This website and videos are being distributed for general information only and does not constitute an offer, recommendation, solicitation or invitation to enter into transaction or adopt any hedging, trading or investment strategy nor does it constitute any prediction of likely future movements in rates or prices or any representation that any such future movements will not exceed those shown in any illustration. The information contained in the website and videos is for general evaluation only and has not been prepared to be suitable for any particular person or class of persons. Any investment or ideas discussed may not be suitable for all investors. You should read and understand the documents of the products before making any investment decision. You are advised to exercise your own independent judgment (with the advice of your professional advisers as necessary) with respect to the risks and consequences of any matter contained herein. Past performance is not indicative of future results and no representation or warranty is made regarding future performance. You are fully responsible for your investment decision, including whether the product or service described (if any) is suitable for you. The products involved are principal at risk and you may lose all or part of your original investment amount. We expressly disclaim any liability and responsibility for any loss arising directly or indirectly (including special, incidental or consequential loss or damage) from your use of contents in the website and videos, however arising, and including any loss, damage or expense arising from, but not limited to, any defect, error, imperfection, fault, mistake or inaccuracy with the contents, or associated services, or due to any unavailability of the document or any part thereof or any contents. No part of this website and videos may be reproduced in any manner without the written permission of Standard Chartered Bank.

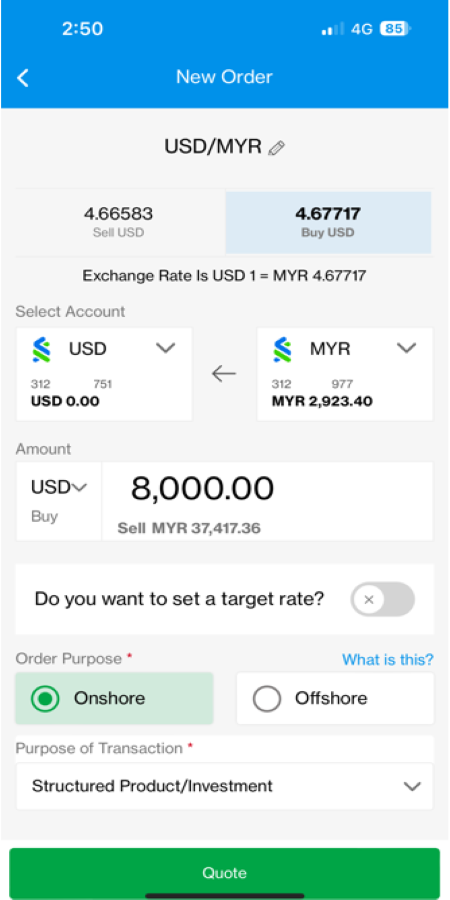

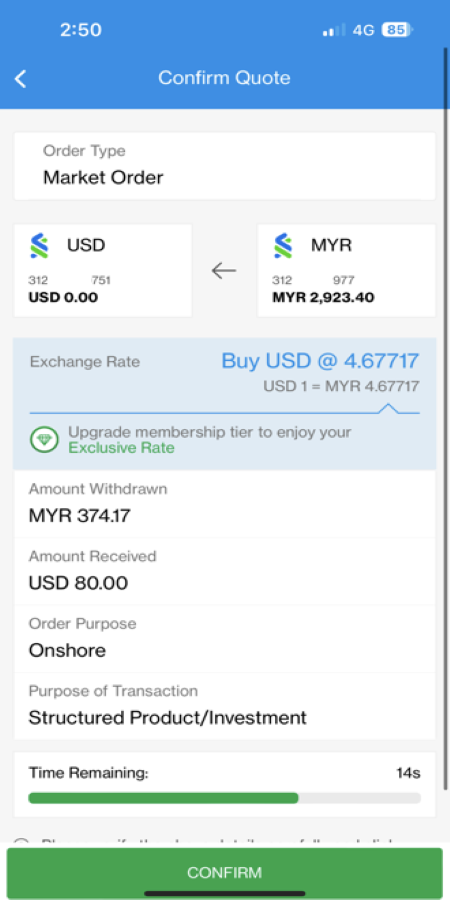

Foreign exchange involves risks. Fluctuation in the exchange rate of a foreign currency may result in gains or significant losses in the event deposits of one currency is converted to another currency (including Malaysian Ringgit).

*Only deposits are protected by PIDM up to RM250,000 for each depositor.

*Click here for PIDM’s DIS Brochure