Important Notice

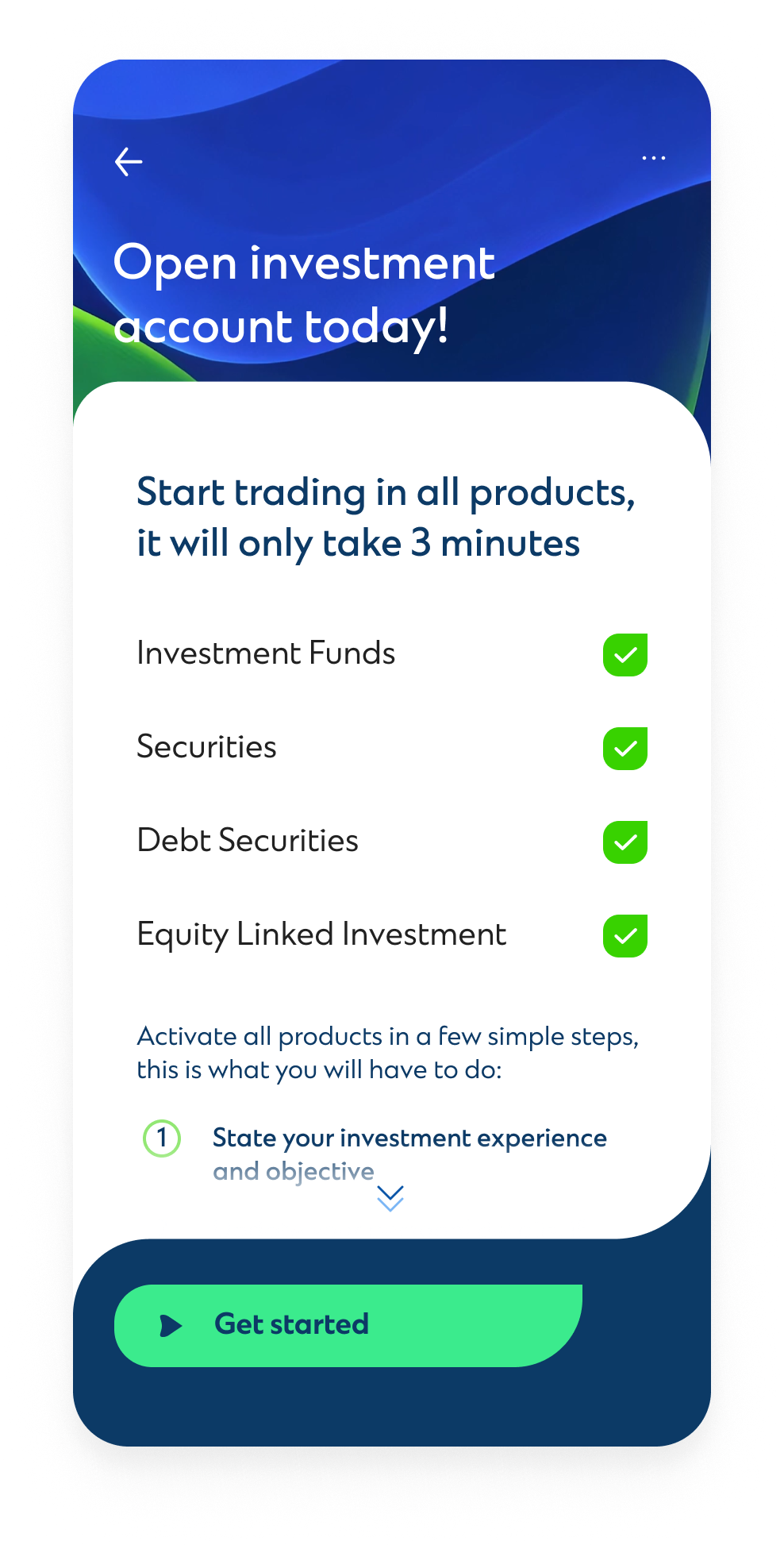

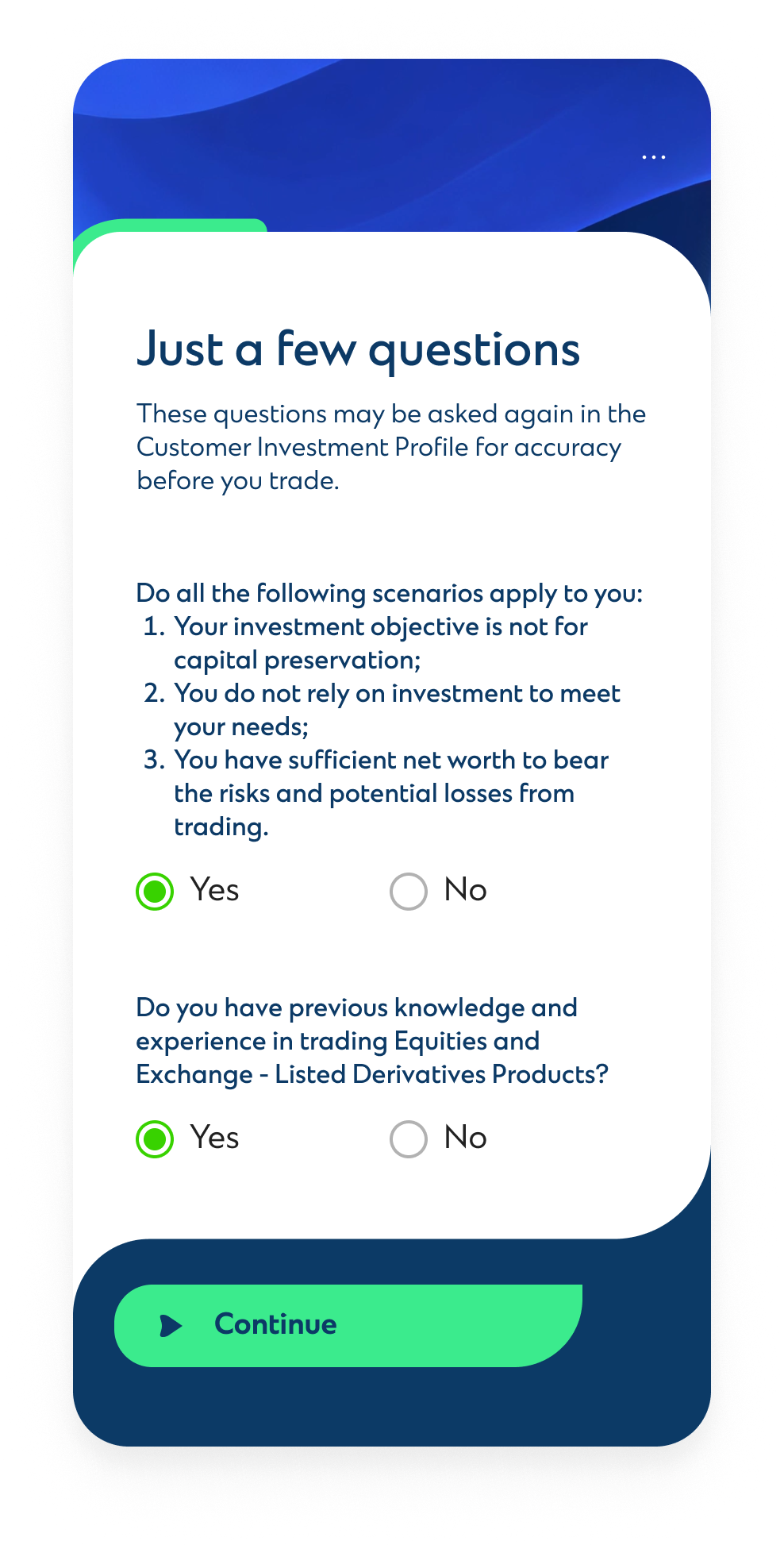

Investment Fund is an investment product and some Investment Funds would involve derivatives. The investment decision is yours, but you should not invest in Investment Fund unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

Risk Disclosure Statement

Investment involves risks. The prices of units/ shares of unit trusts or mutual funds fluctuate, sometimes dramatically and the worst case may result in loss of your entire investment amount. It is as likely that losses will be incurred rather than profit made as a result of buying and selling unit trusts or mutual funds. Past performance of any Investment Fund is no guide to its future performance.

