Table of Contents

To achieve your financial goals, make your money work harder for you.

But what does that mean? Simply put, it means using your existing money to bring in more money. And the way to do this is by growing its value through intelligent and diligent investing.

While the theory is sound, application can be messy as there are many investment options available. For starters, how do you differentiate among the various investment options out there and choose the most ideal option for your specific financial situation and goals?

The following infographics can serve as a guidepost to help you navigate the modern investing landscape.

What are the types of traditional investments?

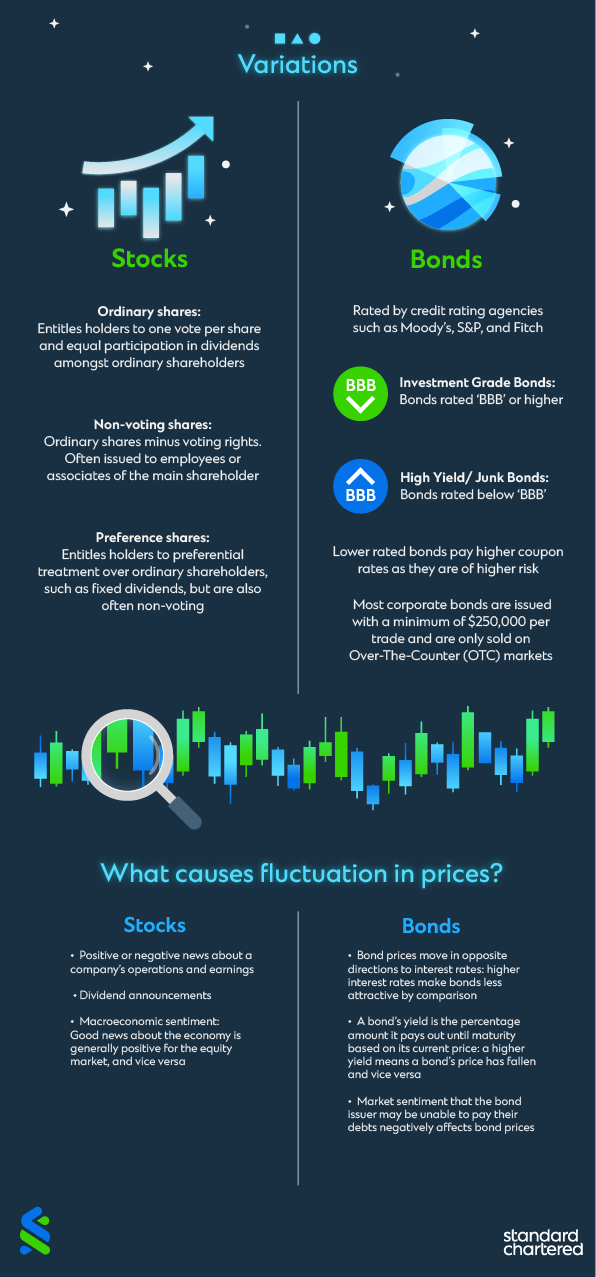

Stocks

- A way to share in the equity of a company, including a public listed company

- Returns are in the form of capital gains from share price increases and dividend payments

- Higher potential for returns, however, investors also take on higher volatility (risk)*

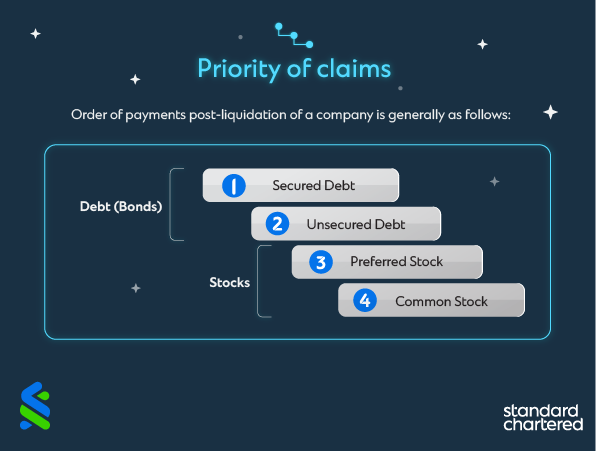

- When the company liquidates, equity holders’ claims are subordinate to (lower than) a company’s creditors (such as bond holders)*

Bonds

- A way to share in the debt of a company or the government

- Has a fixed maturity date

- Returns are in the form a consistent coupon rate (periodic interest payments) until the bond matures, and repayment of the principal amount (but the price of a bond can fluctuate through its life)

- Considered a safer investment with lower volatility, but lower returns*

- When the company liquidates, bondholders are assigned a high claims priority over equity holders*

Why investing in stocks is considered riskier than bonds

- Higher Uncertainty: Bonds have fixed maturity dates and coupon payments – only uncertainty is whether issuing company can meet their debt obligations. Stocks represent equity ownership in a company and investors are not guaranteed returns.

