Faster Payment System (FPS) – Real-time transfers and payments for free

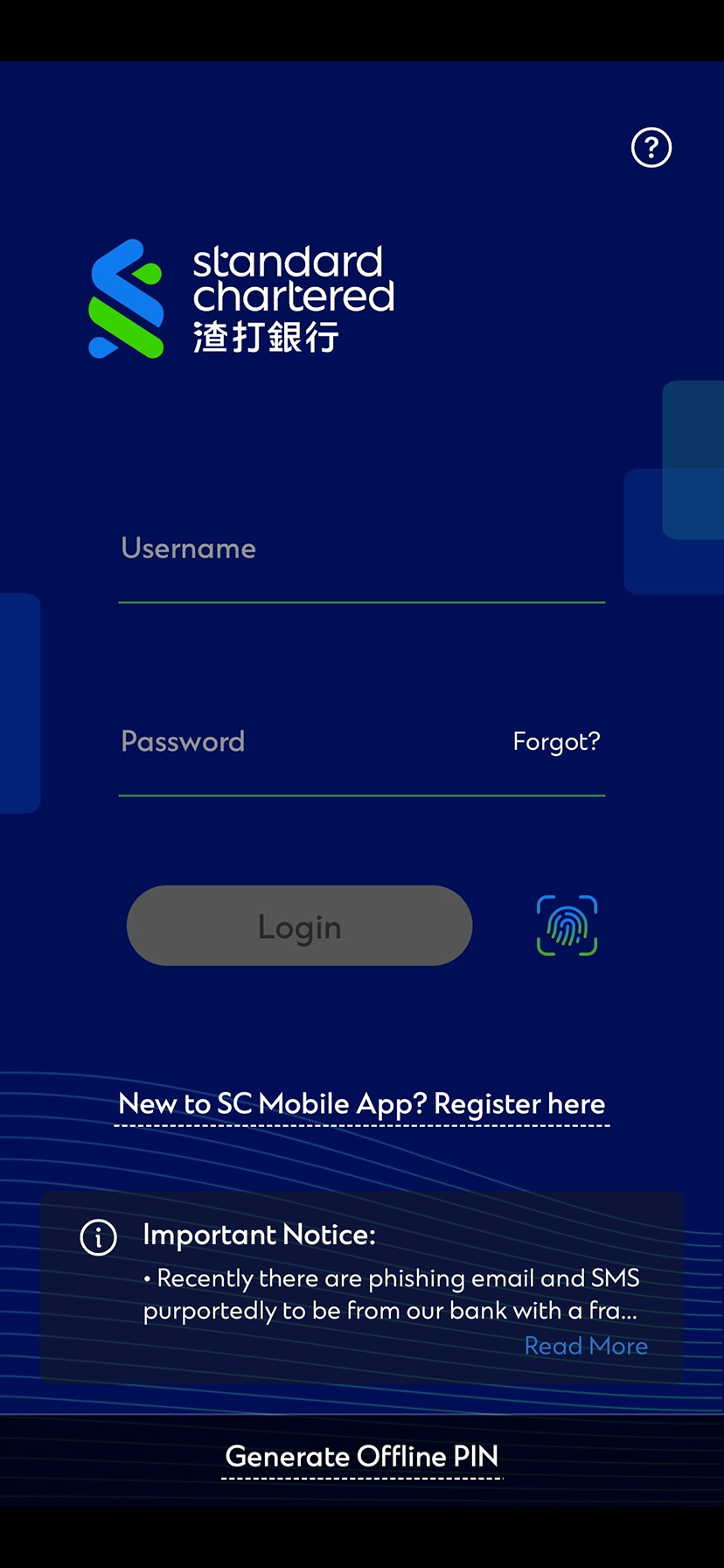

