Table of Contents

In a rush? Read this summary:

- An SWP (systematic withdrawal plan) lets you withdraw a fixed amount from your mutual fund regularly while keeping the rest invested.

- SWPs are ideal for turning lump sums into steady income, making them popular for retirees.

- Pick funds carefully, plan sustainable withdrawals, and review your SWP as market and needs change.

What is SWP?

A Systematic Withdrawal Plan (SWP) offers a structured solution, allowing investors to withdraw a fixed amount from their mutual fund investments at regular intervals—providing stability, flexibility, and control.

Unlike traditional lump sum withdrawals, an SWP investment keeps your money working while you receive consistent payouts.

Turning Lump sum into regular income: A smart way to get monthly income

SWP (Systematic withdrawal plan) in mutual funds, enables investors to redeem a set amount—monthly, quarterly, or annually from their existing mutual fund investments—while the remaining corpus stays invested. It’s particularly useful for those who have built a corpus and now seek regular income, such as retirees or income-focused investors.

This approach supports long-term planning by blending predictability with continued market participation.

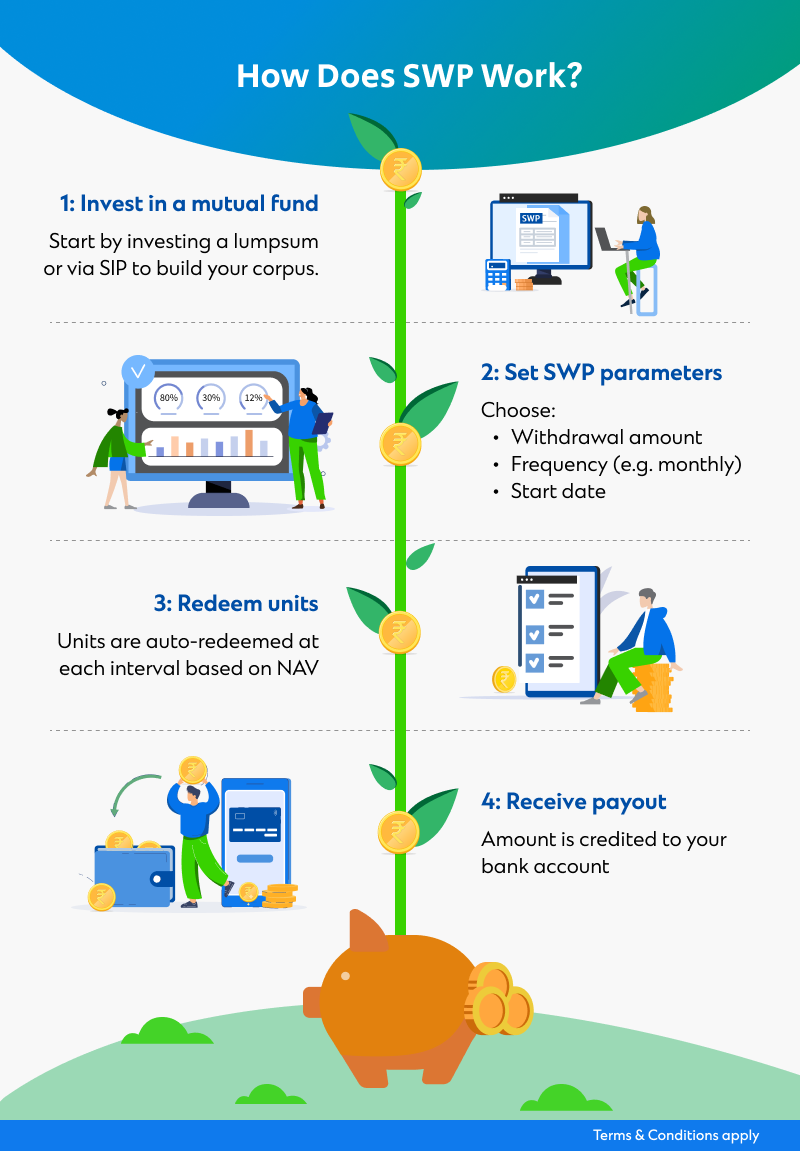

How does the SWP process work?

Starting an SWP typically requires a mutual fund corpus — which can be created through a one-time investment or via regular SIP contributions over time. The investor then specifies:

- The withdrawal amount

- The frequency (e.g., monthly)

- The start date

At each scheduled interval, mutual fund units are redeemed to match the withdrawal, which is transferred to the investor’s bank account. The SWP return rate depends on fund performance, market behaviour, and withdrawal levels.

You can also choose to just withdraw the gains on your investment keeping your invested capital intact. At the set date, units from your portfolio are sold and the funds are transferred to your account.

SIP vs SWP: understanding the contrasting goals

While an SWP helps generate periodic income, a SIP (Systematic Investment Plan) focuses on wealth creation through disciplined investing. A SIP involves investing a fixed amount regularly into a mutual fund, typically over a long horizon. In contrast, an SWP does the reverse: it withdraws a fixed amount from a lump sum investment.

SWP vs SIP comparison:

| Feature | SIP (Systematic Investment Plan) | SWP (Systematic Withdrawal Plan) |

| Objective | Builds wealth through disciplined investing | Offers investors regular source of income since a part of investment is redeemed at regular intervals OR offers investors regular source of income from existing investments. |

| Taxation | Tax applies only when units are redeemed | Withdrawals may incur capital gains tax, based on holding period & type of MF scheme |

| Risk & return | Harnesses market volatility for long-term compounding | Focuses on stable, predictable income |

| Suitability | Ideal for early to mid-career investors targeting future goals | Best suited for retirees or those seeking steady cash flow from investments |

Learn more about mutual fund strategies:

SCB India Investment Overview | Systematic Investment Plans

Benefits of SWP

| Benefit | Description |

| Steady cash flow | SWPs offer consistent, scheduled income at your chosen frequency—ideal for meeting monthly expenses or supplementing retirement income. |

| Flexibility | You control the withdrawal amount, schedule, and duration, allowing you to adjust based on changing needs or market conditions. |

| Capital preservation | Since only a portion of your investment is withdrawn periodically, the remaining corpus continues to stay invested and may generate returns. |

| Investment continuity | The unused capital remains invested in the mutual fund, benefiting from potential market appreciation over time. |

| Reduced emotional decision-making | A structured withdrawal approach reduces impulsive exits during market volatility and encourages long-term discipline. |

Why SWP calculators are a great planning tool

An SWP calculator helps you plan how long your investment will last based on:

- Initial investment

- Expected return rate

- Withdrawal amount and frequency

Benefits:

- Clear cash flow planning

- Accurate sustainability forecasts

- Tax insights (some calculators estimate capital gains)

- Using a calculator before you begin helps set realistic expectations and avoid overspending.

Strategic considerations to make the most of your SWP

Making your SWP investment work for you requires careful planning and regular reviews.

- Choose funds wisely: Align fund type (equity, hybrid, or debt) with your income need and risk appetite.

- Be realistic with withdrawals: Don’t exceed what your fund can sustainably support. Start small and increase only if returns justify it.

- Revisit periodically: Your needs, market conditions, and fund performance will evolve—so should your SWP.

Turn your investments into sustainable income

A well-structured SWP offers a smart way to enjoy the fruits of your investments while preserving your financial independence. From retirees needing monthly income to savvy investors seeking periodic cash flow, an SWP mutual fund can be a strategic pillar of any wealth distribution strategy.