Step 1

Go to ‘Pay & Transfer’ and select 'International & Cross Border Transfer'

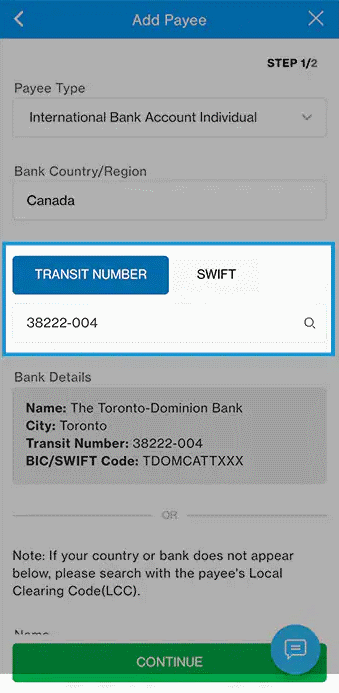

Step 2

1. Enter the local clearing code (e.g. TRANSIT NUMBER) / SWIFT and search OR search by bank name

2. Click “CONTINUE”

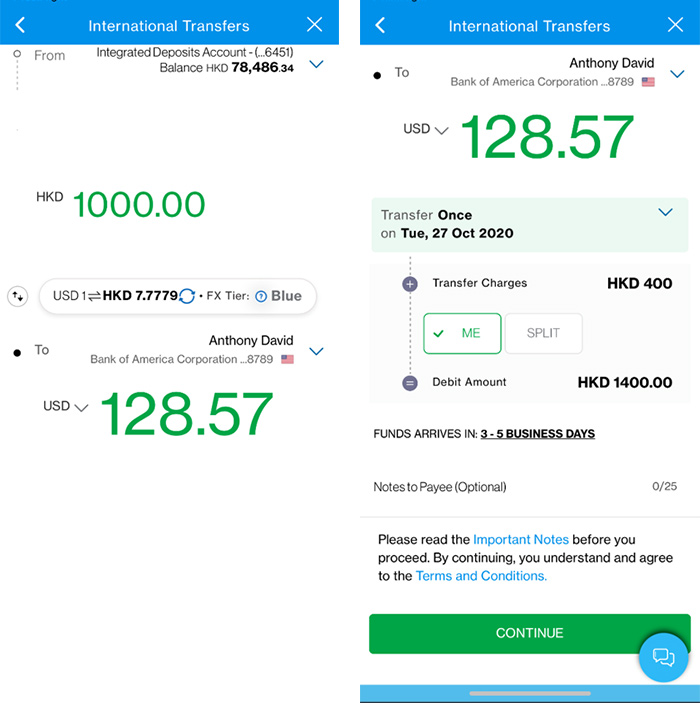

