What is NFO in Mutual Funds? A Complete Guide

Learn More Learn More

In a rush? Read this summary:

For new investors looking to tap into the market or seasoned investors looking to diversify their holdings and mitigate risk, mutual fund New Fund Offers (NFOs) can prove to be an intriguing entry point, allowing them to subscribe to units in a fund at their base price before they’re opened to the broader market.

If you’re new to NFOs, here’s a quick primer on what they are, how they work, their types, and why you should consider investing in them to align with your financial goals and risk appetite.

Asset management companies (AMCs) raise capital for new mutual fund products via a New Fund Offer (NFO), similar to an Initial Public Offering (IPO) for equities. Per the rules of the Securities and Exchange Board of India, subscription windows typically last 10-15 days and a maximum of 30 days. During this period, units of the scheme are sold at their face value—typically between Rs. 10 and Rs. 100 per unit.

Subscribing to mutual funds via NFOs allows investors access to units at a nominal price and helps generate subsequent profits owing to the price rise over time.

Following the end of the subscription period, investments cannot be made into funds at the initial offer price. Funds are traded on the open market with prices varying according to demand.

Not all NFOs are the same. Understanding their types is key to aligning your financial goals and liquidity needs with your investments.

Open-ended NFOs remain available for investment even after the initial offer period ends. The number of units that investors can subscribe to in the fund in question is not limited. Once the NFO closes and the fund is listed, it is kept open for purchase and redemption at the net asset value (NAV). These funds therefore offer high liquidity levels.

Close-ended NFOs allow you to invest in them only during the launch period. These mutual funds often have fixed lock-in periods, and no redemptions can be made till this period ends. This makes them more suited to investors looking to park and grow their surplus funds over time.

Interval NFOs are a hybrid of open- and close-ended NFOs. They allow one to purchase or redeem units only during specific timeframes, which may be semi-annually or annually. This allows greater control and, therefore, greater efficiency for the fund’s portfolio while offering investors liquidity periodically.

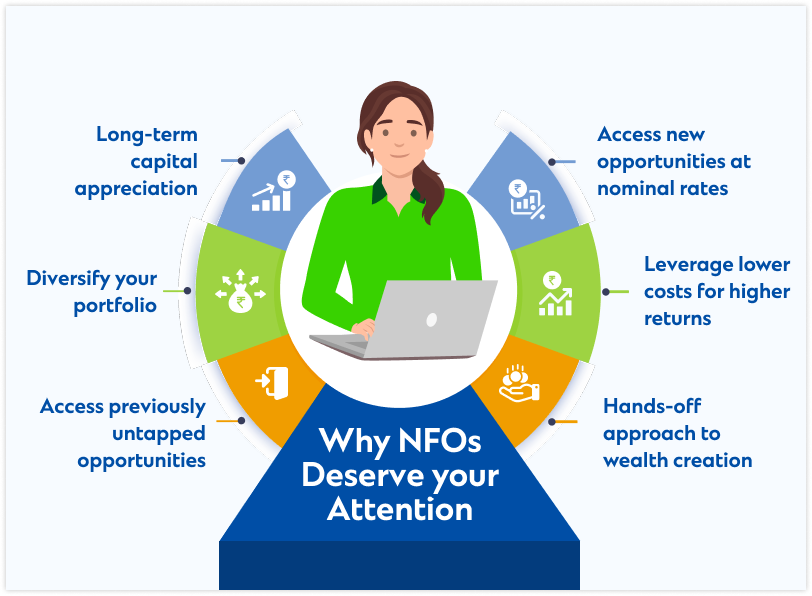

NFOs are a great avenue for investors looking to tap into new opportunities while balancing risk and return via diversification. Here are a few key benefits.

Mutual fund NFOs are typically priced at ₹10 per unit during the offer period, making them highly accessible to newer investors looking to enter the market without locking in a substantial amount of capital.

Many NFOs may begin with nominal or no management fees, allowing for greater cost efficiency and returns. While standard expense ratios may apply once a fund becomes fully operational, this initial advantage can enhance one’s investment value in the early stage.

