Table of Contents

- At a glance: How bond prices and interest rates are connected

- The inverse relationship of bonds and interest rates

- Bond yield vs interest rate: How do bonds work?

- Rising and falling interest rates' effect on bonds

- Bond yield vs interest rate: The link between yield to maturity and rate changes

- The relationship between inflation, bond prices and interest rates

- Mitigating the risks of interest rates' effect on bonds

In a rush? Read this summary:

- Rising interest rates cause bond prices to fall and understanding this inverse relationship is key to smart investing.

- Long-term bonds and low-coupon bonds are more sensitive to rate changes, which can impact an investor’s returns

- To manage risk, consider shorter-duration bonds or floating-rate options, especially in a rising rate environment.

How will your investment perform this year? Still wondering? With an estimated 4.4% growth in the UAE economy in 2025, as projected by the Central Bank , understanding the effect of interest rates on bonds, stocks, and overall investment strategies has become crucial. Many investors are concerned that raising rates will decrease the value of bonds.

Before deciding to sell your bonds, let’s take a closer look at how interest rates affect bonds, enabling you to make an informed decision. In this article, you’ll learn why rising rates lower bond values, how to assess the sensitivity of a bond to growing rates, and how long-term investors should respond to an environment where rates are rising.

At a glance: How bond prices and interest rates are connected

To understand the careful attention that bond investors pay to interest rates, it is necessary to take a step back and consider the significant role that interest rates play in the global economy. Interest rates, usually set by a country’s central bank, influence the cost of borrowing and the return on savings.

Policymakers at the UAE Central Bank, like their global counterparts, use interest rates to manage inflation and steer economic growth.

- In the UAE, for example, the Central Bank often mirrors the US Federal Reserve’s rate decisions due to the dirham’s peg to the US dollar, making global monetary policy shifts highly relevant to local markets.

- In the UAE, since the dirham is pegged to the US dollar, any change in US interest rates has a direct impact on bond prices and interest rates in the UAE, particularly for USD-denominated bonds and Sukuk.

- Conversely, if inflation becomes uncomfortably high, policymakers can raise rates to cool the economy down.

The inverse relationship of bonds and interest rates

Now, let’s consider the effect of interest rates on bonds.

- The yield of a bond is largely composed of two components: the interest rate and the credit spread.

- While the credit spread reflects idiosyncratic risks associated with individual issuers, the interest rate serves as the base rate for all bonds denominated in a specific currency, compensating investors for their baseline economic risks.

Hence, if the market expects interest rates to rise, then bond yields rise as well, forcing bond prices, in turn, to fall. The reverse also applies.

This inverse relationship between interest rates and bond prices is the reason why fixed-income portfolio managers take great pains to understand the drivers of the global economy and to gauge the future path of interest rates.

Bond yield vs interest rate: How do bonds work?

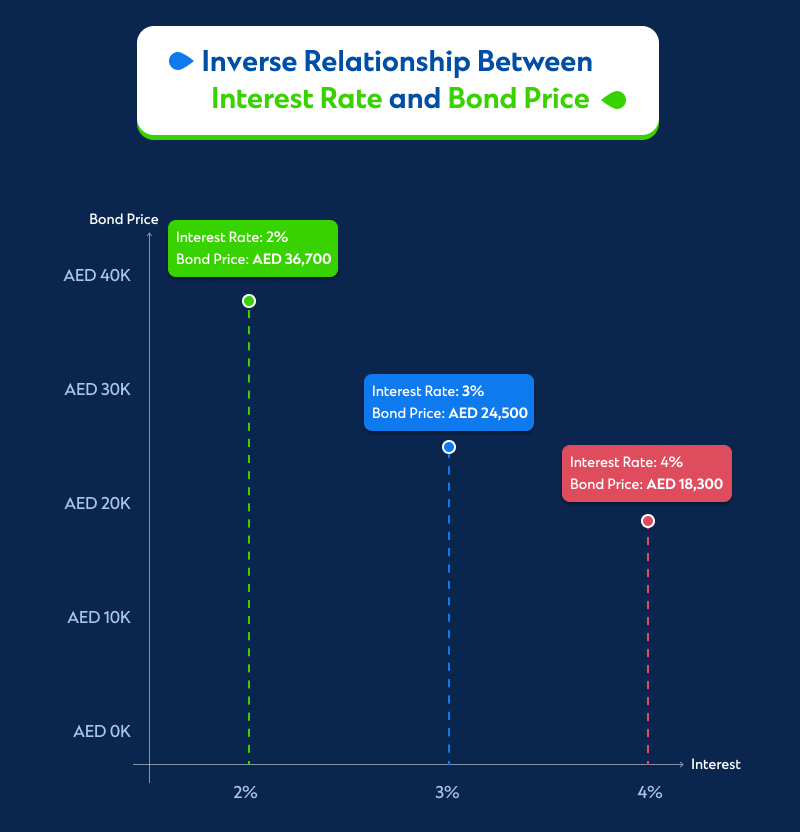

Let’s understand this with a simple example. You invest AED 36,700 (approximately $10,000) in a 10-year bond issued in the UAE that yields 2%.