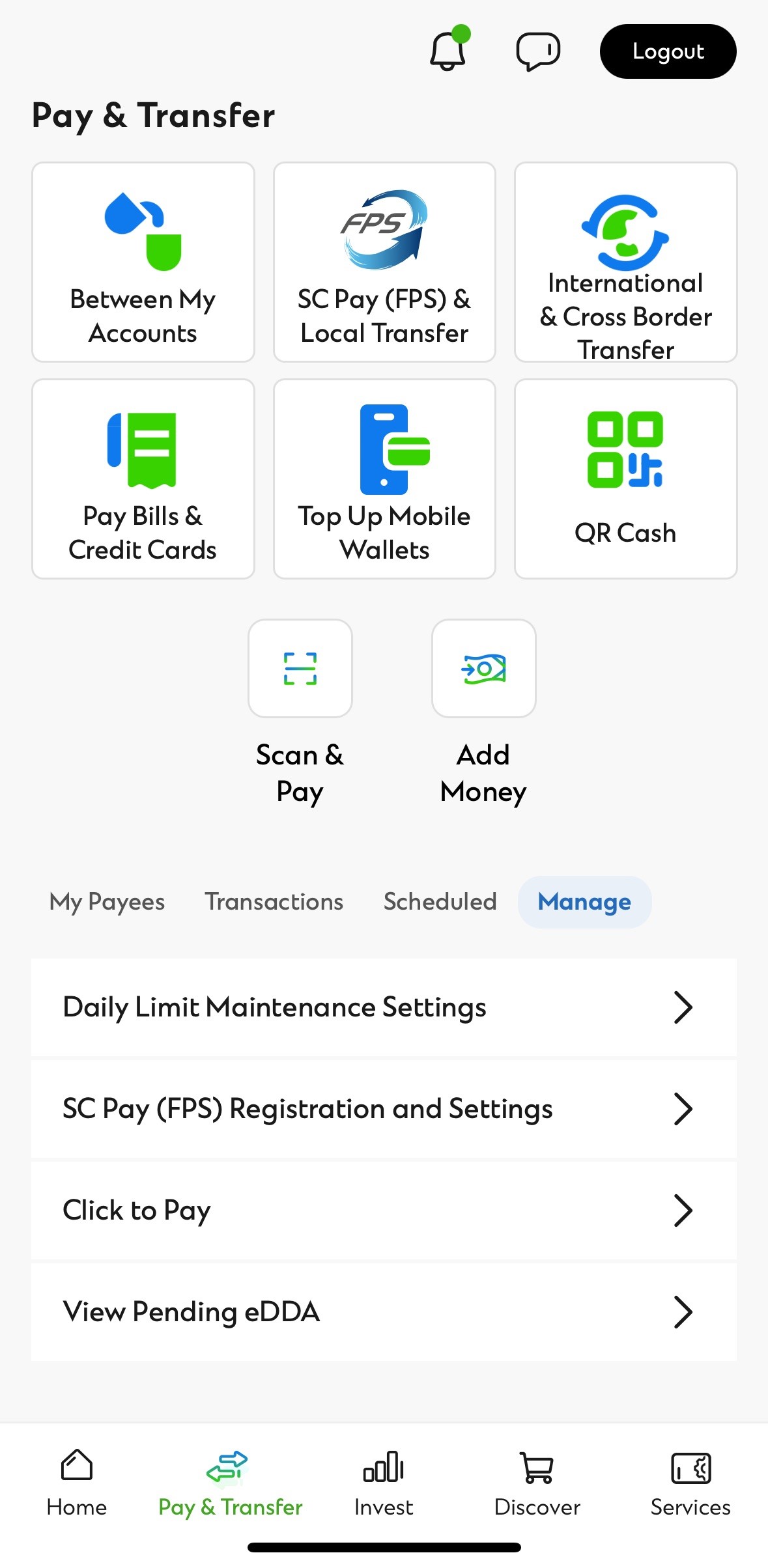

HOW TO REGISTERStep 1

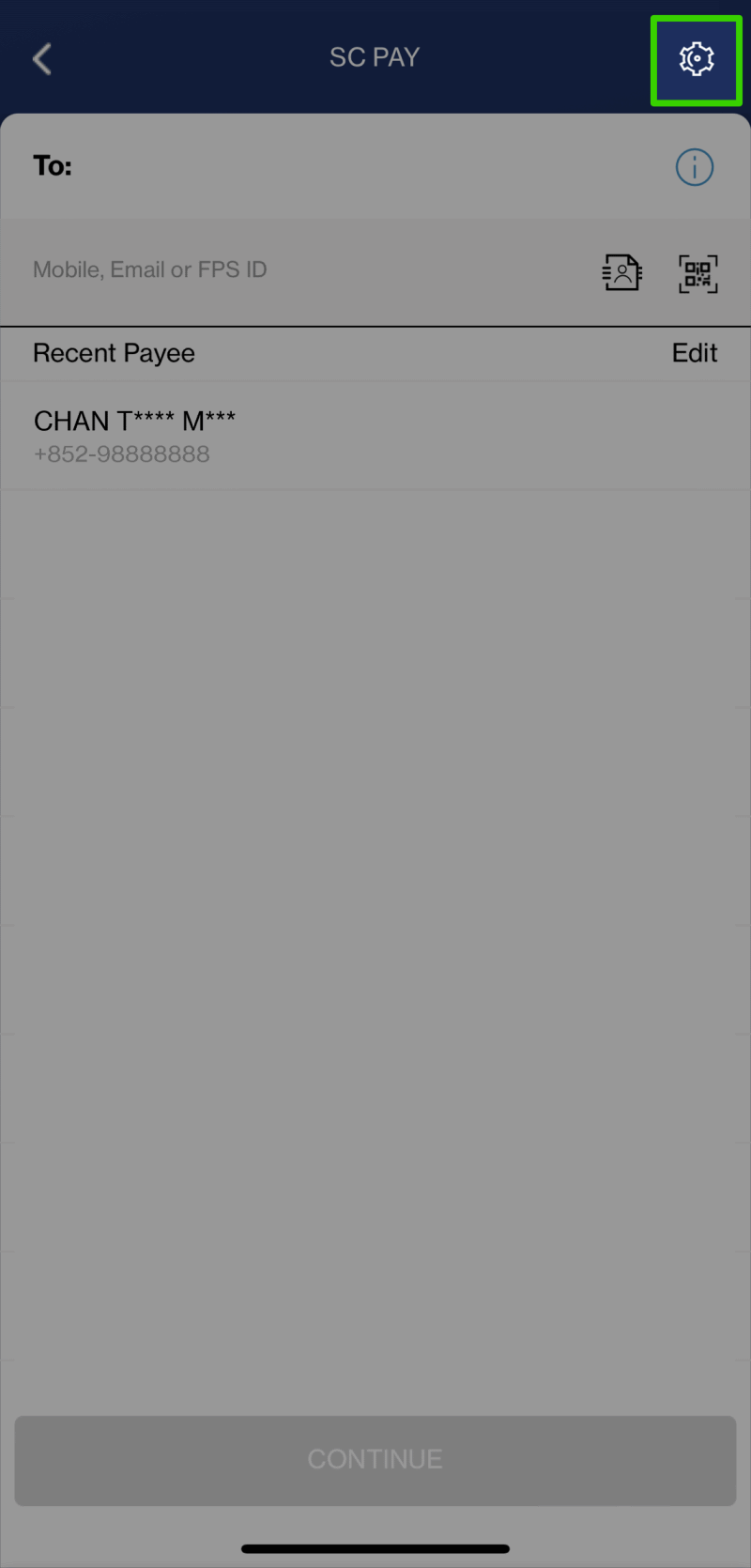

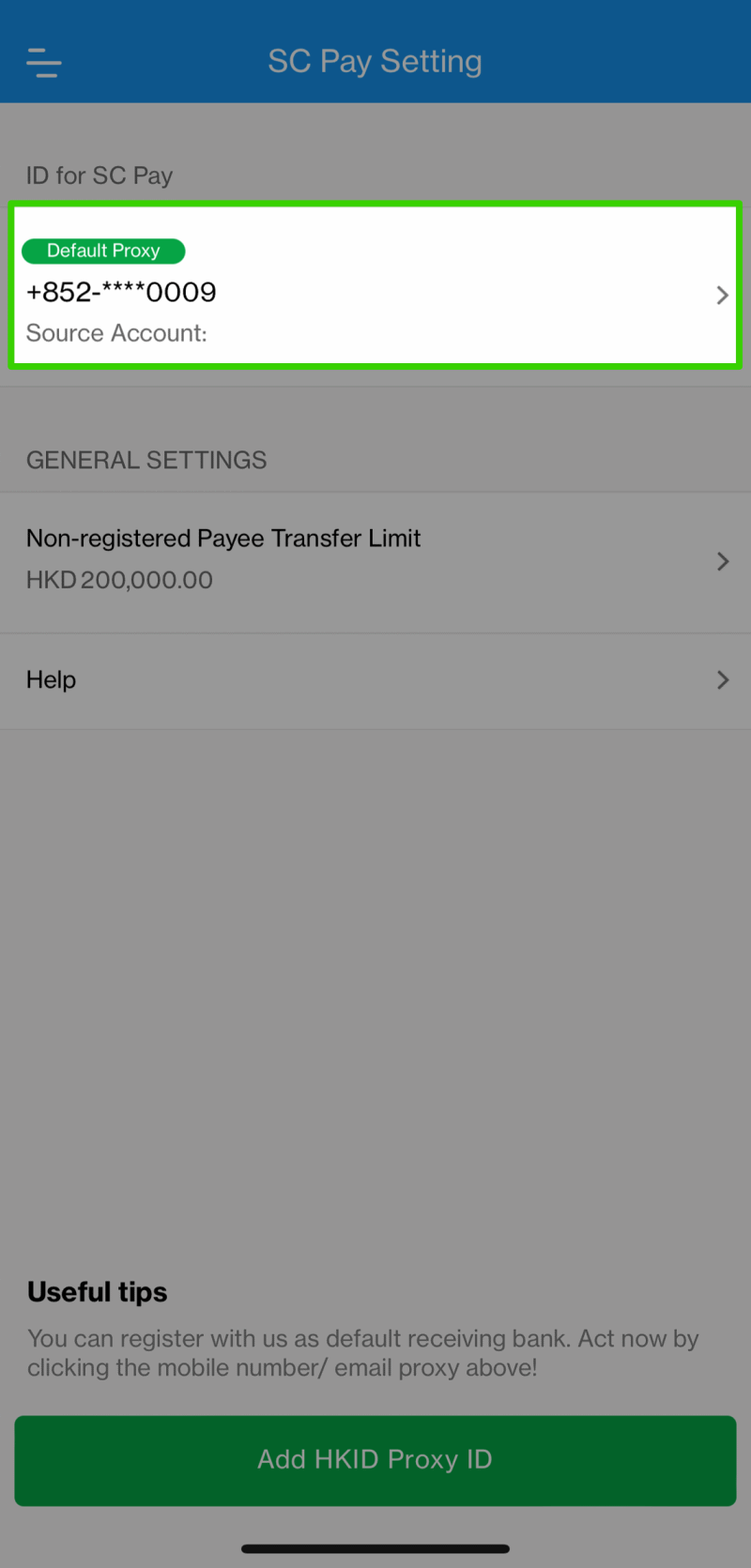

After login to SC Mobile App, go to ‘Pay & Transfer’ then select ‘Manage’ and ‘SC Pay (FPS) Registration and Settings’

