Table of Contents

- Lumpsum investments: Investing a large amount in one go

- SIPs: A smart, disciplined path to long-term growth

- SIP vs. lumpsum: How do these investment paths really compare?

- Returns: What the numbers say about SIP and lumpsum

- Not sure which one to choose? Here are the factors to consider first

- Slow and steady wins the race? Why SIPs shine over time

- Why not both? Mixing lumpsum and SIP for a smarter portfolio

- Making the right move: Tailoring your investment strategy to your goals

Mutual funds offer flexible ways to grow your wealth — whether you prefer to invest a large amount upfront or take a more measured, systematic approach. In India, two popular strategies are Systematic Investment Plans (SIPs) and lumpsum investments. Each comes with unique advantages, and choosing the right method depends on your goals, risk appetite, and market conditions.

Lumpsum investments: Investing a large amount in one go

A lumpsum investment refers to committing a sizeable amount of money into a mutual fund in a single transaction. This method is well-suited for individuals who receive periodic windfalls such as bonuses, inheritance payouts, maturity proceeds from other investments.

In the Indian context, lump sum investments are often used when selling property, redeeming fixed deposits, or reallocating idle funds. The strategy works best when deployed during market downturns or corrections — allowing investors to benefit from low valuations and potential upside. However, since the entire capital is exposed at once, this approach does carry a high timing risk.

SIPs: A smart, disciplined path to long-term growth

An SIP allows you to invest fixed amounts regularly (usually monthly) into a mutual fund of your choice. It’s a favourite among salaried individuals and first-time investors who prefer consistency over speculation.

What makes SIPs particularly effective is that they promote financial discipline, remove the emotion of timing the market, and harness the power of compounding. By investing consistently, investors average out the cost of purchase — a concept known as rupee cost averaging — which helps reduce the impact of short-term market volatility.

For long-term goals such as retirement, children’s education, or buying a home, SIPs offer a steady route to wealth creation without overwhelming monthly commitments.

SIP vs. lumpsum: How do these investment paths really compare?

| Feature | Lumpsum | SIP |

| Investment frequency | One-time investment | Regular (e.g. monthly or quarterly) |

| Risk exposure | High, especially in volatile markets | Lower, thanks to cost averaging |

| Market timing relevance | Crucial – timing drives returns | Less relevant – mitigated over time |

| Investor suitability | Experienced investors with surplus capital | New investors and long-term savers |

Returns: What the numbers say about SIP and lumpsum

Performance analysis over different market cycles shows that SIPs tend to fare better during volatile periods. For example, investors who started SIPs before the 2008 global financial crisis or the COVID-19 dip in 2020 saw their average costs fall over time, often leading to strong recovery.

Conversely, lumpsum investors during the same periods experienced steeper short-term drawdowns but may have caught up eventually if they stayed invested long enough.

A 10-year comparison of Nifty 50-based equity mutual funds indicates that:

- SIPs offered more stable average returns due to disciplined investing.

- Lump sum delivered higher peak returns in bullish years — but also had more volatile swings.

These findings highlight that while both strategies can generate wealth, the experience and emotional resilience required for lumpsum investing are considerably greater.

