Table of Contents

- Understanding regulatory oversight in ETF investments

- What kind of returns can you expect with ETF investments

- Explore different types of ETFs in the UAE

- ETFs growth in the UAE

- Invest in ETFs: The key advantages

- What to watch out for in an ETF investment

- The risks involved with ETF investments

- Why should you choose ETFs for your portfolio

- How to invest in ETFs

In a rush? Read this summary:

- ETFs offer low-cost and diversified exposure to UAE and global markets, perfect for hands-off investors seeking long-term growth.

- With rising trading volumes and regulatory oversight, ETFs in the UAE are gaining momentum as a smart, accessible investment option.

- Choose the right ETF by evaluating asset class, fees, tracking error, and liquidity to align with your risk profile and goals.

What is an ETF? An exchange traded fund (ETF) is a type of investment fund that is listed on a stock exchange (e.g. DFM or Dubai Financial Market, ADX or Abu Dhabi Securities Exchange and Nasdaq Dubai).

ETFs are passively managed; they aim to track the movement of a particular index (such as the DFM General Index or ADX General Index) and do not attempt to outperform the index they intend to replicate. The idea is to match the performance of the broader market.

Understanding regulatory oversight in ETF investments

In the UAE, ETFs and the broader financial markets are primarily regulated by the Securities and Commodities Authority (SCA). This regulatory framework provides a level of oversight and investor protection, ensuring transparency and fair practices within the market.

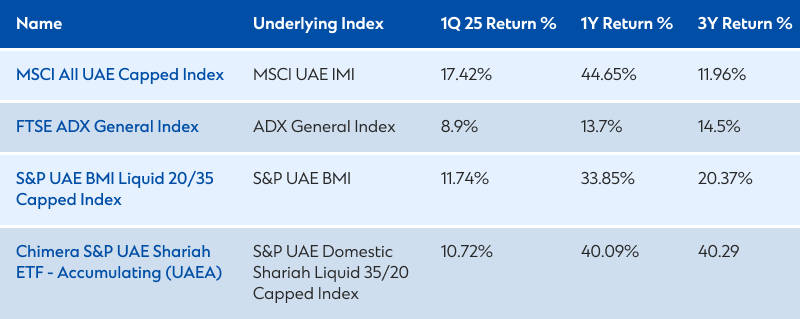

What kind of returns can you expect with ETF investments

As ETFs track an index, the return of an ETF matches that of the index tracked less the ETF’s fees.

It should be noted that ETF transactions incur a brokerage fee, which can vary significantly depending on the broker and exchange rate (e.g., DFM, ADX, Nasdaq Dubai). Investors should consult their chosen brokerage for specific fee schedules. Like mutual funds, ETFs in the UAE typically charge a custodian fee based on the fund’s NAV (net asset value), along with an annual management or expense ratio that is usually under 1%.

Returns vary depending on the type of ETF invested in and its associated risk profile. For example, an equity ETF is likely to have higher returns than a bond ETF, which has a lower risk profile.

Some ETFs may also pay dividends. For example, while specific dividend data for UAE-listed ETFs can vary, investors should research the prospectus or historical performance of individual ETFs to understand their dividend distribution policies.

Explore different types of ETFs in the UAE

ETFs available through UAE brokerages or global platforms can be broadly divided into these categories:

- Equity ETFs: Gain exposure to UAE and global markets through ETFs tracking the DFM, ADX, and sector-specific indices. Ideal for diversified growth and dividend income.

- Bond ETFs: Invest in UAE sovereign and corporate bonds for stable returns and lower risk. A smart pick for steady income and capital preservation.

- Commodity ETFs: Access gold, oil, and more without owning the physical asset. Hedge against inflation while tapping into global commodity trends.

- Real estate investment trust (REIT) ETFs: Invest in global real estate through REIT ETFs without owning physical property. It’s a smart way to earn rental income and diversify your portfolio.

- Shariah-Compliant ETFs: Invest in ETFs that undergo stringent screening processes to exclude investments in sectors such as conventional banking, alcohol, tobacco, gambling, and certain forms of entertainment.