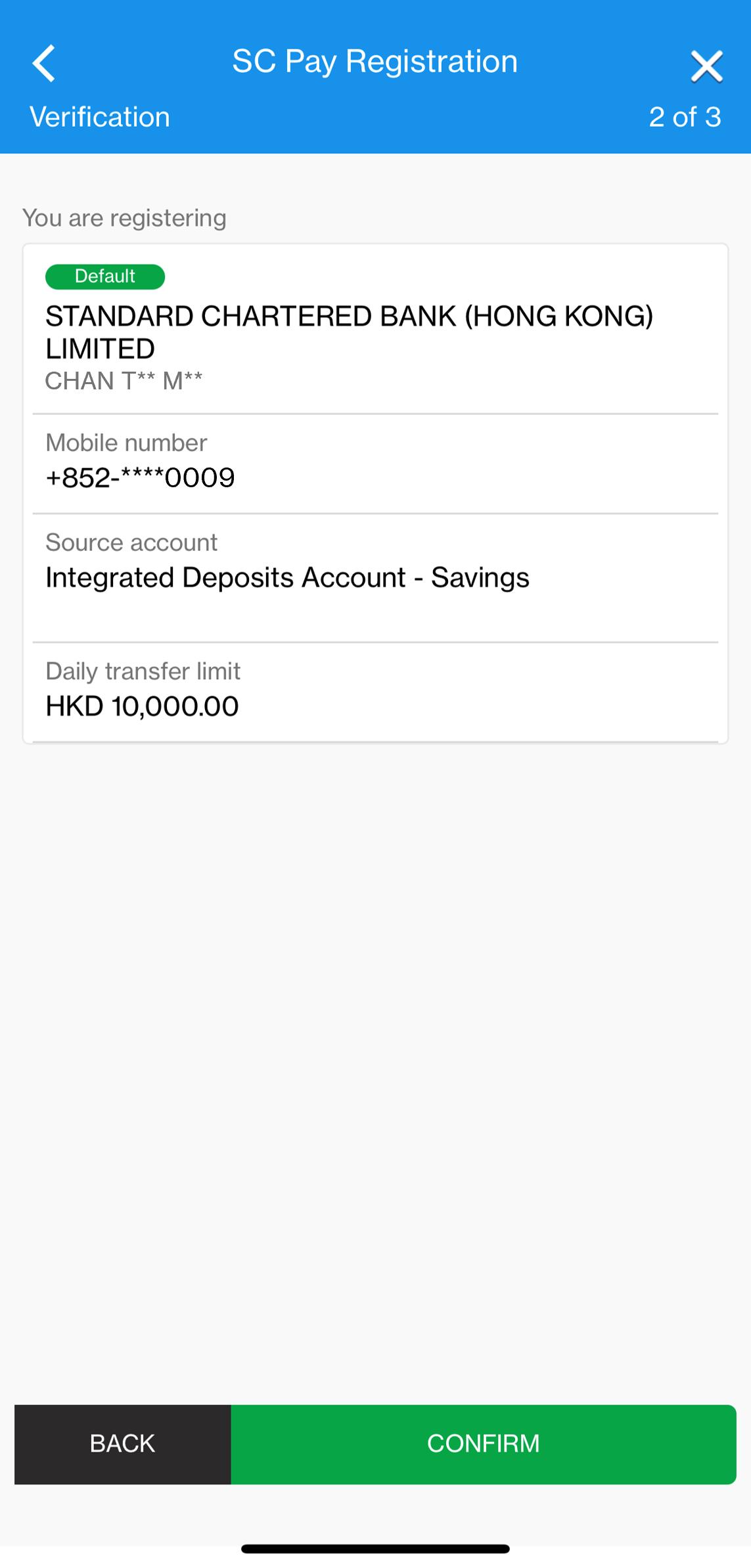

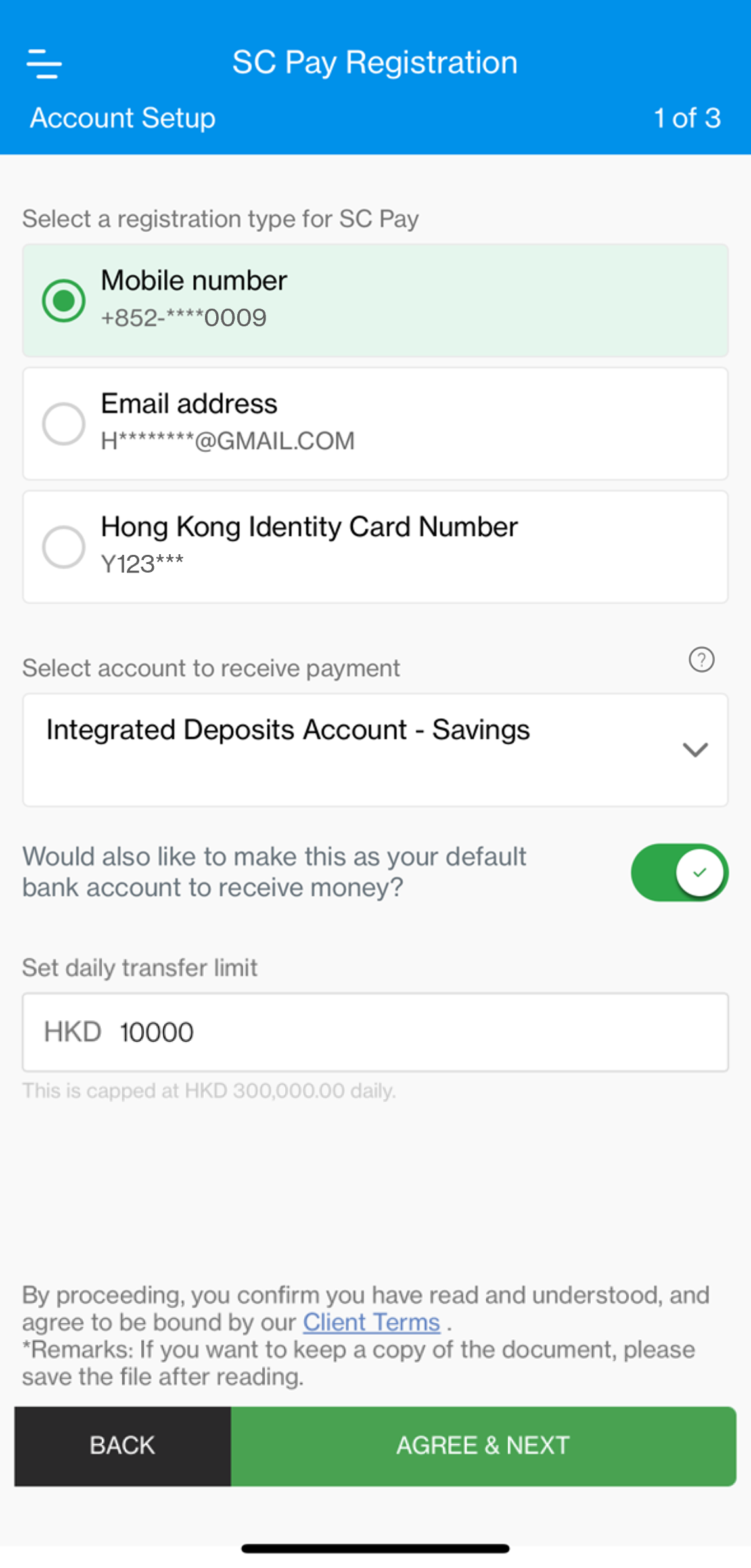

Step 2

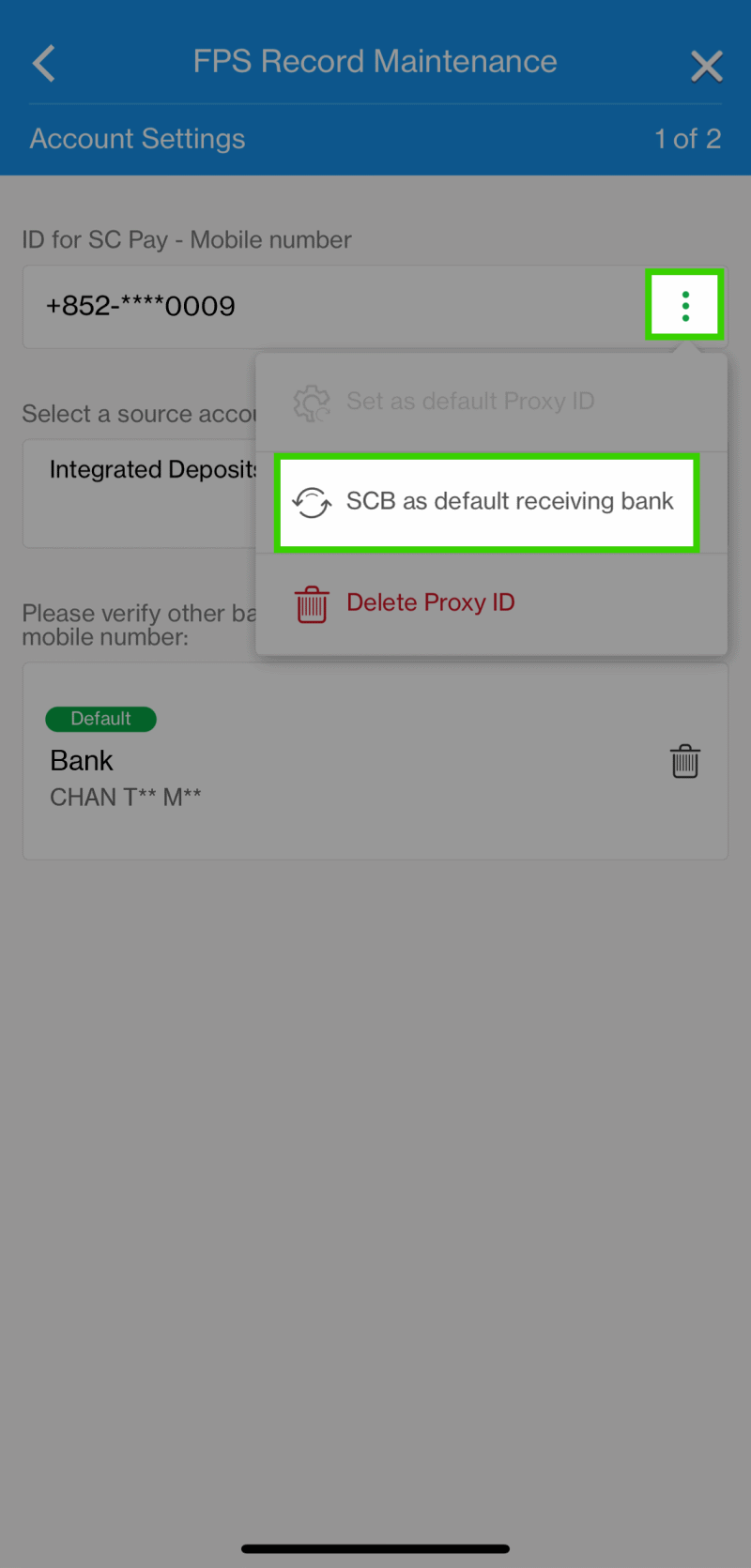

Select mobile number or email address to register with, then your bank account to send and receive money (Note: HKID only allows receiving money from institutions).

