Standard Chartered UAE is licensed by the Central Bank of the U.A.E.

Standard Chartered Bank UAE is licensed by Securities and Commodities Authority (SCA) to practice Promotion Activity.

Standard Chartered UAE acts as a distributor of the funds referred to in this document (which represents a proportion of all of the funds for which Standard Chartered UAE acts as distributor). Standard Chartered UAE receives fees including trail commissions for the funds that it distributes. You should not invest in any of the funds listed above (collectively the “Funds” and individually a “Fund”) unless you are satisfied that an investment in any of the Funds is suitable for you and you have fully understood the features and risk involved of investing in such Funds.

You should read the relevant offering documents of the Funds carefully for detailed information before deciding whether to invest in any of the Funds and you should pay particular attention to the risk factors set out therein. We recommend that you seek independent professional advice that takes into account considerations such as your financial situation and risk tolerance before making any investment decisions. Do not invest in investment products unless you fully understand and are willing to assume the risks associated with them.

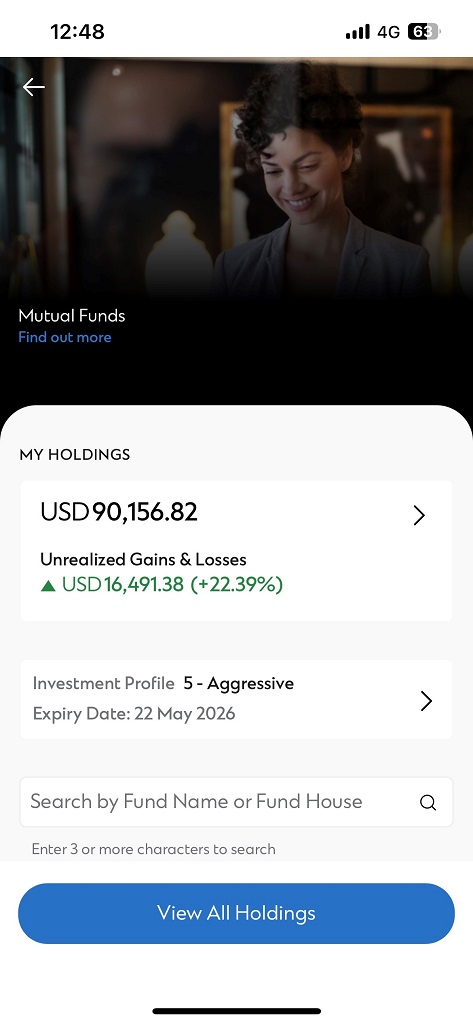

Past performance is not indicative of future performance. An investment in any of the Funds involve risks, the prices of units or shares of the Funds referred to in this email fluctuate, sometimes dramatically, and you may lose your entire investment. Some of the Funds may invest extensively in financial derivatives instruments or emerging markets and may have leveraged exposure, which may lead to higher risk of capital loss. Please ensure that you are comfortable with the risks involved before making an investment. You should be aware that your investment(s) can be negatively affected by foreign exchange risk if your holdings are denominated in foreign currencies.

Information on this webpage is for reference and general information only and it does not constitute an offer, recommendation, solicitation to enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments. The content on this webpage has not been prepared for any particular person or class of persons and does not constitute and should not be construed as investment advice nor an investment recommendation. It has been prepared without regard to the specific investment objectives, financial situation or particular needs of any particular person. This is not intended to be an offer or solicitation of an offer to buy or sell any of the Funds and is not intended to, and shall not, constitute investment advice.

You should seek advice from a financial adviser on the suitability of an investment for you, taking into account these factors before making a commitment to invest in an investment.

Please refer to the offering documents of the respective funds for details, including risk factors. This website has not been reviewed by SCA. The information contained on this website is intended for UAE residents only and should not be construed as a distribution, an offer to sell, or a solicitation to buy any Funds in any jurisdiction where such activities would be unlawful under the laws of such jurisdiction, in particular the United States of America.