SC Invest

Unbiased. Unparalleled expertise. For you.

Enhancing investment journeys for you, with our all-new SC Invest.

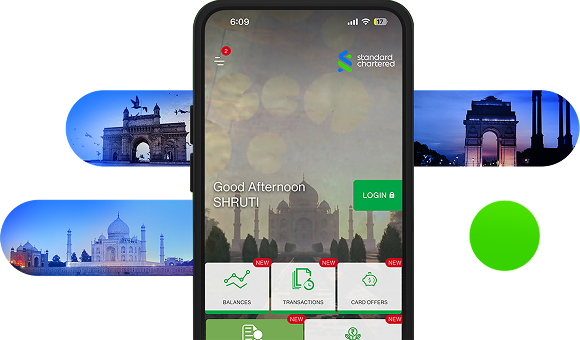

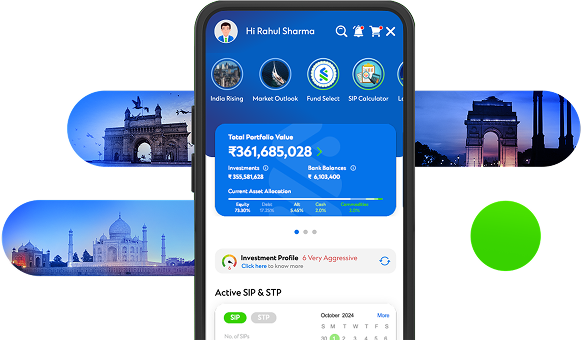

myWealth: Innovative wealth management solutions tailored to you

Access solutions backed by expert insights and analytics, to build a personalised portfolio. Contact your RM today!

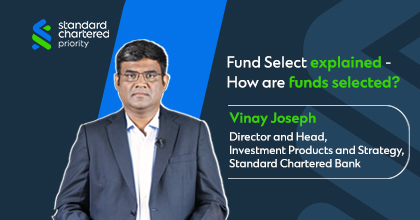

Fund Select

Suggests the top mutual fund picks for you, based on a comprehensive analysis of the market and in alignment with your risk profile.

Tools and Calculators

Find out how much money you need for your financial requirements.