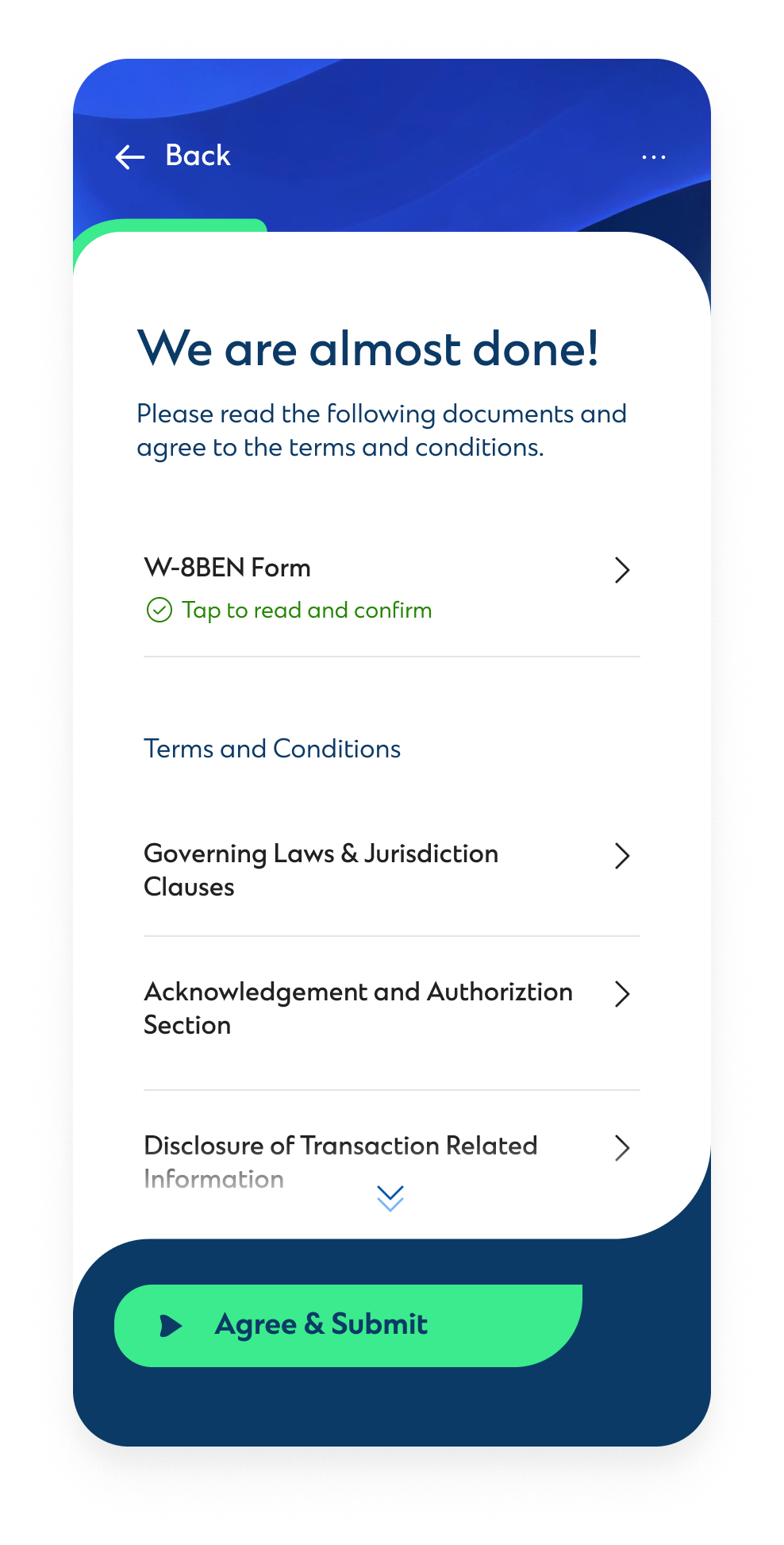

Investors should carefully read the relevant offering documents and in particular the Terms & Conditions contained therein, the investment policies and the risk factors and latest financial results information. It is desirable that the Investor seeks independent financial advice with respect to any investment decision.

Investors should ensure they fully understand the risks associated with unit trusts or mutual funds and should also consider their own investment objective, investment experience, financial situation and risk tolerance level before making any investment decision.

Disclaimer

Various funds are described on this website. These may involve market risk, volatility risk, counterparty risk, credit risk, liquidity risk, concentration risk and risk of loss from use of financial derivatives instruments, amongst other risks. Please refer to relevant fund factsheets for details. Investors should not base on information contained in this website alone to make investment decisions. This website is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this website is prohibited and it is only intended for viewing by existing investors in the investment products distributed by us which are authorized for sale to the public in Hong Kong. Persons in respect of whom such prohibitions apply or persons other than those specified above must not access this website. It is your responsibility to be aware of and to observe all applicable laws and regulations of any relevant jurisdiction. By proceeding, you are representing and warranting that the applicable laws and regulations of your jurisdiction allow you to access the information.

