Table of Contents

Diversification is a principle critical to sound wealth management for two reasons. The first is risk mitigation by attempting to reduce exposure to concentrated risk. The second is striking a balance between stable income and long-term capital appreciation.

Debt mutual funds are a popular means to the same end with their inherent ability for risk mitigation via diversification. Read on.

Debt funds: A balanced approach to growth and stability

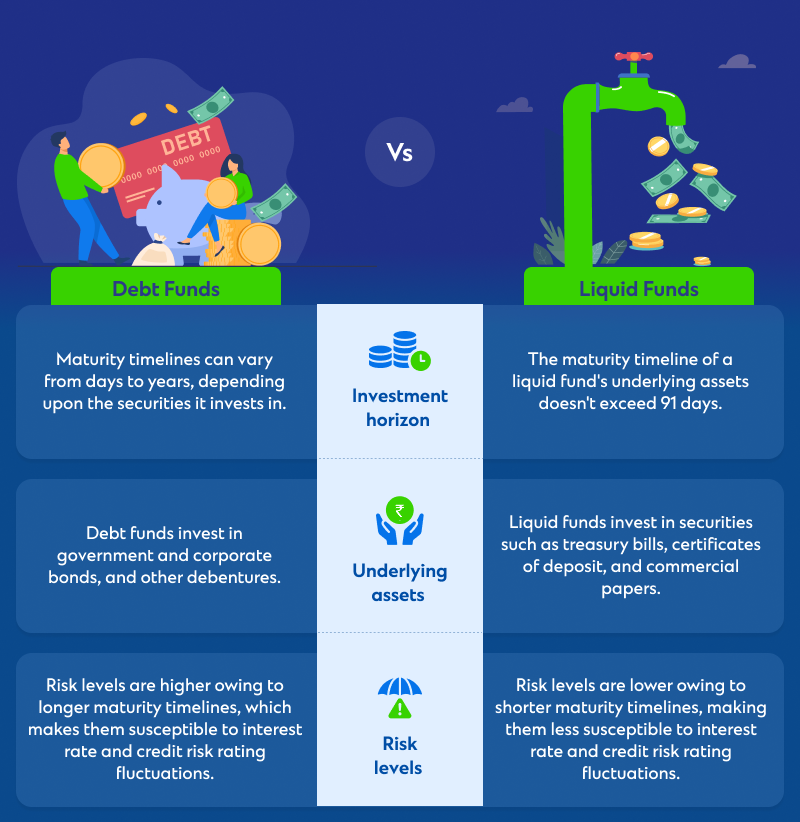

Debt mutual funds invest in fixed-income securities such as government and corporate bonds, treasury bills, commercial papers, and certificates of deposit. Interest payments on these instruments act as the primary source of returns on one’s investment. They are appealing propositions for those with low risk appetites, choosing capital preservation and a predictable income over capital appreciation.

Debt funds’ NAVs are affected by two main factors: The first is interest rate fluctuations and the second is credit ratings. Downgrades in issuers’ credit ratings can reduce securities’ market value, causing the fund’s NAV to go down. These portfolios are consequently reviewed and rebalanced periodically based on their performance and overall fund objectives.

Benefits of investing in debt mutual funds

Whether you’re seeking diversification to protect yourself from concentrated risks or to park your funds for the short to medium-term, these funds have several compelling advantages.

Liquidity

Debt mutual funds are liquid investments. Some debt instruments—especially overnight, and ultra-short duration funds—don’t have a fixed lock-in period, allowing for quick redemptions.

Diversification

Investing in several fixed-income securities, they ensure your portfolio isn’t overly exposed to losses from any single issuer, sector, or asset class. Different maturity timelines and credit ratings allow investors to balance risk and return efficiently.

Lower risk levels

They offer a predictable income stream and are less prone to volatility than equities, making them ideal for capital preservation.

Remember however. While risk levels are lower, they’re not absent.

SC Invest: Designed for informed, intelligent investing

Standard Chartered’s proprietary mutual fund investment platform empowers the discerning investor with the right tools, insights, and expert support requisite for making intelligent investment decisions with conviction.

We offer you access to over 300 mutual funds from more than 23 leading fund houses, to effectively diversify your portfolio based on your financial goals, investment horizon, and risk appetite.

Some of SC Invest’s key features are as follows.

Recommendations

Start with Systematic Investment Plans / SIP packs handpicked by experts based on varying risk profiles and investment goals.

Unified portfolio view

Monitor your holdings’ performance in an easily accessible dashboard, helping you effectively review and rebalance your portfolio when required.

Dedicated support

Relationship managers & our Wealth specialists help you assess emerging opportunities and generate investment orders on your behalf via SC Invest, our online Mutual fund platform.

Actionable insights

Stay ahead of the curve with in-depth market analyses, insights and outlooks across asset classes and sectors via Market Insights.

Investment planning tools

SIP calculator to help you anticipate future returns on your investments, as well as decide on the amount and frequency of your investments to align them with your financial goals.

Types of debt funds: A guide for the astute investor

There are several kinds of debt mutual funds one can choose to invest in, based on varying investment horizons, risk appetites, and priorities – whether it is capital preservation or a stable income stream.

Money market funds

These invest in instruments with a maturity of up to a year. They’re ideal for those seeking low-risk debt securities in the short term, owing to their low price sensitivity to interest fluctuations.

Liquid funds

Liquid funds invest in short-term instruments such as treasury bills, commercial papers, certificates of deposit, and collateralised borrowing and lending obligations (CBLO). For them to qualify as one, the underlying instruments must have a maturity period of no longer than 91 days.

They ensure the availability of high levels of liquidity, lower levels of volatility, and capital preservation for investors.

Gilt funds

Gilt funds invest a minimum of 80% of their capital in government securities, across varying maturity timelines. They provide security against credit rating risks being government-backed and are suitable for risk-averse investors that focus on long-term capital preservation.

Dynamic bond funds

Dynamic bond funds invest in a mix of debt securities across different investment horizons. If fund managers expect a reduction in interest rates, they invest in instruments with longer maturity timelines to leverage their price appreciation. Conversely, if they expect a rise in interest rates, they invest in shorter maturity duration instruments that have higher yields.

Considering their high sensitivity to interest rate fluctuations, these funds are more suited to investors with moderate risk tolerance, and a short-to-medium term investment horizon.

Corporate bond funds

According to the Securities and Exchange Board of India (SEBI), corporate bond funds must invest at least 80% of their capital in high-rated instruments.

They aim to provide investors with a regular income stream, coupled with low levels of risk. They’re ideal for those looking to balance the safety offered by government securities, and the higher returns from corporate securities.

Credit risk funds

Credit risk funds invest at least 65% of their capital in corporate securities with an AA rating, and other short-term instruments with an A2 rating. They are suited more to young investors with higher levels of risk tolerance, provided they have carefully analysed the fund’s past performance.

Debt funds are a great middle ground for investors looking to balance stable returns with measured risk for growth, without diminishing their capital. They are also suited to conservative and short-term investors offering low risk levels with high levels of liquidity.

They are an integral part of any well-balanced investment portfolio, complementing stable returns with capital preservation as well as capital appreciation.