- Lower priority of claims: In event of a default, a company’s remaining assets are liquidated and realised, with proceeds first paid to debt-holders/creditors (such as bondholders), while shareholders rank last in priority of payment.

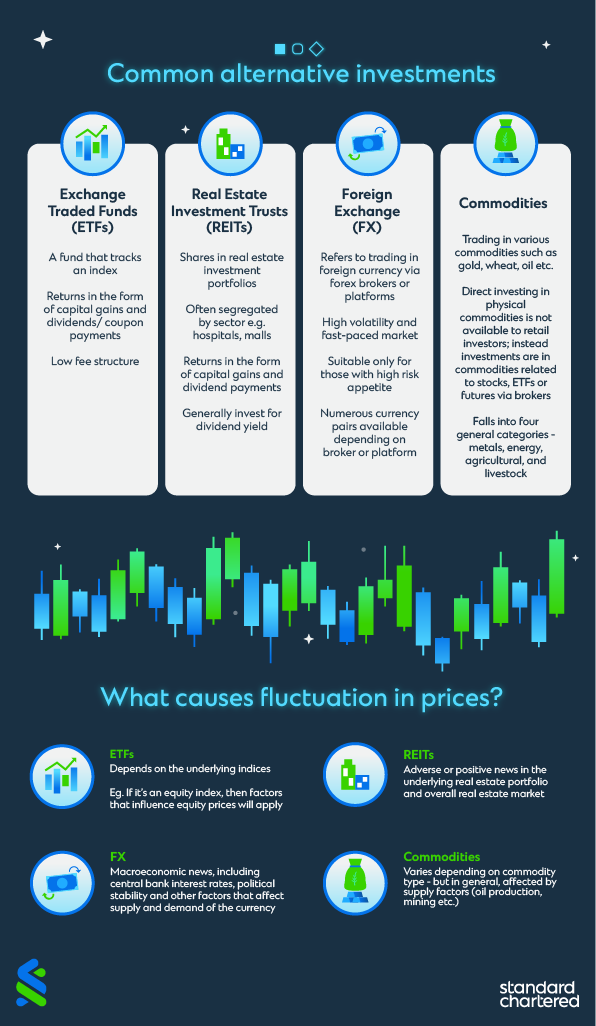

What are the types of common alternative investments?

- Exchange Traded Funds (ETFS): A fund that tracks an index

- Real Estate Investment Trusts (REITS): Shares in real estate investment portfolios

- Foreign Exchange (FX): Refers to trading in foreign currency via forex brokers or platforms

- Commodities: Trading in various commodities such as gold, wheat, oil etc

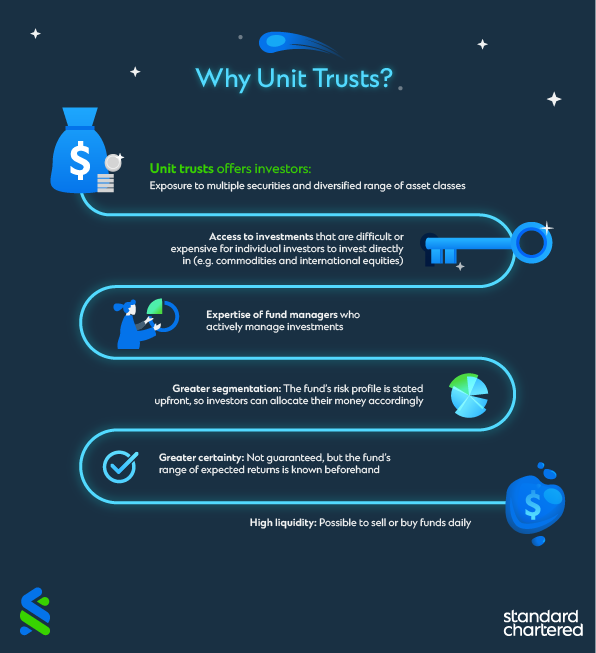

Unit Trusts: A way to invest in a mix of traditional and alternative investments

- Investor money is pooled to purchase stocks, bonds or other securities, which can be a mix of traditional and alternative investments, according to the fund’s stated investment objective

- Often actively managed by an investment fund manager, therefore charges higher fees compared to passively managed ETFS