Information contained in this website does not constitute investment advice. Potential investors should note that investments can involve significant risks and the value of an investment may go down as well as up. No assurance can be given that the investment objective of any investment products will be achieved. The page may contain information and material relating to funds that are authorized by the Securities and Futures Commission in Hong Kong, however, such authorization does not imply official approval or recommendation. This website is prepared and issued by Standard Chartered Bank (Hong Kong) Limited, which is a corporation licensed by the Securities and Futures Commission in Hong Kong to engage in Type 1 (dealing in securities); Type 4 (advising on securities); Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activities. The contents of this website have not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.

Risk Disclosure Statement for Securities Investment Services

Investment involves risks. The prices of stocks fluctuate, sometimes dramatically and the worst case may result in loss of your entire investment amount.

Past performance of any stocks is no guide to its future performance. Investors should consider their own investment objectives, investment experience, financial situation, risk tolerance level and carefully read the Terms and Conditions of relevant Stock Investment Services before making any investment decision.

Important Notes of SMS/Email Communications

Client is responsible for charges that may be imposed by individual mobile network operator (including but not limited to roaming service charges).

You will not receive a personal call to inform you of your order status if you have enrolled for SMS/ email order confirmation or placed your order through the online channel. Please use order status enquiry function to check the updated status of your order. SMS order confirmation and price alert services require pre-registration and are subject to relevant Terms and Conditions.

Standard Chartered Bank (Hong Kong) Limited (the “Bank”) gives no warranty as to the timeliness or reliability of the SMS/ email communications and shall have no liability in the event that the client fails to receive such communication.

Important Notes of Online Stock Trading and SC Equities

The Bank will not be liable for any loss or damage to you as a result of making the Online Stock Trading Services available to you, unless the loss or damage is directly caused by our negligence or our willful default.

For more details and the risks involved, please refer to the Stock Investment Services Terms and Conditions or contact our branch staff.

Stock Investment Services Terms and Conditions

Download here

Note

This webpage does not constitute any prediction of likely future price movements.

Investors should not make investment decisions based on this webpage alone.

This webpage has not been reviewed by the Securities and Futures Commission or any regulatory authority in Hong Kong.

Important Notes of Debt Securities Services

The price of bonds/structured notes can and does fluctuate and the price of any individual bonds/structured notes may experience upward or downward movements and may even become valueless. There is an inherent risk that losses may be incurred rather than profits made as a result of trading bonds/structured notes. Independent assessment of the risk and appropriateness of the transaction in light of your own objectives and circumstances, including the possible risks and benefits of entering into such transaction, should be considered before entering into any transaction.

Important Notes of Equity Linked Investment

Equity Linked Investments are structured products involving derivatives. The Investment decision is yours but you should not invest in the Equity Linked Investments unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

SFC authorization does not imply official recommendation, it is not a recommendation or endorsement of a product, nor does it guarantee the commercial merits of a product or its performance.

ELI Contracts are NOT equivalent to time deposits.

The price or value of the Equity Linked Investments (ELIs) fluctuates, sometimes dramatically. The price or value of the ELIs may move up or down, and may even become valueless. It is as likely that losses will be incurred rather than profit made as a result of subscribing for, buying and selling the ELIs. Investors should therefore carefully consider whether such transactions are suitable in light of their financial position and investment objectives before entering into such transactions.

Not principal protected: ELIs are not principal protected. You may suffer a loss if the prices of the underlying asset(s) of an ELI go against your view. In extreme cases, you could lose your entire investment.

Limited potential gain: the potential return on your ELI may be capped at a predetermined level specified by the issuer.

Credit risk of the issuer: when you purchase an ELI, you rely on the credit-worthiness of the issuer. In case of default or insolvency of the issuer, you will have to rely on your distributor to take action on your behalf to claim as an unsecured creditor of the issuer regardless of the performance of the reference asset(s).

No collateral: ELIs are not secured on any assets or collateral.

Limited market making: issuers may provide limited market making arrangement for their ELIs. However, if you try to terminate an ELI before maturity under the market making arrangement provided by the issuer, you may receive an amount which is substantially less than your original investment amount.

Investing in an ELI is not the same as investing in the reference asset(s): during the investment period, you have no rights in the reference asset(s). Changes in the market price of such reference asset(s) may not lead to a corresponding change in the market value and/or potential payout of the ELI.

Conflicts of interest: issuer of an ELI may also play different roles, such as the arranger, the market agent and the calculation agent of the ELI. Conflicts of interest may arise from the different roles played by the issuer, its subsidiaries and affiliates in connection with the ELI.