Table of Contents

Every investment inherently carries risk. However, this risk tends to be particularly pronounced in the case of equities. And a time-tested approach to mitigating this volatility is diversification.

That’s precisely what index funds offer . They offer investors broad exposure to markets, sans the hassle of managing multiple securities, and offer risk mitigation too. With returns linked to market indices and low management costs, they have become a core tenet of wealth-planning strategies for beginner and seasoned investors alike.

Index mutual funds: A simple, strategic approach to long-term wealth creation

Index funds attempt to track and replicate the performance of specific market indices such as the Nifty 50, Sensex or debt indices, by investing in all their constituent securities in the same proportion. They are passively managed and suited to investors with a medium risk appetite.

How index funds work

As per the Securities and Exchange Board of India (SEBI), mutual funds must invest at least 95% of their capital into the securities of a specific index to qualify as an index fund.

Indices are selected based on criteria such as market capitalisation or sectors, amongst others. They are then periodically reviewed to align with updated index weights, to replicate the index’s performance.

This replication of performance isn’t always exact, owing to factors including management fees, cash holdings, sampling techniques, dividend reinvestments, the size of the fund, and more. The difference in fund performance and that of the underlying index is referred to as the tracking error. The lower this number, the better it is for an investor.

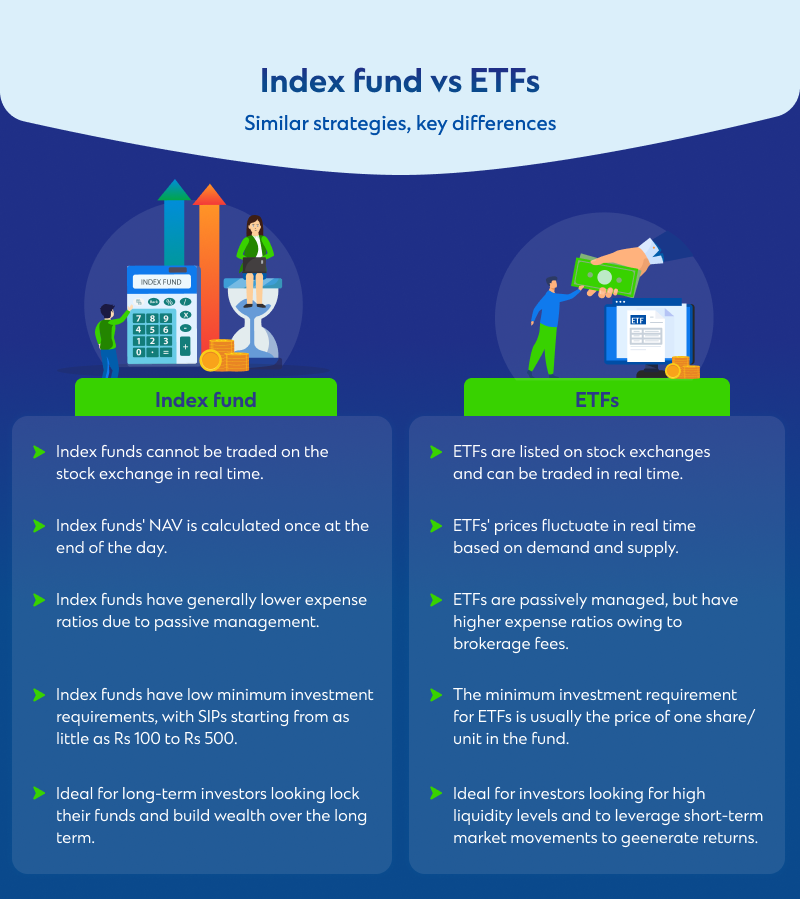

Index funds vs ETFs: Similar strategies, key differences

Index funds and ETFs may seem alike — but they function differently and fit different investor needs.

A look at the different types of index funds for strategic allocation

While the core principle of index funds is to track and replicate the performance of a specific benchmark index — the ways they achieve this varies based on their types.

Broad market index funds

Broad market index funds track and replicate large indices such as the S&P 500 or the Nifty 50. Being sector-agnostic indices, they also invest in multiple sectors, which allows for the diversification of investor portfolios.

Market capitalisation-weighted index funds

Market capitalisation-weighted index funds invest in the constituents of an index in proportion to their market capitalisation. This ensures performance is more correlated with market’ performance, which results in lower tracking errors as well as expense ratios.

Equal-weight index funds

They invest in the constituents of indices in equal proportions regardless of market capitalisation. This offers increased diversification and reduces concentrated risks stemming from a few companies dominating the fund’s portfolio.

Factor-based index funds

Also called smart beta index funds, they invest in indices that select constituents based on specific factors such as value, momentum, and growth, rather than the traditional market capitalisation or sector-based approach.

This approach could potentially provide for market-beating returns since they undergo reviews and rebalancing frequently. This method removes emotional biases from investments and contributes to robust portfolios. An example of factor-based index funds is the Nifty100 Low Volatility 30 index, which focuses on the 30 least volatile stocks within the Nifty 100.

Sector-based index funds

These invest in sector-specific indices such as Nifty Bank, Nifty IT, Nifty Auto, and Nifty Pharma, allowing one to capitalise on sector-specific opportunities.

However, they’re more suited to those with a higher risk tolerance, as they’re exposed to more concentrated risks compared to, say, broad market index funds. Higher volatility also means they’re more geared those with a longer investment horizon, to ride out short-term fluctuations.

International index funds

These invest in indices comprising of stocks, bonds and other securities issued by overseas governments and private sector companies, offering a great way for domestic investors to expand their portfolio.

Debt index funds

They follow fixed-income indices comprised of bonds and other debt securities. One example is the Nifty PSU Bond Plus SDL Apr 2026 50:50 Index. They’re suited to investors seeking capital preservation and a stable income.

Investing in index funds: Insights to help you choose wisely

Here’s a quick guide to the most important factors to consider before investing in index funds:

Tracking errors

The hallmark of a good index fund is a low tracking error rate. The less the tracking error, the better it can be said to be performing.

Expense ratios and exit loads

Expense ratios refer to the charges levied by the Asset Management Company (AMC) for managing your investment. This along with the exit ratio, which is the fee levied if you choose to redeem your investment in a mutual fund within a certain period, can potentially impact your returns.

Investment goals and horizons

Index funds are recommended for those with a long-term investment horizon. It is important to understand one’s own financial goals (whether short-term, such as taking a trip abroad or putting a downpayment on a house, or long-term, such as building a retirement corpus or funding your children’s education) to decide whether to invest in them.

SC Invest: Your companion for smarter fund selection

SC Invest, our proprietary online mutual fund platform , empowers you to make your investments a simple, intuitive, and insight-driven process

- Access to over 300 mutual funds from 23 fund houses.

- SIP packs curated by experts.

- A consolidated view of your investments and their performance.

- The ability for relationship managers to generate investment orders for you.

- In-depth analyses on different asset classes and sectors via Market Insights to identify emerging opportunities and impending risks.

- An SIP calculator and calendar to help plan your investments.

- Fund Select one access to mutual fund recommendations as per individual risk profiles.

Index funds are a compelling avenue for beginner and seasoned investors alike, owing to their low-cost passive approach and inherent diversification.

At the same time, however, it is a wise idea to balance them with other assets in your portfolio since the former’s returns are market-linked.