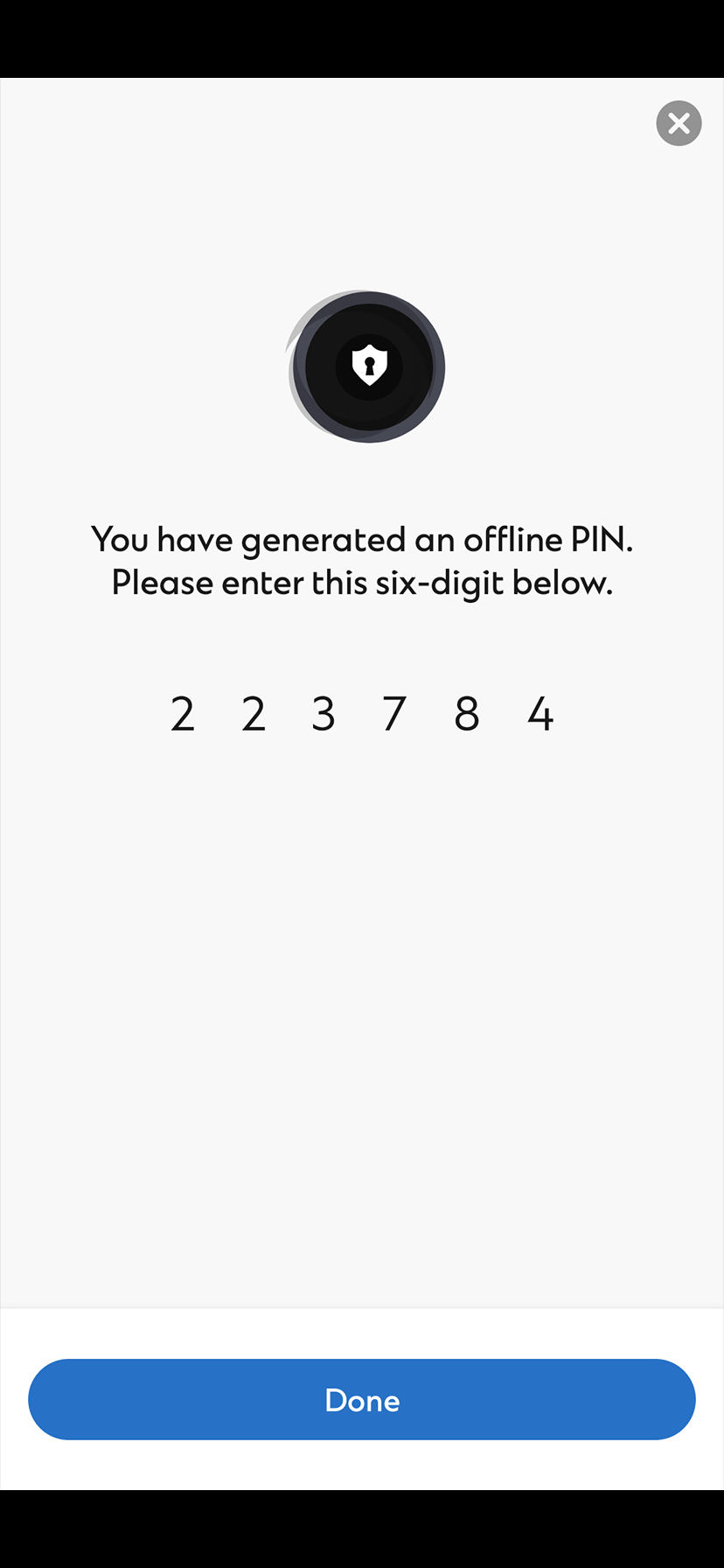

Set up a new 6-digit PIN

Step 6

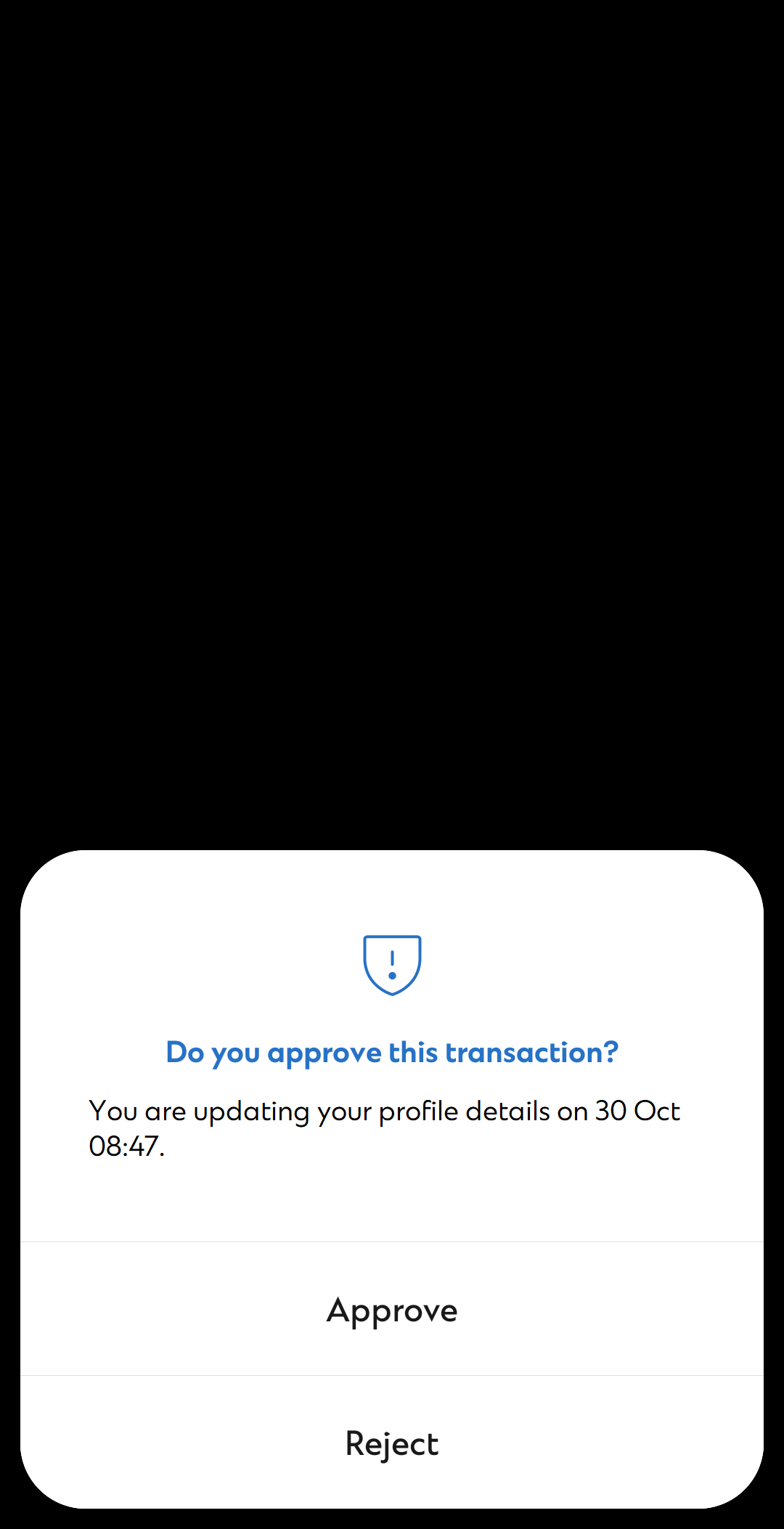

You can now use your 6-digit PIN with your registered mobile phone to approve all future transactions.