You can also set Standard Chartered Bank as your FPS default receiving bank and change the pre-set daily transfer limit (maximum HK$300,000).

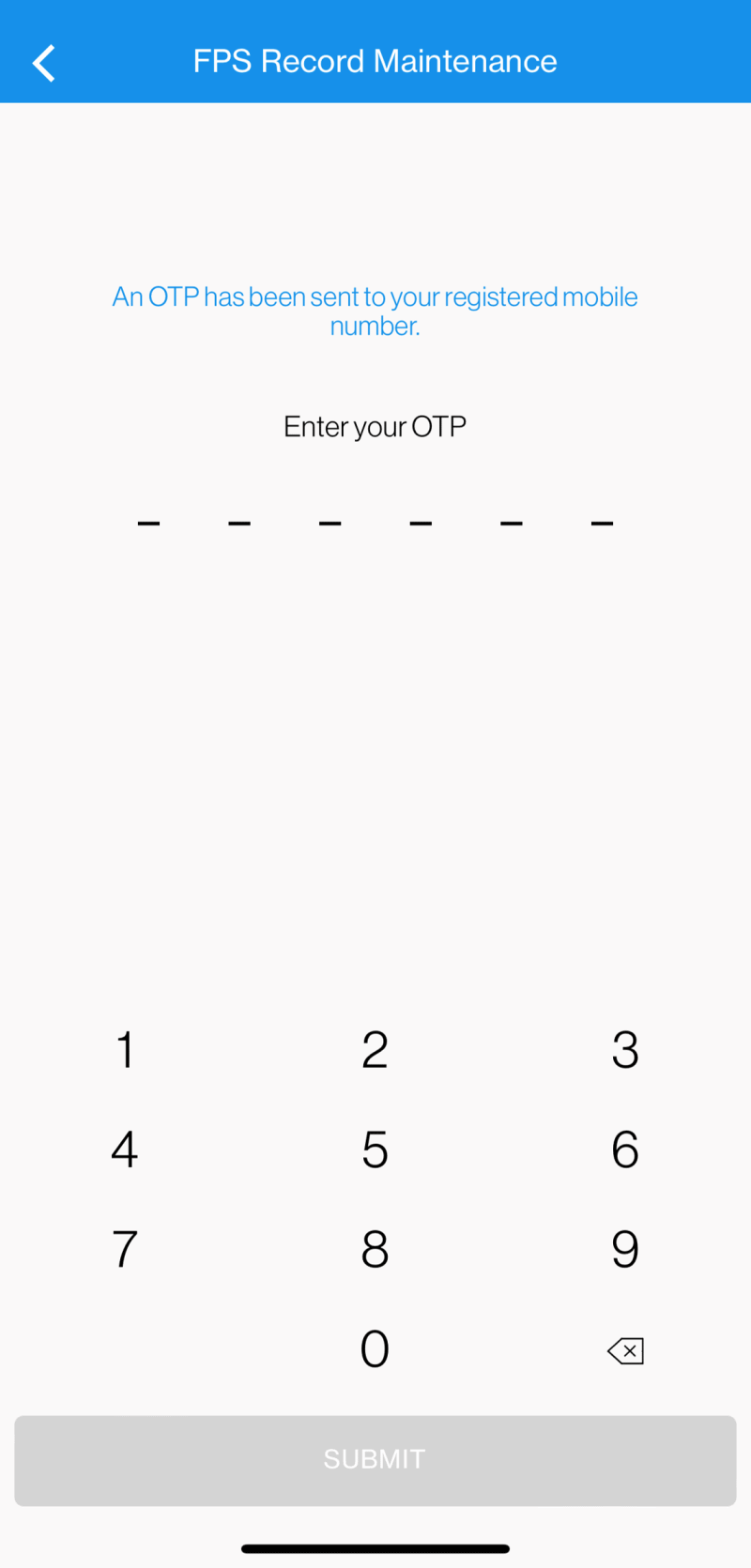

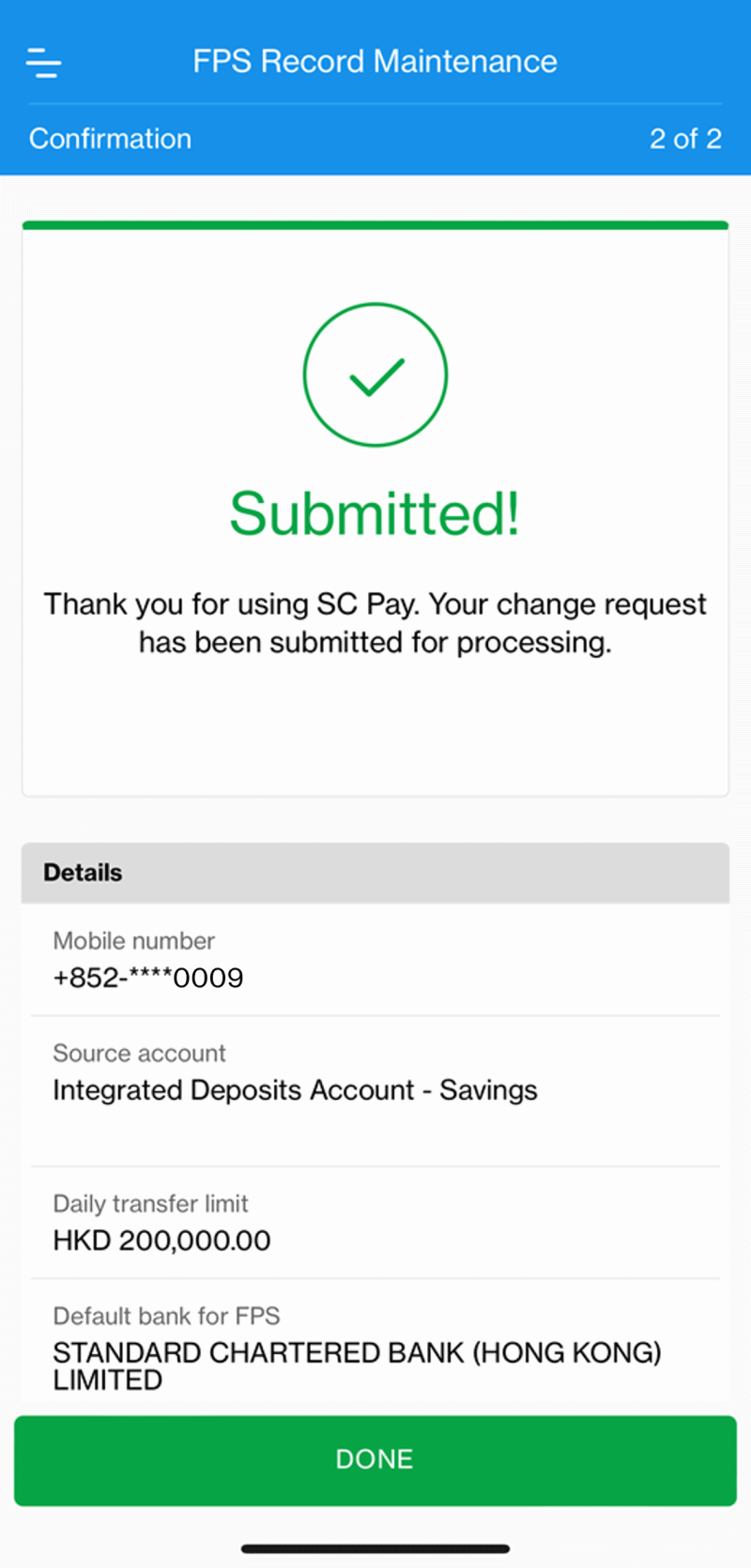

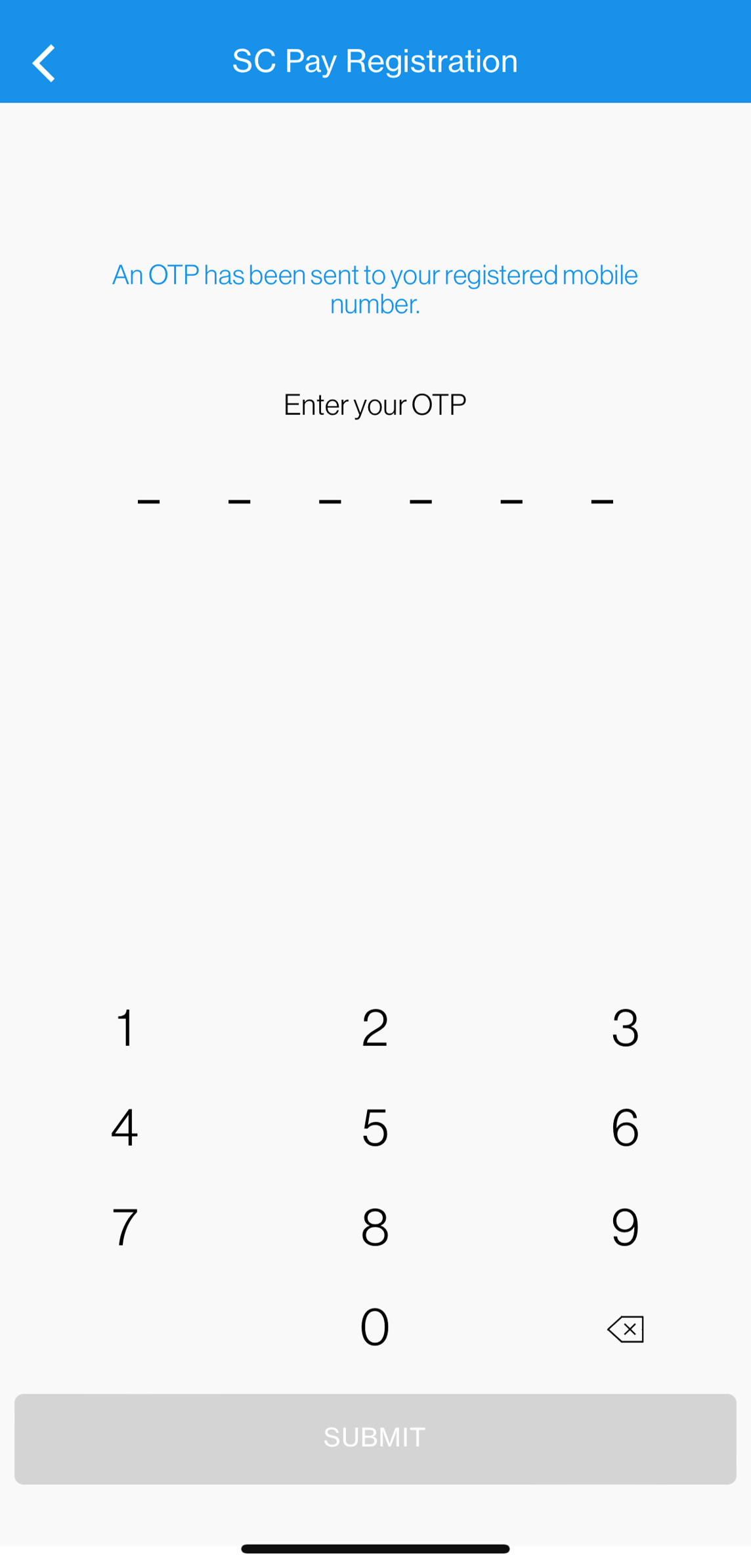

Step 3

Enter SMS or email One-Time