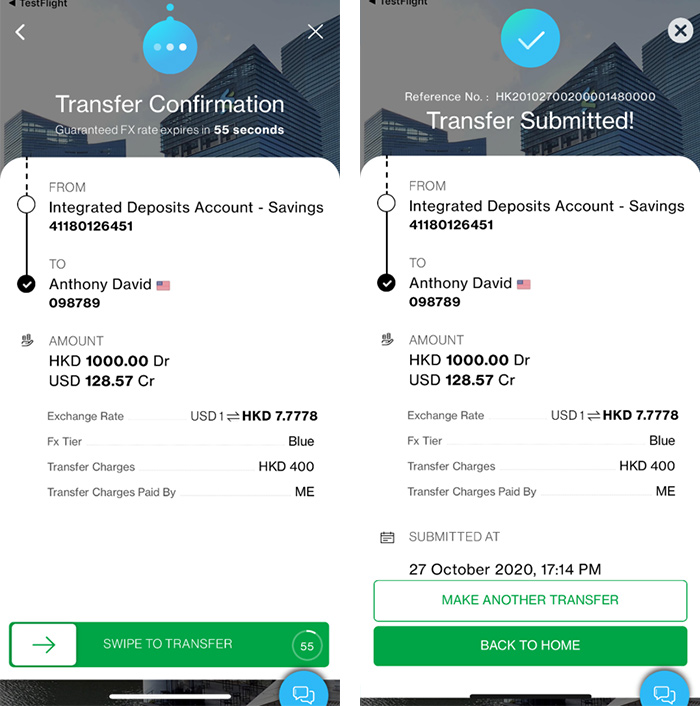

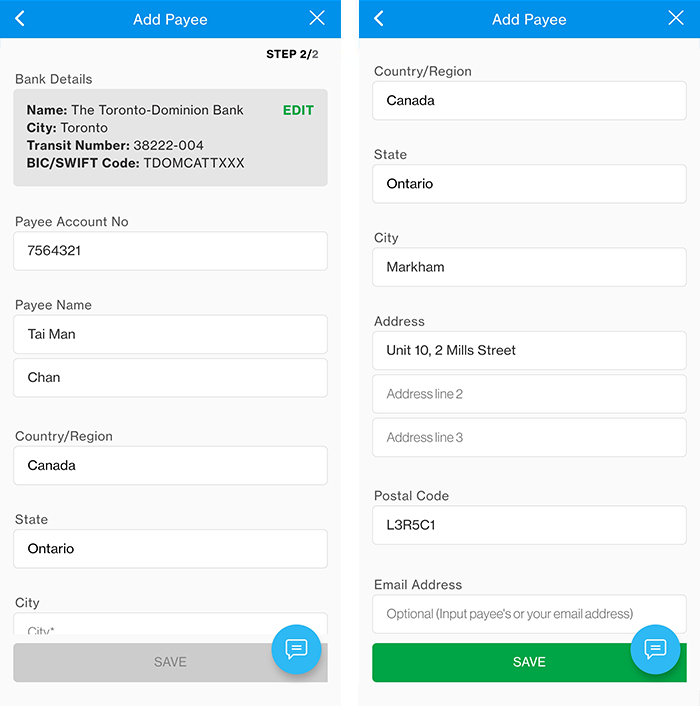

Step 3

1. Input payee details

2. Review and click “SAVE”

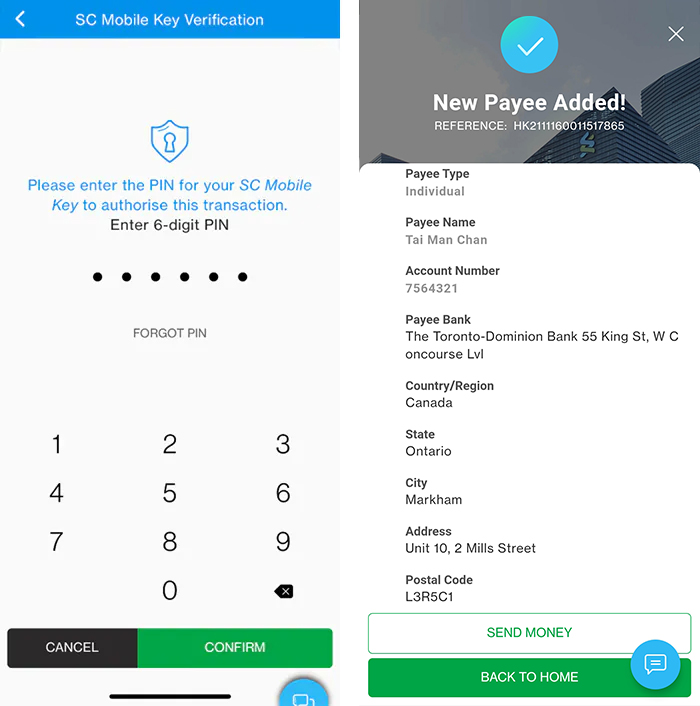

Step 4

1. Enter 6-digit SC Mobile Key and “CONFIRM”

2. New payee added!

Note: Click here to know how to register SC Mobile Key