Index Funds vs Mutual funds: A Beginner’s Guide

Learn More Learn More

In a hurry? Read this summary:

Diversification is key for effective investment planning, which mutual funds offer a simple way to achieve. Before investing in them, though, it is essential to understand the different types of mutual funds and how each of them compares to the other.

Amongst these, index funds have recently emerged as a popular option. Read on to understand how index funds fit within the broader mutual fund universe — and yet, how they differ at the same time.

Mutual funds are pooled investment instruments that invest their capital in a mix of assets, including equities, debt instruments, or a mix of both. Investing across asset classes, sectors, geographies, and market capitalisations helps reduce concentrated risks and balance capital appreciation and a stable income. One can choose to invest in them via a one-time lumpsum payment, or invest pre-determined amounts in them at fixed intervals, under a systematic investment plan (SIP).

Depending on whether mutual funds look to beat market performance or simply replicate it, they are classified as actively or passively managed funds. In actively managed funds, managers regularly review and rebalance asset allocation to generate returns above benchmark indexes, with passively managed funds, the goal is simply to track and match the performance of underlying indices or sectors with little to no intervention.

Index funds track and replicate the performance of specific market indices, by investing in their constituents in the same proportion. To qualify as an index fund, they must invest at least 95% of their capital in said securities, per SEBI (Securities Exchange Board of India) rules.

Those with low-to-medium levels of risk tolerance may consider investing in them, as they offer diversified exposure to equity markets. Since portfolio composition isn’t actively rebalanced, index funds tend to have relatively lower expense ratios as well, which further enhances returns. This makes them appealing to beginner and seasoned investors alike.

That said, there may at times be gaps between the performance of these funds and their underlying indices. This is referred to as a tracking error, and can be caused by expense ratios, transaction costs, delays in rebalancing in the fund when the index changes its composition, and other such factors. Generally, the lower the tracking error, the better the returns one can expect from these funds in the long run.

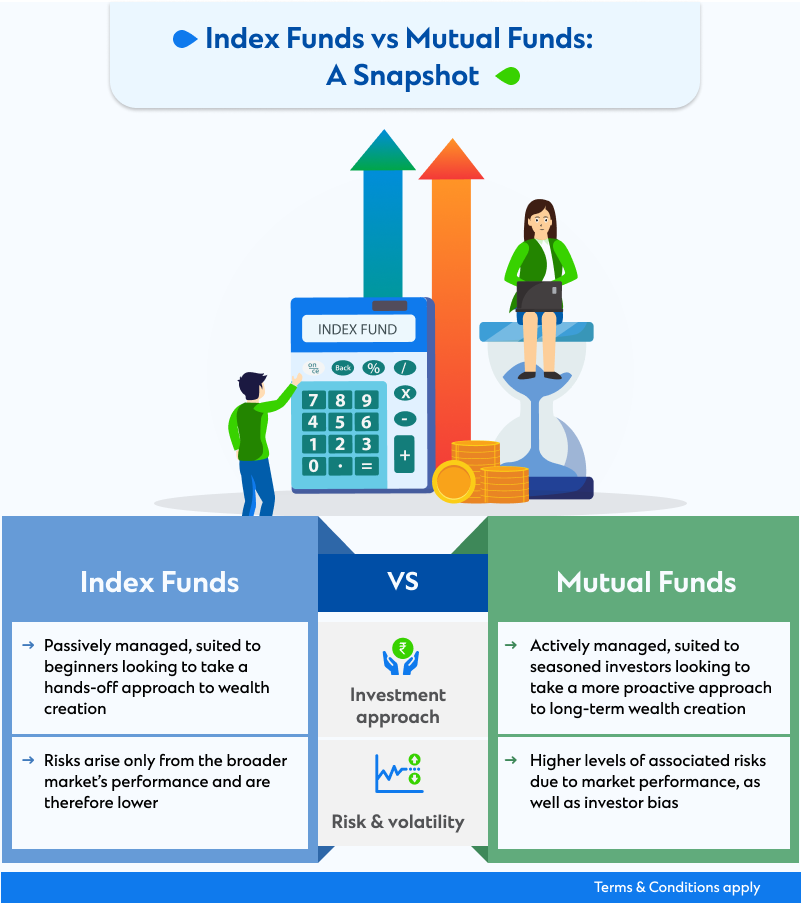

When one refers to mutual funds, they often picture actively managed schemes that aim to beat the market. Passively managed options such as index funds have recently gained significant ground however, amongst risk-averse and conservative investors. While index funds fall under the broader mutual fund universe, their approach, along with cost, and performance outcomes differ in important ways.