Each NFO is backed by experienced fund managers, whose insight ensures that the portfolio aligns with broader investor expectations, individual financial goals, and risk profiles, while mitigating risks and capitalising on emerging opportunities in time.

NFOs often target niche investment trends, markets, and sectors previously untapped. This offers discerning investors access to future-focused opportunities, ensuring their portfolio evolves and responds to ever-evolving market dynamics in real time.

Capital raised via NFOs is invested in a diversified mix of assets, sectors, and geographies to ensure that gains from the others can offset the underperformance of any one asset. It also helps investors balance long-term capital appreciation alongside a stable income stream.

Assuming favourable market conditions and sound management practices, investing in a fund at its inception allows investors to leverage and capitalise on a mutual fund’s whole growth trajectory, ensuring long-term capital appreciation.

NFOs aren’t a one-size-fits-all solution. Like any other investment instrument, it is of the essence to keep in mind specific key considerations while investing in them.

Analyse and evaluate a fund’s stated objectives, and understand the sectors, asset classes, market capitalisations or themes it invests in. This lets you judge how well it aligns with your short- and long-term financial priorities and risk profile.

Past performance isn’t always a guarantee of future returns. However, a track record of managing similar funds in the past and their performance does provide investors with an indicator of potential fund performance in the future.

And if you’re looking for a reliable partner for your investments, consider leveraging SC Invest, Standard Chartered Bank’s proprietary online mutual fund trading platform.

When investing in any given fund, it is important to evaluate associated costs, such as expense ratios and exit loads. These expenses and potential tax implications can significantly impact long-term investment returns.

Certain NFOs have specified lock-in periods. One example is Equity-Linked Savings Scheme (ELSS) funds, which have a mandatory three-year lock-in period. Investing in multiple funds with varying lock-in periods is advisable to ensure some degree of liquidity in one’s portfolio.

Whether you’re just starting your investment journey or are a seasoned investor looking to diversify your portfolio, NFOs offer a valuable proposition with its easy accessibility and long-term growth potential, allowing one to participate and benefit from the Indian growth story from day one.

Related articles:

The What, Why & How of Debt Funds: A Complete Guide

Hybrid Mutual Funds: The Balanced Route to Growth and Stability

Standard Chartered Bank, India (‘Bank’) is an AMFI-registered distributor of mutual funds and referrer of other third-party investment products and does not provide any investment advisory services as defined under the SEBI (Investment Advisers) Regulations, 2013. Mutual fund investments are subject to market risks, please read scheme related documents carefully before investing. Past performance is not indicative of future returns. Apart from the RM-assisted journey, SC Invest is an EXECUTION-ONLY platform. The Bank does not provide any investment advice or investment recommendations in respect of any transaction effected through the SC Invest platform.

The contents on this webpage are for general information only and does not constitute an offer, recommendation or solicitation of an offer to enter into a transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movements in rates or prices or any representation that any such future movements will not exceed those shown in any illustration. You are fully responsible for your investment decision, including whether the product or service described here is suitable for you.

Standard Chartered Bank will not accept any responsibility or liability of any kind, with respect to the accuracy or completeness of the information in this webpage. The contents herein are for general evaluation only and has not been prepared to be suitable for any particular person or class of persons. Standard Chartered Bank makes no representation or warranty of any kind, express, implied or statutory regarding the contents on this webpage or any information contained or referred to herein. This webpage is distributed on the express understanding that, whilst the information in it is believed to be reliable, it has not been independently verified by us.

This communication has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Standard Chartered Bank India (“SCB/ Bank”) does not warrant its completeness and accuracy. This information is not intended as an offer or solicitation for the purchase or sale of any financial instrument / units of Mutual Fund. Recipients of this information should rely on their own investigations and take their own professional advice. Neither SCB/Bank nor any of its employees shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this material. SCB Bank and its affiliates, officers, directors, key managerial persons and employees, including persons involved in the preparation or issuance of this material may, from time to time, have investments / positions in Mutual Funds / schemes referred in the document.

Standard Chartered Bank (“SCB/ Bank”) is a AMFI-registered Mutual Fund Distributor & a Corporate Agent for Insurance products.