Risk Disclosure Statement for RMB Deposit Services

- Renminbi (“RMB”) exchange rate, like any other currency, is affected by a wide range of factors and is subject to fluctuations. Such fluctuations may result in gains and losses in the event that the client subsequently converts RMB to another currency (including Hong Kong dollars); and

- RMB is currently not freely convertible and conversion of RMB through banks in Hong Kong is subject to restrictions specified by the Bank and regulatory requirements applicable from time to time. The actual conversion arrangement will depend on the restrictions prevailing at the relevant time.

Foreign Exchange Risk Disclosure Statement

- Foreign Exchange involves risks. Fluctuation in the exchange rate of a foreign currency may result in gains or losses in the event that the client converts a time deposit from the foreign currency to HKD.

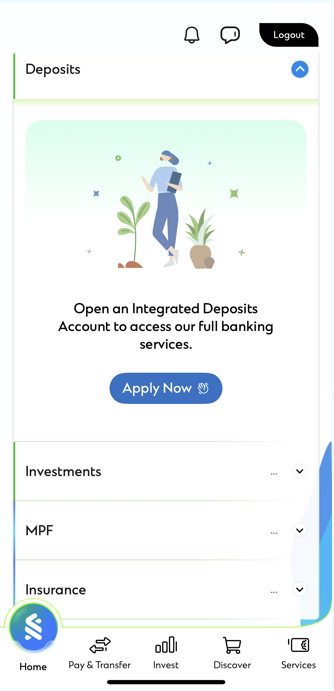

myWealth Risk Disclosure Statements

- Investment involves risks. The prices of investment products fluctuate, sometimes dramatically and the worst case may result in loss of your entire investment amount. Past performance is no guide to its future performance.

- Investors should read the terms and conditions contained in the relevant offering documents and in particular the investment policies and the risk factors and latest financial results information carefully and are advised to seek independent professional advice before making any investment decision.

- Investors should consider their own investment objectives, investment experience, financial situation and risk tolerance level.

Notes:

This webpage does not constitute any prediction of likely future price movements. Investors should not make investment decisions based on this webpage alone. This webpage has not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.