If the rates jump to 3% overnight and you decide to sell your investment, will you be able to sell the bond at its AED 36,700 face value? No. That is because an investor can easily invest AED 36,700 in a new 10-year bond and gain 3%. Instead, the bond’s value decreases to compensate for its lower interest rate.

Now, if you decide not to sell the bond, you earn an interest rate of 2%, which may not feel like a loss. But it’s a loss in terms of opportunity costs. However, you may think you have to wait 10 years to reinvest, but the truth is you can start reinvesting the periodic interest payments right away.

Rising and falling interest rates’ effect on bonds

The impact of rising and falling interest rates is not uniform for all bonds. Duration, coupon rate, or bonds with longer maturity tend to be more sensitive towards interest rate changes. It means long-term bonds experience significant price fluctuations during interest rates change.

Bonds with lower coupon rates are more sensitive to interest rate changes because their smaller coupon payments are a smaller part of their overall value. Therefore, their prices are more effected by interest rate changes compared to bonds with higher coupon rates.

Bond yield vs interest rate: The link between yield to maturity and rate changes

What is yield to maturity? It is a measure of the total annual return you receive if the bond is held to maturity. Yield to maturity accounts for the bond coupon payments, the current bond price, and the capital gain or loss you make if you keep it until it matures.

- If the interest rate rises, a bond’s yield to maturity also increases. Why? That is because if the market price of a bond falls, the investor who bought the bond at a lower price would receive a higher return.

- If the interest rate falls, a bond’s yield to maturity also decreases. That is because it’ll lower the yield. As a result, the investor who bought the bond at a higher price will receive a lower return.

Is there any reinvestment risk with falling interest rates?

Yes, falling interest rates come with the risk of reinvestment. It happens when you receive your coupon payment and reinvest it at a lower interest rate. If the interest rate falls, you will not be able to reinvest your coupon payment at the same rate or a higher rate. It will also reduce the overall return on your investment.

For example, imagine you have a bond with a 4% coupon rate. If the market interest rate falls to 2%, reinvesting your interest income at a lower rate means earning less income on the same capital.

The relationship between inflation, bond prices and interest rates

Inflation expectations often influence interest rates, as the Central bank is the deciding body in this regard. Central banks often raise interest rates in response to rising inflation to cool down the economy while lowering interest rates in the face of sluggish economic growth.

- Therefore, you can easily understand that rising inflation equals rising interest rates as central banks increase interest rates with the rise of inflation to combat inflation. As a result, your existing bonds with lower coupon rates become less attractive.

- On the other hand, lower inflation equals lower interest rates. Central Banks may reduce interest rates to stimulate economic growth when inflation is low. If you are expecting higher returns from your existing bonds, this is an ideal time to receive them.

Mitigating the risks of interest rates’ effect on bonds

Both inflation and rising interest rates can have a detrimental impact on an investor’s fixed-income portfolio . The manager’s job is to mitigate these risks, and one of the most common ways to do this is via adjusting duration. Duration measures how sensitive a bond is to a change in interest rates.

Duration: A key factor in managing interest rates’ effect on bonds

We tend to express a bond’s duration in terms of years, but it is not the same as the maturity date. Typically, bonds with the longest maturity dates and the lowest coupons are the most sensitive to interest rate changes and, therefore, have higher durations.

- Duration can be calculated for both individual bonds and a whole portfolio of them. If a manager is concerned about rising interest rates, they might decide that a portfolio’s overall duration needs to be shorter.

- Consequently, the manager might sell some of the longer-dated, low-coupon bonds, thereby reducing the duration

In the UAE, most retail investors access bonds through mutual funds or other investment platforms. If you are investing through such a platform, you can look for funds that offer lower duration or floating-rate exposure to manage interest rate risk effectively.

Speak with Standard Chartered’s Relationship Managers or contact us to learn more about bond investments.

This is an updated version of an article that was published on Standard Chartered Singapore.