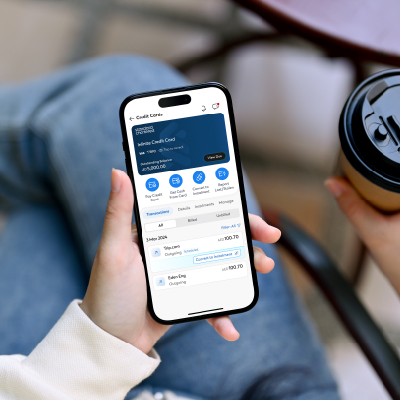

Registration

Steps on how to register for Online Banking or the SC Mobile app.

Step 1: Visit Online Banking or SC Mobile app login screen.

Step 2: Click “New to online/mobile banking?”.

Step 3: Register with either your:

- Standard Chartered Debit Card, Credit Card* or Account Number

- Temporary ID and SMS PIN (expires within 4 working days of registration)

Step 4: Verify your details and click ‘Next’.

Step 5: Enter the One Time Password (OTP) sent to your registered mobile number.

Step 6: Create Login user ID and password.

Step 7: You are now registered for Online Banking and the SC Mobile app.

Step 8: To login, you will need to register for Standard Chartered Mobile Key, click here to get further details on Standard Chartered Mobile Key.

If you wish to do this now, click here.

*Please note that the Credit Card option is for clients who only hold a credit card with the bank.