Not sure which one to choose? Here are the factors to consider first

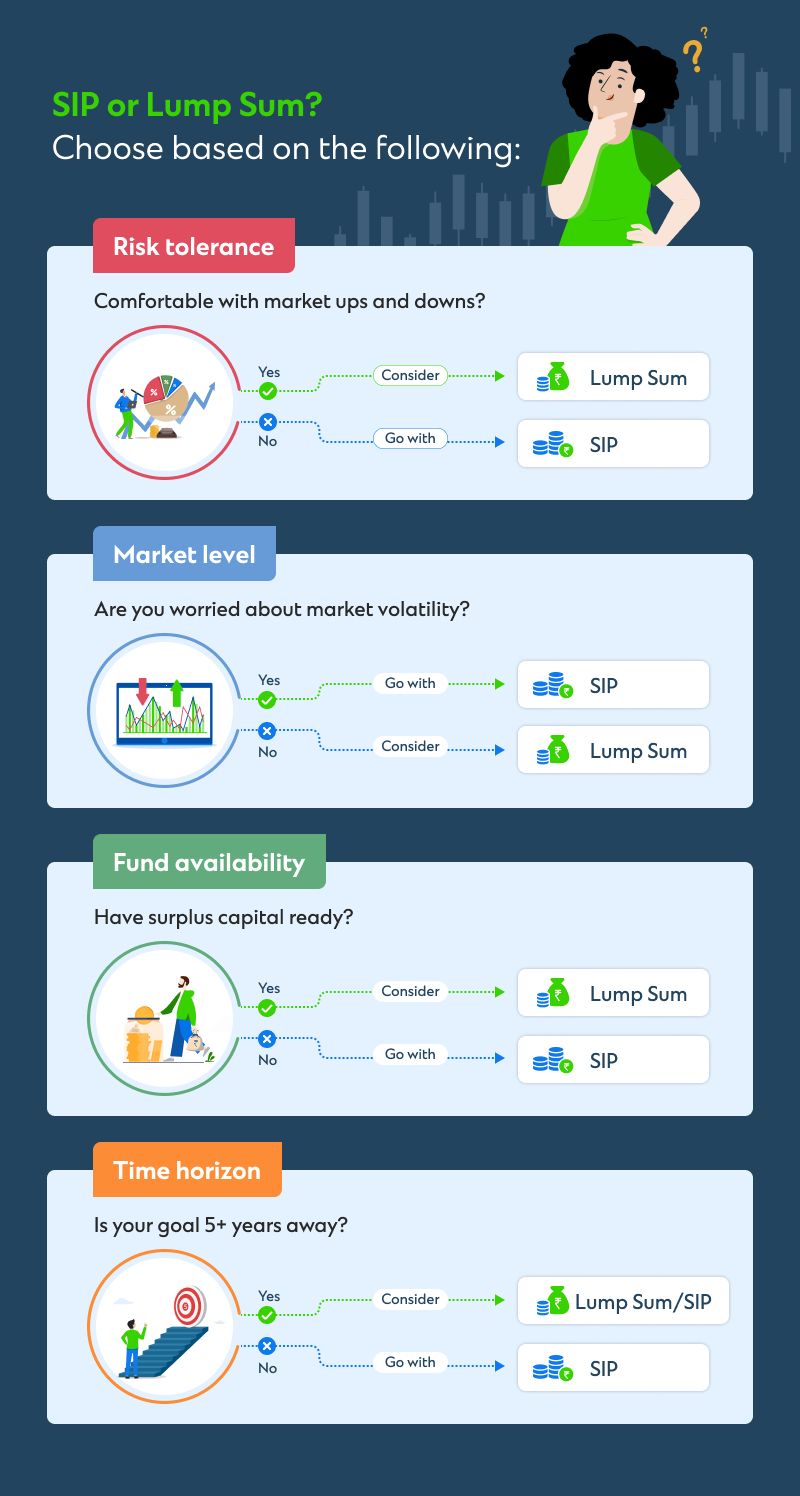

Selecting between SIP and lumpsum depends on a blend of personal and market factors. Ask yourself:

- Risk tolerance: Are you comfortable seeing your investment value fluctuate significantly?

- Market outlook: Are markets near highs or experiencing a correction?

- Liquidity: Do you have surplus funds to deploy, or will you build a corpus gradually?

- Time horizon: Are your goals long-term (5+ years) or short- to medium-term?

These considerations should guide your investment choice. If you have funds readily available and the market looks favourable, a lumpsum could work. On the other hand, if you’re looking for consistency and peace of mind, SIPs might be the better path.

Explore these options further using tools on SC Invest — Standard Chartered’s intuitive digital platform that simplifies mutual fund investing.

Slow and steady wins the race? Why SIPs shine over time

SIPs are designed for long-term investing. They:

- Encourage financial discipline

- Help mitigate market volatility through rupee cost averaging

- Enable emotional detachment from market cycles — a common challenge among retail investors

- Make compounding more effective by allowing early and consistent investing

When paired with a clear goal and sufficient time horizon, SIPs can quietly build substantial wealth while minimising risk.

Why not both? Mixing lumpsum and SIP for a smarter portfolio

You don’t have to choose one or the other. Many investors adopt a hybrid strategy that combines lump sum and SIPs:

- Use STPs (Systematic Transfer Plans) to gradually move funds from a liquid fund into an equity fund — this usually works well if you’ve received a bonus or windfall.

- Invest part of your available capital via lump sum, while continuing your regular SIP contributions for consistent growth.

This approach offers the best of both worlds — allowing you to benefit from market opportunities while maintaining long-term discipline.

Making the right move: Tailoring your investment strategy to your goals

There’s no universal answer when it comes to choosing between SIP and lumpsum investing. Your ideal path depends on where you are financially, what the market is doing, and how comfortable you are with risk.

Whether you choose to invest gradually through SIPs or capitalise on an opportunity with a lump sum, the most important step is to begin — with a clear plan and a trusted platform.

Take your next step with confidence. Visit SC Invest and start building your mutual fund portfolio today.