Traditionally, investors have focused on balancing risk and return. The objective has been to maximise the value of the investment while minimising the risks. While this strategy remains as relevant as ever, there’s a third element that’s rapidly gaining traction in the minds of investors.

With globalisation, social media, overpopulation-driven poverty and increasing attention toward the climate crisis, most investors today want to know broadly where their money is being applied.

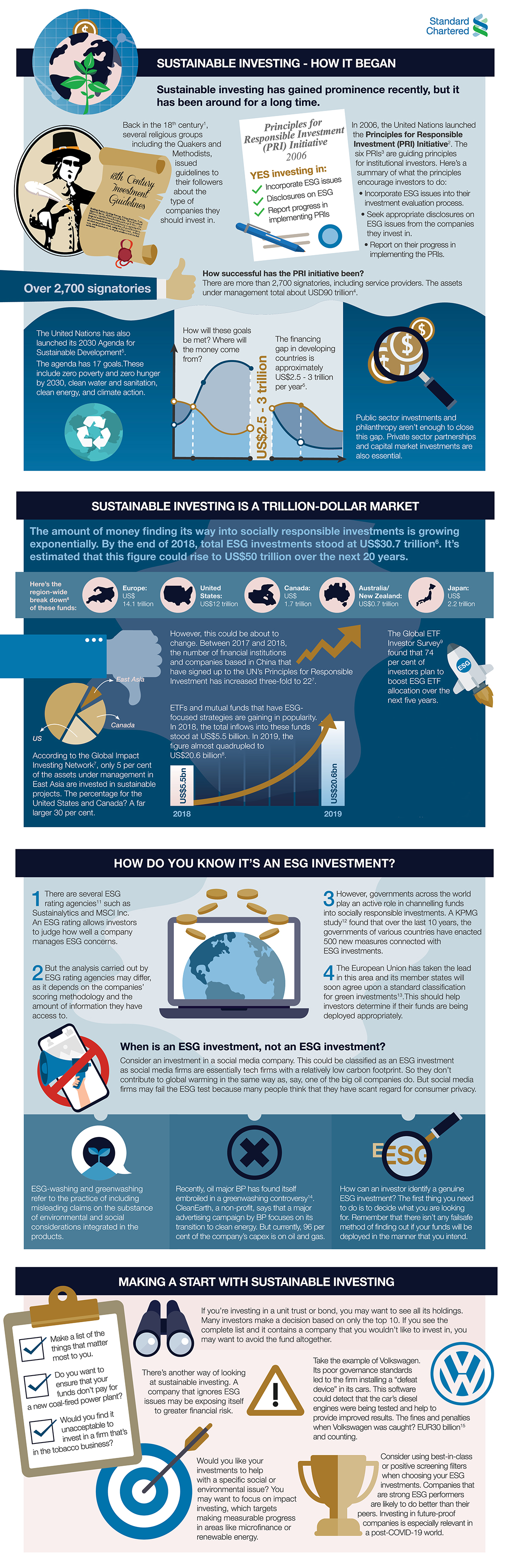

Sustainable investing involves deploying your funds in a targeted manner into the shares and bonds of companies that focus on Environmental, Social and Governance (ESG) aspects. The objective of these firms is not restricted to making profits. They also want to make a positive impact on the world.

For more information on our Wealth Management Solutions, get in touch with us now.

Footnotes:

1A short history of responsible investing

2United Nations Global Compact

3What are the Principles for Responsible Investment?

4PRI hits 500th asset owner signatory ‘milestone’ with Colombian fund

5Sustainable Development Goals

6Your complete guide to investing with a conscience, a $30 trillion market just getting started

7Asia can overtake the west in sustainable investing

8Money moving into environmental funds shatters previous record

9The numbers suggest the green investing ‘mega trend’ is here to stay

11Conflicting ESG Ratings Are Confusing Sustainable Investors

12Sustainable investing — Fast-forwarding its evolution

13The EU’s risky green taxonomy

14BP faces ‘greenwashing’ complaint over advertising campaign

15Volkswagen Offers 830 Mln-Euro Diesel Settlement in Germany