FX Membership Program

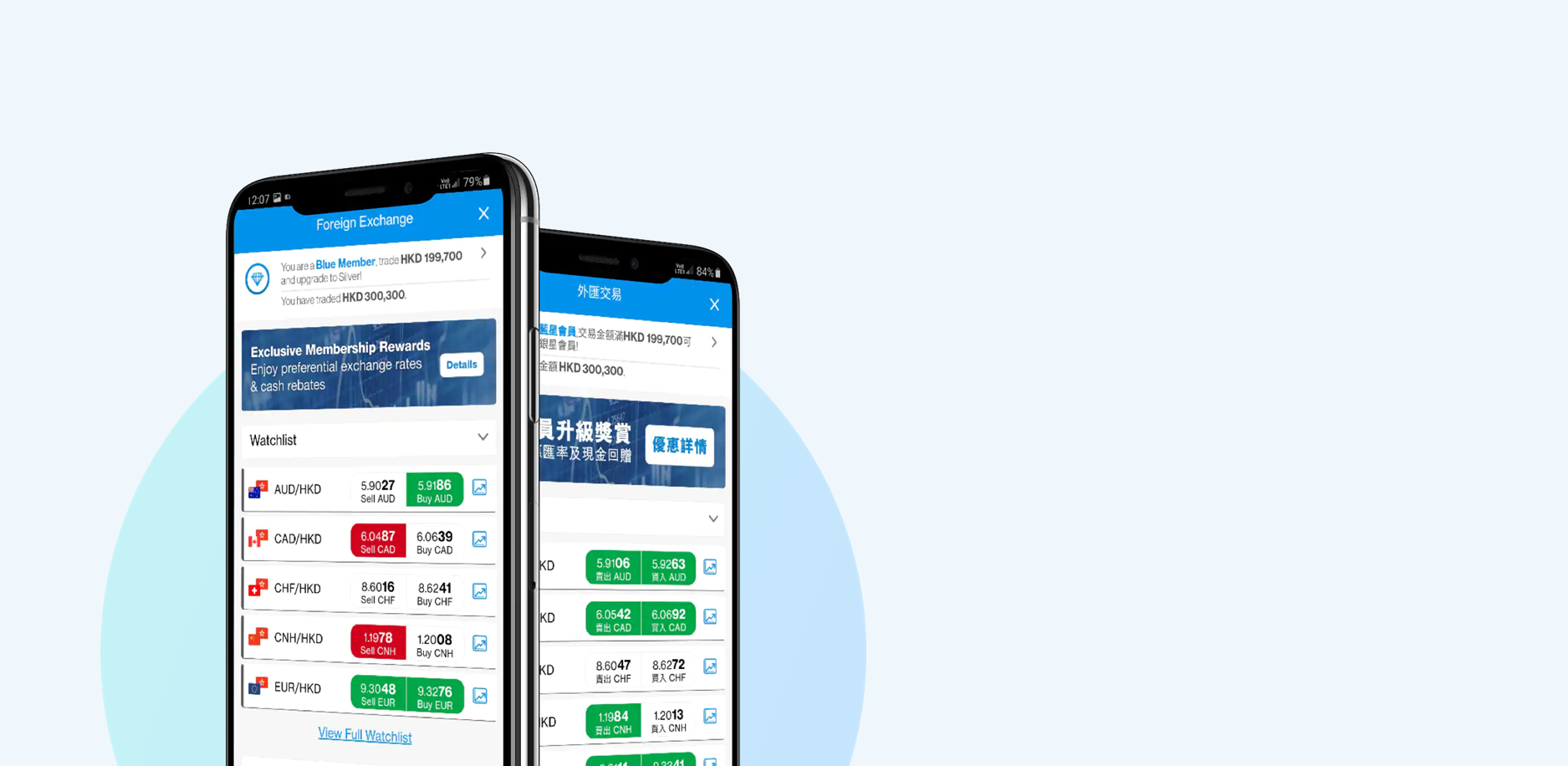

Check real-time foreign exchange rates and convert currencies via Standard Chartered Online Banking and SC Mobile

Eligible Clients New Client

Existing Client

Earn HKD128 when you accumulated HKD100,000 FX transactions!

-

View FX Rates

View FX Rates

How to start trading? Log onto Foreign Exchange Platform now

Via SC Mobile App

Use mobile device (iOS App or Android App) to click the following button. Simply click “FX” on Invest tab.

Via Online Banking

Login Online Banking and select “Foreign Exchange” from the menu