Table of Contents

In a hurry? Read this summary:

- Standard Chartered’s Fund Select list features 35+ high-quality mutual funds to help

- you build a strong, future-ready portfolio. Investors can access Fund Select funds via the SC Invest platform, where they can review the list of funds showcased based on their risk appetite.

- Funds with long term potential are shortlisted based on our proprietary 3-step framework, which integrates the 3Ps—People, Process, and Performance.

- And we don’t stop there. Our experts review each fund quarterly to ensure quality, performance, and relevance As of March 2025, 84% of our Fund Select funds ranked in the top two quartiles relative to peers, since their recommendation.

Mutual funds have emerged as a popular avenue, as well as an integral part of every investor portfolio today. This is evident from how total assets under management (AUM) in mutual funds in India stood at as much as ₹75.19 trillion as on August 31, 2024, according to the August 2025 monthly note from Association of Mutual Funds in India (AMFI).

And if you’re looking to add mutual funds to your portfolio, Standard Chartered’s Fund Select steps in as an indispensable ally.

Why Choose Fund Select on SC Invest

Designed to suit your risk profile

Fund Select presents fund ideas that align with your risk profile, along with key details such as performance, risk factors, and the rationale behind each selection.

Thorough analysis across parameters

Funds are selected based on a detailed assessment using multiple qualitative and quantitative factors.

Clear, focused fund ideas

We simplify the process by cutting through the noise, helping you focus on what truly matters.

Regular review for continued performance

The selected funds are regularly reviewed to ensure they stay aligned with performance expectations.

Supports smarter diversification

By outlining the risk characteristics of each fund, Fund Select helps build a well-diversified and balanced portfolio.

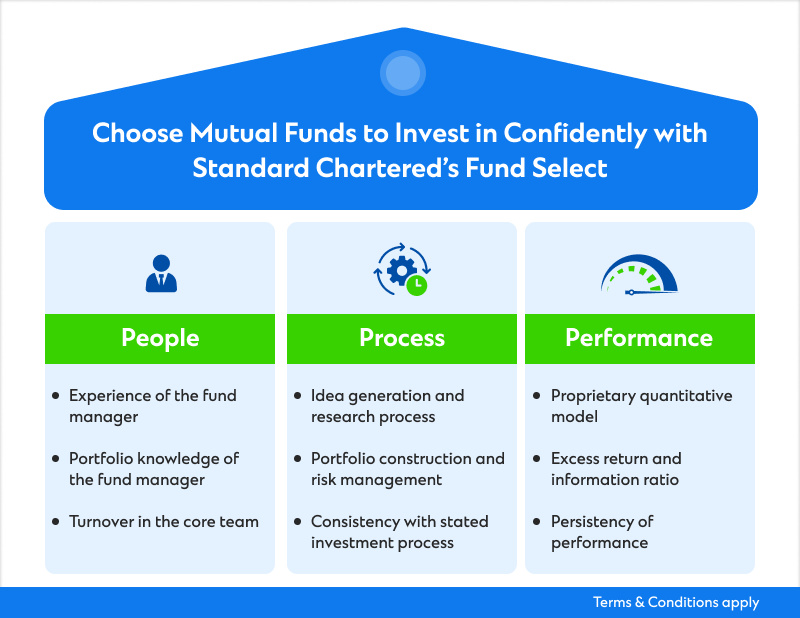

How Fund Select’s three-step framework helps choose mutual funds for long-term growth

There is more to selecting the right mutual funds than assessing past returns. Fund Select conducts a thorough review of each fund using its proprietary 3P-framework: People, Process and Performance. It is only after rigorous screening and monitoring that a fund is recommended to potential investors.

Fund Select screens options from over 300+ mutual funds listed in the market across fund types, each suited to different investment horizons and risk profiles, to help investors narrow down their choices easily.

Every fund is evaluated in reference to prevailing market conditions, as well as emerging investment themes shaping India’s economy. These funds are also aligned with views from Standard Chartered Bank’s in-house experts who provide forward-looking insights on Indian, as well as global investment trends.

Looking beyond mutual funds’ performance history with the 3P framework

People

People are an integral aspect of a fund’s ability to deliver consistent returns and achieve its stated investment objectives.

Experience of the fund manager

A seasoned fund manager, with their past learnings help a fund efficiently weather and navigate volatile capital markets.

Portfolio knowledge of the fund manager

A strong knowledge of the sector and asset classes one is investing in helps them identify emerging opportunities and impending risks well in time.

Turnover in the core team

A low amount of churn in a fund’s core management team signals alignment with the fund’s stated objectives and investment strategy, potentially reducing the chances of volatility in a fund’s portfolio.

Process

A fund’s edge lies in in how ideas are translated into translated into portfolio decisions. It also lies, in equal measure, in how well risk and return are balanced.

Idea generation and research process

Fund portfolios that reflect in-depth research backed by sector and asset class expertise alongside a long-term view are always given precedence over those that merely chase short-term returns.

Portfolio construction and risk management

While shortlisting mutual funds, how well a mutual fund ensures capital preservation in addition to providing one with a stable income and capital appreciation is also assessed. Efficient diversification and risk management practices are central to any given funds’ success.

Consistency with stated investment process

Decisions aligned with the fund’s stated investment process and objectives are key to our selection process, to ensure trust and reliability at every step for our investors.

Performance

Post recommendation, every fund is carefully and consistently scrutinised and monitored.

Proprietary quantitative model

Rooted in data-backed insights, our evaluation model assesses fund performance in a consistent and objective manner, helping reduce the risk of investment decisions based on sentiment.

Excess return and information ratio

Fund performance is analysed not just on a stand-alone basis, but in relation to the fund’s under or over performance relative to its peers and benchmark index as well. Additionally, all shortlisted funds are also evaluated for their information ratio, which refers to their performance relative to the amount of risk undertaken, to ensure capital preservation.

Persistency of performance

Every shortlisted mutual fund is continually monitored for performance across market cycles.

Take the first step in your investment journey today

To help enhance your investments, you can invest in Fund Select’s list of funds via the SC Invest platform — a tool that helps you find funds most suited to you based on your risk profile. Investments can be made both via lump sum payments or Systematic Investment Plans.

Ready to begin? Explore SC Invest and Fund Select or speak to your Standard Chartered relationship manager to learn more.