Table of Contents

- Understanding gold forecast: Gold prices in the UAE

- Factors influencing gold prices in the UAE

- Local demand and supply: Impact on gold rate in the UAE

- Fluctuation of currency and its effect on the gold rate

- Economic impact on gold prices in UAE

- Central bank policies and gold rate in the UAE

- Gold prices in UAE: Stay ahead of market shifts

In a rush? Read this summary:

- Gold prices in the UAE are shaped by local demand, currency fluctuations, global economic trends, and central bank policies.

- A strong or weak US dollar directly influences the gold rate, making timing and market tracking essential for investors.

- Whether choosing physical gold or ETFs (Electronic-Traded Funds), each comes with its own set of challenges. The key to smart gold investing is to ensure your strategy is aligned with your financial goals.

From glimmering souks to high-end malls, gold is more than just a luxury in the UAE; it’s a way of life. Due to its inherent value and ability to serve as a hedge against both economic uncertainty and inflation, gold remains a preferred asset for investors.

Planning to invest in the “City of Gold”? Understanding the forces behind the fluctuating gold rate can help in making informed investment decisions in the UAE.

Understanding gold forecast: Gold prices in the UAE

The demand for gold in the United Arab Emirates has consistently been on the higher side. Several factors influence the demand.

- Cultural significance: Gold is an important part of Emirati traditions and celebrations, which keeps its demand steady.

- Favourable tax regime: The UAE’s tax-free policies on gold attract both local and international investors.

- Market drivers: A mix of global market trends, currency fluctuations, and consumer demand shapes the local gold rate.

- Hedge against inflation: For most investors, this metal is a cornerstone of economic security. Gold acts as a hedge against both currency devaluation and inflation.

- A safe haven in turbulent times: Dubai’s position in the gold market is particularly powerful. It has always been a secure haven during economic turmoil, even amidst worldwide economic uncertainty, it remains a steady investment choice.

Whether to invest in or sell gold, this guide will help you understand the gold market and optimise your financial strategies.

Factors influencing gold prices in the UAE

Diverse global economic factors influence gold prices in Dubai . Understanding these crucial factors can help you spot the most valuable moments to buy and sell gold.

Local demand and supply: Impact on gold rate in the UAE

The demand and supply dynamics in the local market are undeniable, especially in Abu Dhabi. The demand for gold here is culturally embedded and often tied to important life events such as weddings, engagements, etc. As a result, we can see a surge in the price of gold as demand spikes during festive seasons.

Additionally, gold prices are also impacted by certain market conditions such as:

- Import disruption: Any supply chain disruption creates an impact on gold prices in the UAE. The disruption is created either due to logistical reasons or regulatory changes.

- Regulatory impact: Tariffs on importation or restrictions placed by government agencies also play a vital role in raising prices for gold locally.

Fluctuation of currency and its effect on the gold rate

The value of currencies, particularly the dollar, determines gold prices. Any fluctuation in the value of the dollar against other major currencies has the potential to impact gold prices worldwide.

Dollar impact on gold prices in the UAE

A strong dollar tends to lead to lower gold prices globally, as it becomes more difficult for holders of other currencies to purchase gold.

On the other hand, a weak dollar increases gold prices, as it becomes easier for those holding other currencies to buy gold. This is especially influential in the UAE, where most foreign investors are involved in the gold trade.

Exchange rate volatility and gold rate in the UAE

Fluctuating foreign exchange rates can result in frequent changes to the gold rate. UAE investors, a majority of whom deal in currencies other than the U.S. dollar, must be aware of this volatility.

Tracking the strength of the U.S. dollar, both now and in the future can provide valuable insights into the optimal times to buy or sell gold.

Economic impact on gold prices in UAE

- It reacts very quickly to the world economy, reflecting economic shifts and global investment trends.

- World economic indicators, such as GDP growth rates, unemployment rates, and significant economic statements, can lead to fluctuations in the gold price.

- Both small and large institutional investors create an impact on the gold investment demand in the UAE. However, this demand can vary significantly due to external economic factors.