Here’s a closer look at how they compare:

Investment approach

Index funds are passively managed instruments. Portfolio composition is based on that of the underlying index. Those looking to take a more hands-off approach to wealth creation may consider investing in them.

Mutual funds may be either passively or actively managed. In case of the latter, portfolio managers actively review and rebalance a fund’s holdings in response to market conditions, capitalising on emerging opportunities and mitigating impending risks. They are therefore more suited to those looking to take a more proactive approach when it comes to long-term wealth creation.

Risk levels

Both index funds and actively managed mutual funds provide one with portfolio diversification. However, just like any other market-linked instrument, they do have a certain degree of risk associated with them as well. The difference lies in the levels of said risk, stemming from varying management approaches.

Since index funds passively track benchmark indices, their portfolio compositions remain relatively stable. This lowers volatility and makes performance more predictable which may appeal to risk-averse investors (for example, those who will be retiring soon).

On the other hand, actively managed mutual funds are frequently rebalanced, in a bid to capitalise on opportunities and avoid downturns. While this could result in potentially higher returns, it also makes them more prone to volatility arising from manager bias and potential emotional investing. As such, those with higher levels of risk tolerance (such as those starting out in their careers) may consider investing in more actively managed mutual funds.

Choosing between index funds and mutual funds requires a thorough analysis of one’s preferred approach to wealth creation, their investment expertise, and risk tolerance. To know more about how each of these fund categories can fit into your broader investment portfolio and get started on your investment journey today, visit SC Invest on the SC mobile app or contact our representatives today.

Equity Mutual Funds: Benefits & How to Invest

The What, Why & How of Debt Funds: A Complete Guide

Hybrid Mutual Funds: The Balanced Route to Growth and Stability

Standard Chartered Bank, India (‘Bank’) is an AMFI-registered distributor of mutual funds and referrer of other third-party investment products and does not provide any investment advisory services as defined under the SEBI (Investment Advisers) Regulations, 2013. Mutual fund investments are subject to market risks, please read scheme related documents carefully before investing. Past performance is not indicative of future returns. Apart from the RM-assisted journey, SC Invest is an EXECUTION-ONLY platform. The Bank does not provide any investment advice or investment recommendations in respect of any transaction effected through the SC Invest platform.

The contents on this webpage are for general information only and does not constitute an offer, recommendation or solicitation of an offer to enter into a transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movements in rates or prices or any representation that any such future movements will not exceed those shown in any illustration. You are fully responsible for your investment decision, including whether the product or service described here is suitable for you. Standard Chartered Bank will not accept any responsibility or liability of any kind, with respect to the accuracy or completeness of the information in this webpage. The contents herein are for general evaluation only and has not been prepared to be suitable for any particular person or class of persons. Standard Chartered Bank makes no representation or warranty of any kind, express, implied or statutory regarding the contents on this webpage or any information contained or referred to herein. This webpage is distributed on the express understanding that, whilst the information in it is believed to be reliable, it has not been independently verified by us.

This communication has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Standard Chartered Bank India (“SCB/ Bank”) does not warrant its completeness and accuracy. This information is not intended as an offer or solicitation for the purchase or sale of any financial instrument / units of Mutual Fund. Recipients of this information should rely on their own investigations and take their own professional advice. Neither SCB/Bank nor any of its employees shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this material. SCB Bank and its affiliates, officers, directors, key managerial persons and employees, including persons involved in the preparation or issuance of this material may, from time to time, have investments / positions in Mutual Funds / schemes referred in the document.

Standard Chartered Bank (“SCB/ Bank”) is a AMFI-registered Mutual Fund Distributor & a Corporate Agent for Insurance products.