How to identify the right ESG investment

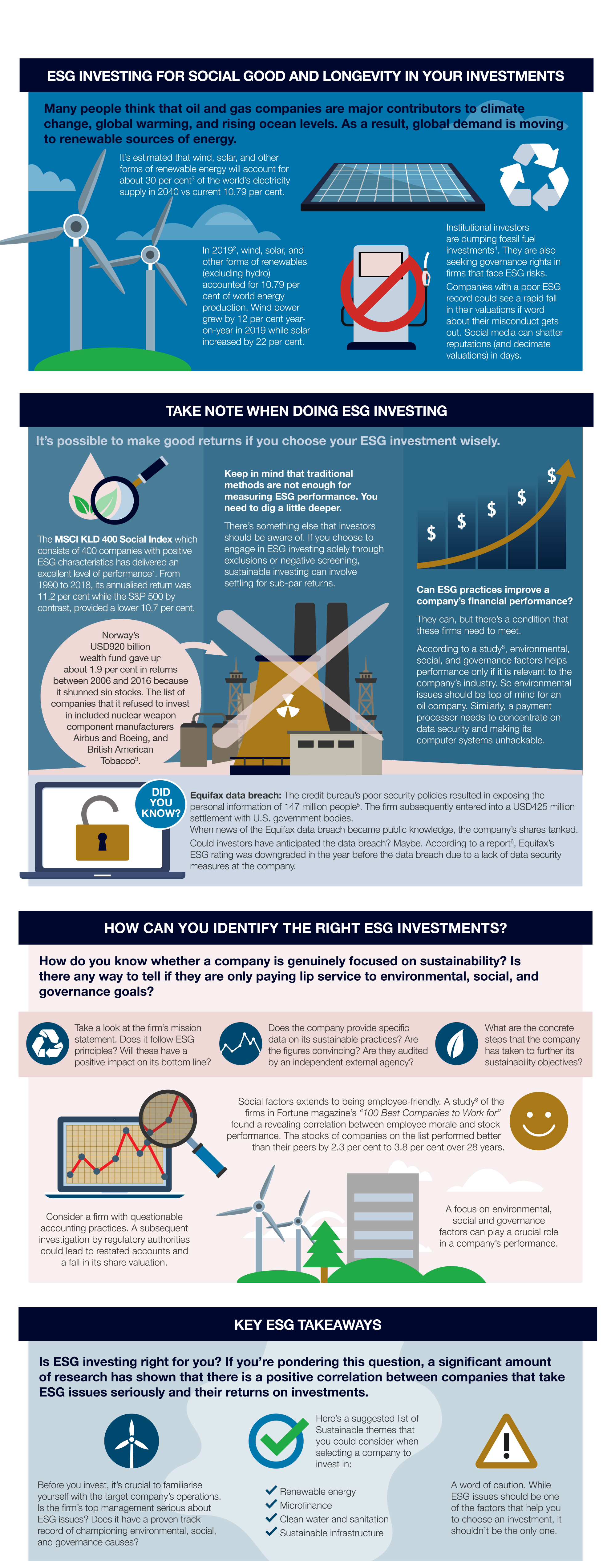

Sustainable investing could make a positive impact on global problems and provide you with above average market returns.

Sustainable investing could make a positive impact on global problems and provide you with above average market returns.

Some investors are reluctant to put their money into sustainable investments. Their reason is that these investments could earn suboptimal returns. They could argue that, saving the world should be the job of global leaders and international non-profit organisations. Why should private investors have to compromise on their returns?

In fact, the opposite could be true. Sustainable investing could make a positive impact on global problems and provide you with above average market returns.

But are all sustainable investments a sure win? Certainly not.

ESG-washing or greenwashing, where companies make misleading claims about their environmental and social practices, performances or products, could be an issue. Investors on the lookout for sustainable investments could be fooled by a product that is given a “green or ESG stamp”.

So, what should investors do? How can you identify the right ESG investments?

Standard Chartered UAE offers clients opportunities to invest responsibly.

For more information on our Sustainable Investing solutions that match your investment goals, get in touch with us now.

2Global wind and solar energy growth rate in 2019 was ‘slowest this century’

3Renewable energy will be world’s main power source by 2040, says BP

4Enlightened ESG investors engage, but retain right to divest

5Federal Trade Commission — Equifax Data Breach Settlement

6How ESG Investing Increases Risk-Adjusted Returns

7Sustainable investing can propel long-term returns

8Future leaders, take note: finance and sustainability go together

9Norway’s oil fund returns crimped by ethical stance

This article is brought to you by Standard Chartered Bank (UAE) Limited. All information provided is for informational purposes only. This information is neither an offer to sell, purchase or subscribe for any investment nor a solicitation of such an offer. This information is general and does not take into account a person’s individual circumstances, objectives or needs. Investments carry risk and values may go up as well as down. Standard Chartered is not liable for any informational errors, incompleteness, delays, or for any actions taken in reliance on information contained herein.