- Uncertainty in the global economy often prompts investors to turn to gold. The gold market in the UAE reflects this, where demand spikes dramatically due to geopolitical tensions.

Geopolitical factors and global events affecting gold prices in UAE

Every occurrence, from trade disputes to political unrest in gold-producing countries, has the potential to ripple through the world gold market, instantly impacting gold prices in the UAE.

Central bank policies and gold rate in the UAE

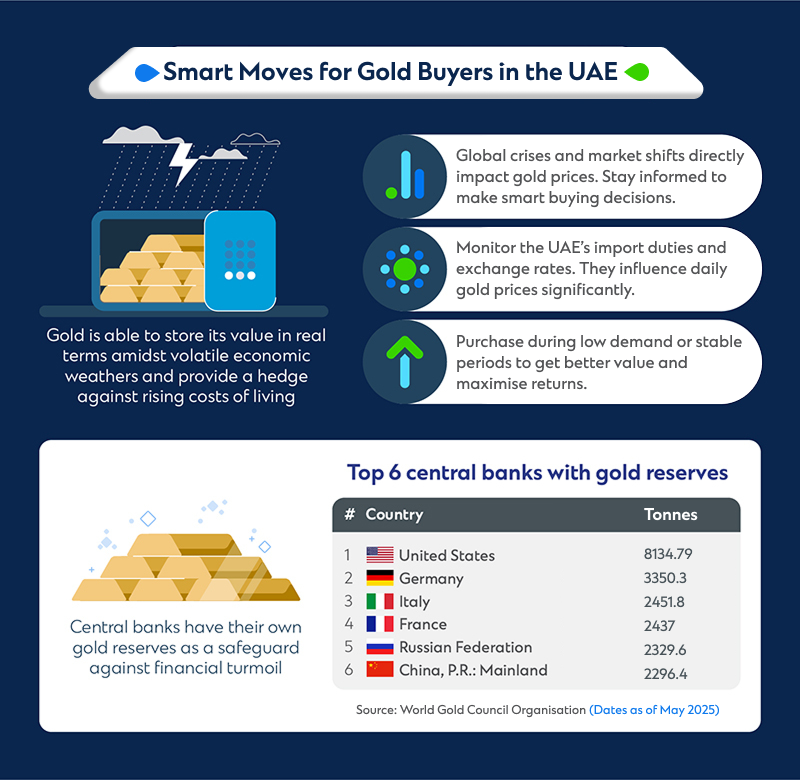

Central bank policies in the UAE and around the world have a significant impact on influencing gold prices. Central banks can influence interest rates and implement monetary policies that have a substantial effect on the gold rate in Abu Dhabi and the UAE.

For example, suppose central banks choose to reduce interest rates or undertake quantitative easing policies, a measure that involves pumping a large amount of money into the economy. In that case, this tends to increase the gold rate.

Under such circumstances, investors seek alternative investment sources, such as gold as reduced interest rates make traditional interest-bearing assets, such as bonds, less attractive.

Gold prices in UAE: Stay ahead of market shifts

If you are considering investing in gold in the UAE and are interested in knowing the gold forecast or the 1-gram gold price in the UAE, remember that it’s beneficial to research thoroughly before investing, especially during market dips.

Keep in mind that timing, quantity, and the form of investment matter the most. It all depends on the type of gold investment you choose and how much patience you have to hold it.

Gold forecast: Choosing between physical gold and gold ETFs

Each investment comes with its own set of challenges. For example, if you want to invest in physical gold, such as coins or bars, you must consider factors like storage and insurance.

On the other hand, you can only trust reputable dealers, as pure gold is 99.9% precious metal.

Alternatively, if you prefer to avoid handling physical assets, Gold ETFs, may be your go-to option. Without holding this precious metal, you can invest in gold through ETFs. However, its performance depends on the underlying assets in the fund, which adds complexity and risk.

With considerable options for investing in gold, it’s crucial to match your financial goals with your investment strategy. Speak to Standard Chartered’s relationship managers or contact us to learn more about Gold as an investment option in the UAE.