Table of Contents

How to Decode Your Mutual Fund Statement with Confidence.

In a hurry? Read this summary:

- Mutual fund statements contain detailed records of investments in a given fund or funds offered by an AMC (asset management company) and are issued either monthly or quarterly.

- They highlight essential information such as one’s folio number, a summary of their performance, asset allocation strategies, expenses, nominees, and more.

- Regular reviews of the fund’s performance, asset allocation strategies, associated expenses, and more via the statement help investors decide whether a fund aligns with their short and long-term financial goals, investment horizon, as well as risk profile.

Sustainable wealth creation demands precision and discipline. This refers to not just selecting and investing in the right instruments consistently, but also periodically reviewing and rebalancing one’s portfolio. A tool critical to this process, especially when it comes to mutual funds, is one’s consolidated mutual fund statement.

Why your mutual fund statement matters

Mutual fund statements provide investors with a record of where their capital is invested, and how it is performing. Typically issued monthly or quarterly, these statements contain several bits of important information including the number of units held in a fund, their net asset value (NAV), purchase costs, as well as current market value.

The statement also contains details of whether transactions are made as lump sums or via systematic investment plans (SIPs), and details of any systematic transfer plans (STPs) one may have opted for. It is important to note here however, the distinction between mutual fund statements and one’s consolidated account statement (CAS).

How are mutual fund statements and consolidated account statements different?

Asset management companies (AMCs) issue mutual fund statements for their investors typically every month or every quarter. These statements may focus on a single mutual fund, or a set of funds managed by the AMC in question.

Consolidated account statements (CAS), on the other hand, help one with a snapshot of their investments across mutual funds, as well as other securities held in demat accounts, across AMCs. In essence, they consolidate the details of all of one’s investments linked to your permanent account number (PAN). However, should you be looking for more ease when it comes to viewing and tracking your investments in one place, SC Invest lets you do that with its “External Holdings” feature. All you need to do is enter your pan details and verify your phone number, and you’re all set.

Essential terms you need to know on your mutual fund statement

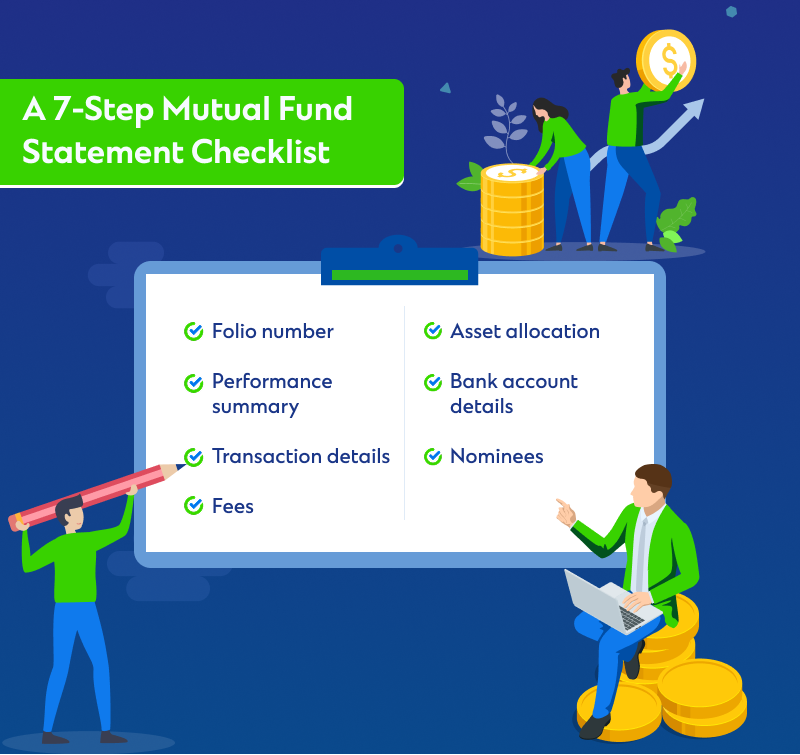

Mutual fund statements contain a wealth of information to help one make future investment decisions with conviction. Leveraging this information effectively requires an investor to familiarise themselves with the terminology used therein. Take a look at this list of common keywords to look out for in one’s mutual fund statement.

Folio number

A folio number groups an investor’s mutual fund holdings with an AMC under a single point to enable simplified portfolio management.

Performance summary

This section provides a snapshot of the total returns generated by a fund during a specific period, denoted using changes in the fund’s NAV.

Transaction details

Each statement lists details all the transactions made in a portfolio within a specific period. These include purchases, redemptions, exchanges, dividend payouts (if any), or capital gains distributions. Along with the amount, these details also mention the date and type of transactions.

Fees and/or expenses

This section details the costs associated with investing in the mutual fund, including expense ratios, exit loads, and other costs incurred on an investor’s account.

It is important to note that some of the details may or may not always be listed on one’s mutual fund statement, depending on the AMC that issued it.

Asset allocation

Mutual fund statements may also provide investors with a breakdown of the fund’s asset allocation. This section details the exact percentage of their capital invested in various kinds of underlying assets, such as equities, debt instruments, commodities, and more.

Bank account details

These details are particularly important if one holds multiple bank accounts. It provides them with the details of the bank account from which their investments are auto debited every month. These details typically include the name of the bank, its IFSC code, and the investor’s account number.

Nominees

This section provides the details of the nominees one has designated, and the percentage of assets to be allocated to the nominee in the unfortunate event of one’s demise.

How to interpret your mutual fund statement

The data on your mutual fund statement needs to be understood and used to refine and rework your investment strategy periodically. Here are a few things to keep in mind when you are reviewing and rebalancing your portfolio.

Review fund performance

The performance summary in mutual fund statements usually states returns as a percentage over a specific timeframe. This helps assess whether a scheme is delivering returns in a manner aligned with your short and long-term financial goals.

Another factor to consider is the fund’s performance not just against its underlying benchmark (which is usually listed on the fund’s factsheet) but also relative to the mutual fund’s category average, provided for by several third-party platforms. This provides a comprehensive overview of a fund’s performance as compared to its peers and benchmark.

Assess asset allocation

The asset allocation section explains if a fund aligns with an investor’s risk profile and investment horizon. For example, younger investors may prioritise capital appreciation and prefer equity-heavy allocations, while retirees may prefer debt-heavy allocations to ensure capital preservation and a stable income stream.

Using NAV trends to evaluate returns

A mutual fund’s NAV can tell investors of trends in the broader marker over time, as well overall returns on one’s investments. They can be used to make entry and exit decisions, based on a fund’s performance against underlying benchmarks as well as its peers.

Evaluate the expenses

High expense ratios and exit loads can significantly impact one’s returns. It is a good idea to consistently check these expenses and compare them with the fund’s peer funds using aggregator websites.

Achieving and maintaining optimal portfolio health requires one to regularly review their mutual fund statements. Doing so diligently lets one leverage them as an ally to provide them with actionable insights, to ensure efficiency in their investments amidst ever-evolving capital markets globally.