ETFs growth in the UAE

ETFs have gained significant popularity in the UAE region.

- Since the beginning of 2024, the value and volume of ETFs trading on ADX have increased significantly. It has become one of the most active and liquid ETF markets in the Middle East region.

- According to data received from the Emirates News Agency (WAM) and ADX, the total trading volume in exchange-traded index funds (ETFs) on ADX has reached 450.7 million units, with 19,853 transactions since the beginning of 2024.

- At the same time, the market cap of the Arab stock exchanges amounted to more than USD 4.174 trillion as of the first half of 2024, according to the Arab Monetary Fund (AMF).

Invest in ETFs: The key advantages

- Low fees: ETFs’ fees can be much lower compared to actively managed mutual funds. Without the need for active fund managers and related researchers for stock selection, cost savings can be passed on to investors.

- Instant and convenient diversification: Investing in an ETF can be equivalent to investing in an entire basket of securities, thus providing instant diversification. Investors will not have to make multiple investments to achieve diversification.

- Less time: Since ETFs are part of a passive investment strategy, less research and due diligence may be required compared to actively picking out securities. Less time is needed to monitor performance since ETFs are typically held on a long-term horizon.

What to watch out for in an ETF investment

- Potentially higher costs: Although ETFs generally have lower fees compared to actively managed funds, they may still incur higher costs than buying individual stocks or bonds due to management fees.

- Potentially missing out on growth opportunities: ETFs do not cover the entire range of the market. Investors may miss out on growth opportunities from smaller stocks that are less represented on indices. Since ETFs only aim to match market performance and not beat the market, potential returns are limited to the performance of the underlying index.

- Lower dividend cash flow: Investing in equity ETFs is likely to yield lower dividends compared to investing in dividend stocks.

- Lack of control: Less control over your investments. For example, if an ETF tracks several specific securities that comprise an index and suddenly decline in price, investors cannot reduce their exposure to only those securities.

The risks involved with ETF investments

- Market risk: Investing in ETFs involves exposure to the broader market, meaning your investment remains subject to market risk.

- Liquidity risk: ETF markets may become illiquid during periods of high volatility, particularly for ETFs tracking less liquid indexes. The result could be a distortion in the prices of ETF shares.

- Tracking risk: ETF performance may not perfectly match the performance of the underlying index. While an ETF attempts to mimic the performance of the underlying index perfectly, there is usually some degree of tracking error.

Why should you choose ETFs for your portfolio

If you’ve already determined that you want to have some passive investments in your portfolio, then ETFs can be a good option. Here are a few key tips on how to choose an ETF to invest in:

Key 1: Know which asset class you want to invest in

Understand which asset class (i.e., equities, bonds, REITs, gold) matches your risk profile best.

For example, consider investing in an equity ETF for greater potential returns but at a higher risk or in a bond ETF for lower returns but at a lower risk.

Key 2: Aim for the lowest fees and expense ratios

Even a small difference in fees can have a significant impact over the long term. Since most ETFs are competitive on share price, choose the one with the lowest costs.

Key 3: Pay attention to tracking error

Tracking error indicates how closely an ETF is tracking the underlying index; tracking error figures are usually published on an ETF’s fact sheet or prospectus.

Key 4: Look at liquidity

To mitigate liquidity risk, look at ETF’s trading volumes, which are publicly available on the relevant stock exchange website (e.g., DFM, ADX, Nasdaq Dubai). For those who shy away from stock picking and actively choosing securities, ETFs can allow them to invest in broader markets at lower costs.

How to invest in ETFs

The common ways to invest in ETFs in the UAE include:

- Brokerages licensed by the relevant UAE authorities

- Online trading platforms offering access to UAE and international markets

- Robo-advisors operating in the UAE regulated by the relevant financial authorities

If you are interested in adding ETFs to your portfolio, Speak to Standard Chartered’s relationship managers or contact us to learn more about ETF investing in the UAE.