Password (OTP) to authenticate the registration

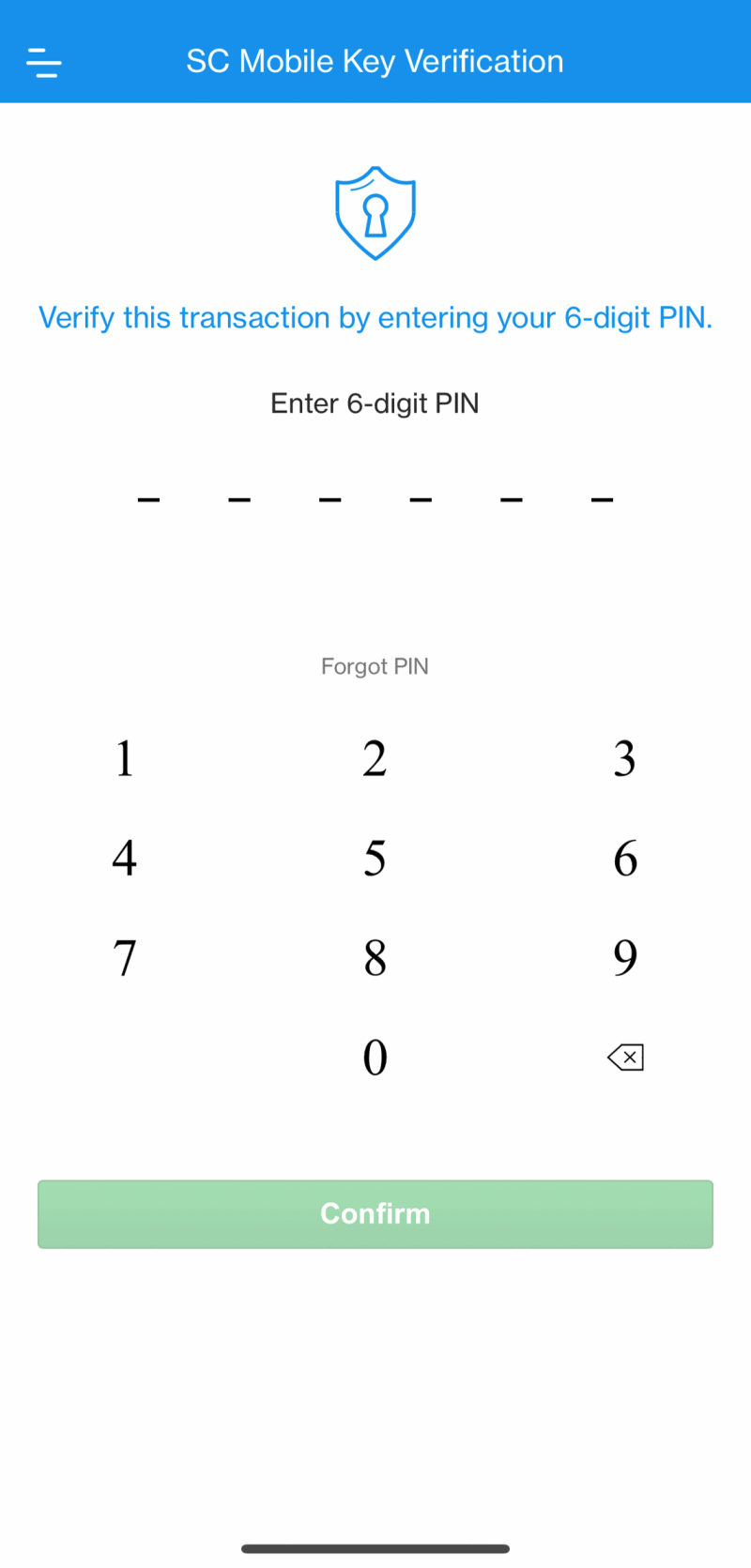

Step 4

Review registration details and tap ‘Confirm’ to complete