Important Note Customer Investment Profile:

- Having a “Customer Investment Profile” will be a prerequisite for investors and for us to assess suitability of all investment subscriptions / switch-in transactions*. Therefore, please remember to complete the questionnaire before investing to avoid any inconvenience.

- “Customer Investment Profile” is valid for two (2) years from the last updated date. Client should complete a new questionnaire regularly, and whenever there is any change in circumstances that may impact on her/ his risk appetite.

*excluding securities trading

Important Risk Warning & Disclaimers of Investment Product Risk Rating Overview:

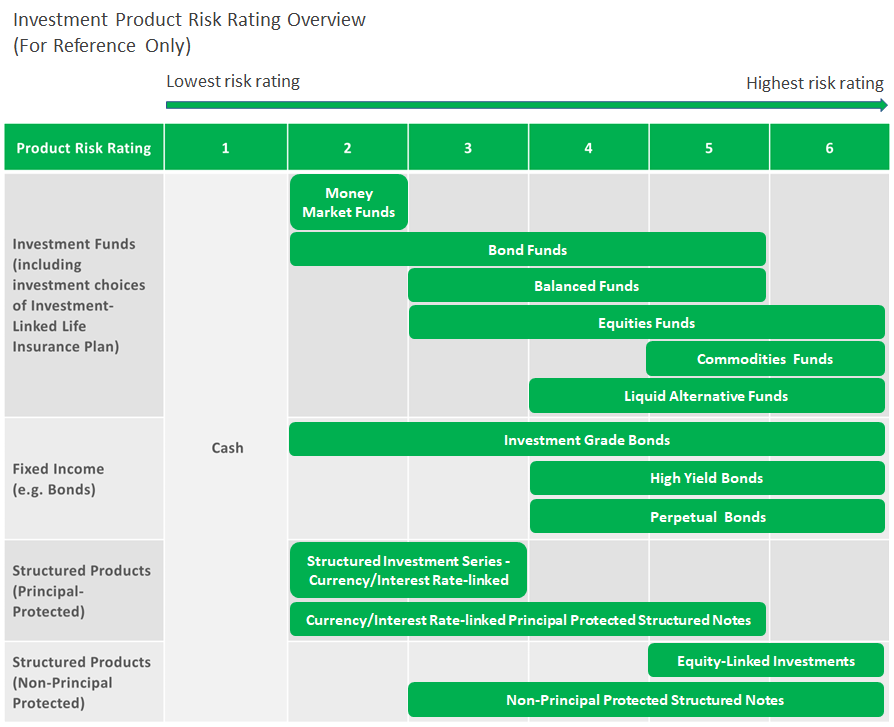

- Investment Product Risk Rating Overview (Overview) shows you the product risk ratings (PRR) for different product categories based on our quantitative evaluation of their respective price volatility, embedded leverage, secondary market liquidity, issuer / counterparty risk and contractual maturity.

- Content of this Overview is updated on a regular basis. PRR for each product category may be changed from time to time.

- This Overview cannot be used to assess the suitability of any individual investment product for you. You should not invest in any product unless you are satisfied that it is suitable for you having regard to your own personal circumstances, including your financial situation, investment knowledge and experience, investment objectives and horizon.

- This Overview is presented for your reference only and should not be considered as a buy or sell recommendation, offer or solicitation of any product.

- For details of the risk factors of individual investment products, please refer to the individual product materials.

Risk Disclosure Statement

- Investment involves risks. The prices of investment products fluctuate, sometimes dramatically. The price of the investment products may move up or down and may become valueless, and investors may not get back the amount they have invested. Past performance is no guide to its future performance.

- Investors should read the terms and conditions contained in the relevant offering documents and in particular the investment policies and the risk factors and latest financial results information carefully and is advised to seek independent professional advice before making any investment decision. Investors should not only base on this webpage alone to make investment decisions. Investors should ensure they fully understand the risks associated with investment products and should also consider their own investment objective and risk tolerance level.