Table of Contents

In a rush? Read the summary:

- Investors with foreign holdings are exposed to currency risk from exchange rate fluctuations, which can increase uncertainty and negatively impact investment returns.

- The UAE Dirham (AED) is pegged to the US Dollar (USD), making it stable and minimising currency risk for AED-based investors, primarily for non-USD foreign assets.

- Investors can manage currency risk through strategies like diversification and hedging.

Currency fluctuations can introduce uncertainty for investors holding ETFs (exchange-traded funds) or mutual funds that invest in foreign securities. The value of the currency may change during buying or selling the investment, which is known as currency risk. It arises from changes in the value of the currency relative to others. Investors with assets outside the UAE can face currency risk, especially if their portfolios are not hedged. Given that the UAE Dirham (AED) is pegged to the US Dollar, currency risk for AED-based investors primarily relates to assets in currencies other than USD.

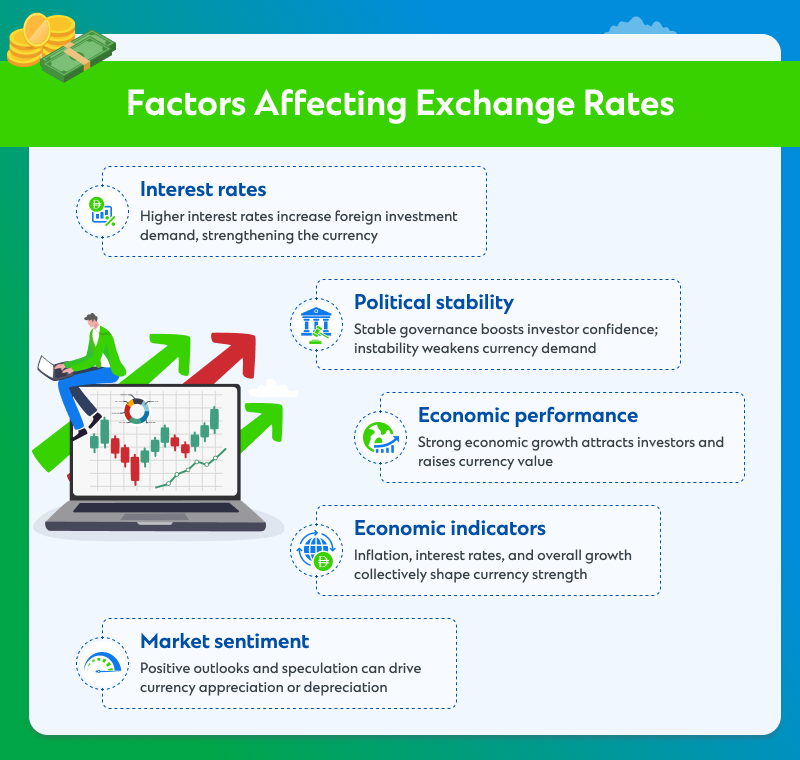

The exchange rate largely determines the value of different currencies and can significantly impact investments.

How do foreign exchange rates affect an investment portfolio

- Foreign investment returns: Overseas asset purchases are subject to exchange rate fluctuations. If an investor invests $1,000 in a company’s stock listed on the London Stock Exchange, the investment value will fluctuate in tandem with changes in the UAE dirham-to-British pound exchange rate. It can lead to both profit and loss, depending on how exchange rate fluctuations occur.

- Business profits: The exchange rate can also affect business profits. Multinational corporations’ earnings and expenses can be affected by exchange rate fluctuations. Businesses that export or import services and goods can be affected by exchange rate fluctuations as well.

- Inflation rate: A higher inflation rate occurs when it takes more currency units to purchase the same amount of goods and services because the currency’s buying power has decreased. This may impact investments by reducing their buying power and earnings.

How to manage exchange rate risks in investments

- Diversification: Investors who want to mitigate foreign exchange rate risk can diversify their portfolios to lessen exposure to a single currency and reduce the possibility of losing investment due to market volatility by spreading their investments across other currencies.

- Hedging: Hedging is another strategy that guards against losses from exchange rate fluctuations by employing various financial instruments, including options and futures contracts. Investors usually lock in an exchange rate for upcoming transactions to lower the risk through the hedging process.

- Research: Investors who want to control the exchange rate risk can engage in thorough research and analysis, which reduces the impact of market volatility and political swings and helps them make better judgments by keeping abreast of changes.

While the exchange rate can significantly influence investments, currency pegging can stabilise exchange rates and boost trade and investor confidence.

How currency pegging is related to currency fluctuation

A country fixes its exchange rate to another currency to maintain economic stability. It is known as currency pegging, and it helps make international investments and trade more predictable while reducing the risk of currency fluctuations. Currency pegging also helps stabilise the exchange rate. But it can also create challenges, such as limited control over domestic monetary policy and trade deficits. That is because it constantly requires market intervention. Therefore, countries can manage pegged exchange rates carefully through their central banks, and failure to maintain the peg can lead to inflation and economic instability.

Investors should understand how currency fluctuations may affect investment choices and yields before investing their hard-earned money in assets.

Speak to your Standard Chartered relationship manager or contact us to learn more about currency fluctuation’s impact in the UAE.