Table of Contents

- Exploring the relevance of Takaful in sophisticated financial planning

- Structural differences between takaful and conventional insurance models

- Takaful solutions for private clients and business entities

- Strategic value of takaful coverage and its portfolio contribution

- Choosing the right takaful provider: Due diligence for long-term peace of mind

- Rethinking protection: When trust, transparency, and ethics matter

Short on time? Here’s what to expect from the article:

This article explores takaful as an ethical, Shariah-compliant alternative to conventional insurance for high-net-worth individuals and business families. It explains how takaful integrates with long-term wealth planning, legacy goals, and ESG values—positioning it as a strategic layer in a diversified financial portfolio.

Exploring the relevance of Takaful in sophisticated financial planning

As high-net-worth individuals and business families increasingly seek financial models that align with both ethical and legacy planning objectives, takaful, also known as Islamic Insurance, emerges as a natural choice. Rooted in Shariah principles, takaful operates on mutual cooperation and shared responsibility, offering more than just protection—it reflects a values-based approach to financial planning.

Unlike conventional insurance, takaful isn’t merely a product to cover risk; it’s a tool that integrates with long-term wealth strategies, especially for those committed to faith-based investing, philanthropic goals, or multi-generational estate structuring.

The inherent philosophy of community contribution (tabarru) and risk pooling ensures that participants support one another while funds are invested in Shariah-compliant assets, reinforcing financial and ethical integrity.

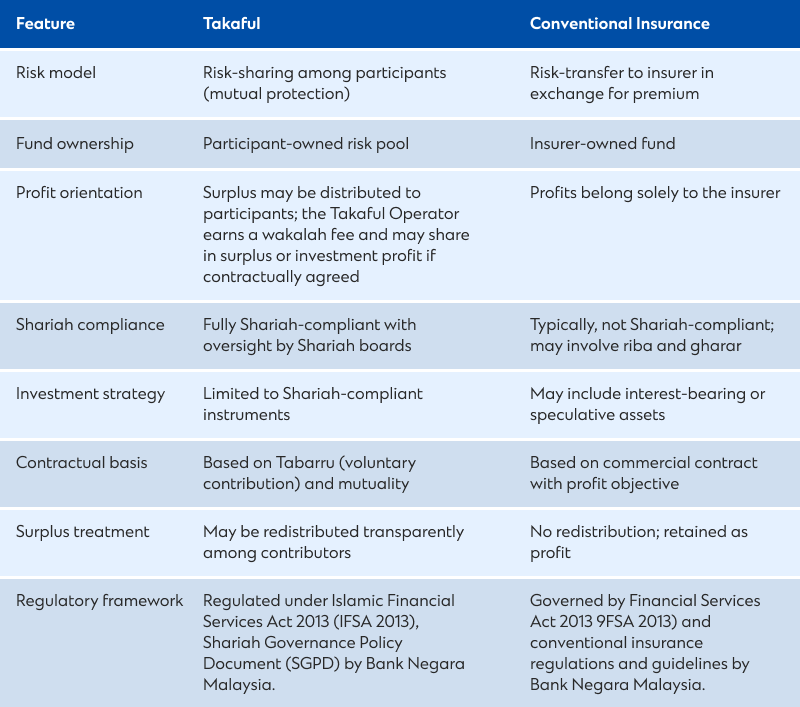

Structural differences between takaful and conventional insurance models

Note: Learn about Standard Chartered Saadiq – the Islamic bank subsidiary under SC Malaysia with robust Shariah governance and oversight.

Takaful solutions for private clients and business entities

Takaful caters to both personal and corporate needs. For individuals, family takaful offers long-term protection and structured benefits, supporting estate continuity, liquidity for heirs, and financial stability.

For home protection needs, explore mortgage reducing term takaful (MRTT), designed for Islamic-compliant mortgage coverage.

For business owners and corporate leaders, executive takaful provides faith-compliant alternatives to key-person coverage, partnership insurance, and shareholder protection.

Group takaful schemes further allow employers to extend Shariah-aligned benefits to their staff, enhancing retention while meeting cultural or ethical expectations.

High-net-worth clients may also opt for wealth-linked takaful plans—tailored to balance protection with investment returns, offering disciplined capital deployment in Shariah-screened assets. These can be layered with international structures, offering flexibility for cross-border asset management.

Would a conventional policy support Islamic inheritance goals or wasiyyah planning? Often, the answer is no.

Strategic value of takaful coverage and its portfolio contribution

Takaful is not just about protection; it’s a strategic addition to a diversified wealth portfolio. Its cooperative model often results in stable returns, while surplus distribution adds to capital resilience. This makes takaful an attractive proposition in volatile markets or low-yield environments.

The underlying asset allocation is usually conservative and free from speculative instruments, supporting portfolio stability. Additionally, its strong ethical foundation positions it well with environmental, social, and governance (ESG) mandates and responsible investment strategies favoured by family offices (private advisory firms specialising in wealth management services for ultra-high net-worth individuals) and philanthropic investors.

From a risk-mitigation perspective, takaful covers both expected and unanticipated liabilities, serving as a buffer without conflicting with religious or ethical boundaries. This reinforces financial independence while preserving value across generations.

If your wealth is carefully diversified across equities, sukuk, and offshore trusts, your protection strategy should reflect the same sophistication.

Choosing the right takaful provider: Due diligence for long-term peace of mind

Selecting a takaful provider involves more than comparing premiums. Affluent clients must assess governance structures, fund transparency, and the provider’s history of surplus distribution.

Key considerations include:

- Strength and credibility of the Shariah board: Discover the Saadiq Shariah Committee, which ensures continuous religious compliance and ethical fund governance.

- Investment philosophy and adherence to Islamic principles

- Audit frequency and public disclosure practices

- Cross-border portability and claims responsiveness

For global families or business owners with assets across multiple jurisdictions, the portability of coverage and alignment with estate regulations are essential. Providers offering customisation, robust digital servicing, and long-term claims integrity stand out in this space.

Rethinking protection: When trust, transparency, and ethics matter

In an age where investors demand transparency, ethical stewardship, and alignment with deeper values, takaful presents a compelling alternative. It transcends the transactional nature of conventional insurance by embedding protection within a framework of cooperation, trust, and shared responsibility.

For high-net-worth individuals, takaful is not just a financial instrument—it’s a reflection of purpose-led wealth planning. When chosen carefully, it becomes a strategic layer in a sophisticated portfolio, offering both protection and peace of mind, grounded in ethical clarity.

For investors seeking not just protection but alignment with values, takaful is no longer a secondary choice — it is the superior one.

To learn more about Standard Chartered’s takaful offerings, visit the Saadiq Islamic Banking page.

Note: Takaful offerings are subject to regulatory approval and vary across jurisdictions. Prospective clients are encouraged to consult a licensed adviser familiar with Islamic financial structures before making any decisions.