Table of Contents

- Investment grade vs high yield bonds: What suits your investment style

- Corporate bond risk classification: Tailoring your portfolio

- Corporate bond risk classification: How bonds get their ratings

- Credit ratings explained from highest possible credit quality to Junk

- Government bonds investment grade

- Investing in UAE Government bonds: Economic insights

- The benefits of adding high-yield bonds in a diversified portfolio

- Investment grade vs high yield: Rate impact

In a rush? Read this summary:

- Corporate bonds are categorised as either high yield or investment grade, with high-yield bonds offering the potential for higher returns at a greater level of risk.

- Bonds are assigned ratings by external credit agencies; those with ratings of ‘BBB-‘ or higher are considered investment grade, while bonds with lower ratings are classified as high yield.

- High-yield bonds offer income potential and low correlation with other assets, enhancing portfolio depth.

Not all bonds are the same. Some promise steady returns, others carry a little more thrill. Successful fixed-income investors start with a smart move: seize a bond’s risk. In this article, we will decode corporate bonds and their two key risk classifications: investment grade and high yield. Knowing the difference will be the first step to more thoughtful and confident investing.

Investment grade vs high yield bonds: What suits your investment style

Corporate bonds are considered an alternative yet lucrative option for investors who prefer investing in businesses instead of buying shares.

It is widely accepted that bonds classified as investment grade tend to be less risky than those designated as high yield and usually deliver a lower return.

High-yield bonds typically offer higher returns but with more risk since issuers are often younger or less established companies and considered to have a greater chance of default. As a result, these companies pay higher coupons to reflect the additional uncertainty associated with their debt. For example, bonds from ambitious start-ups like a rising tech farm or a growing property developer are often considered high-yield bonds, and corporate bond risk classification helps investors assess these potential risks more clearly.

Corporate bond risk classification: Tailoring your portfolio

Corporate bonds function as an I owe you (IOU) for a business. They borrow money, deliver the funding to investors, and pay back interest on the specified fixed scheduled dates before returning the principal amount when the bond matures.

On the other hand, different types of bonds appeal to different investors. Someone in their 20s with a long investment time horizon to recoup any capital losses might include high-yield bonds in their diversified portfolio, knowing they have enough time to recover from potential capital dips, yield to maturity and bond ratings.

Conversely, investment-grade bonds like government bonds may find favour with an older investor who is nearing retirement, prioritising capital preservation and reliable income. “Comfort” is one of the most underrated considerations in bond investing . Older investors usually look for bonds with strong cash flow and long-term stability.

High yield bonds vs investment grade: What is the best approach?

The best approach? Conduct thorough research. Look at a company’s financial position before handing over your money. Always take a long-term view. Corporate bonds are not a “get-rich-quick ” option. Investors usually prefer companies that can demonstrate long-term stability.

Corporate bond risk classification: How bonds get their ratings

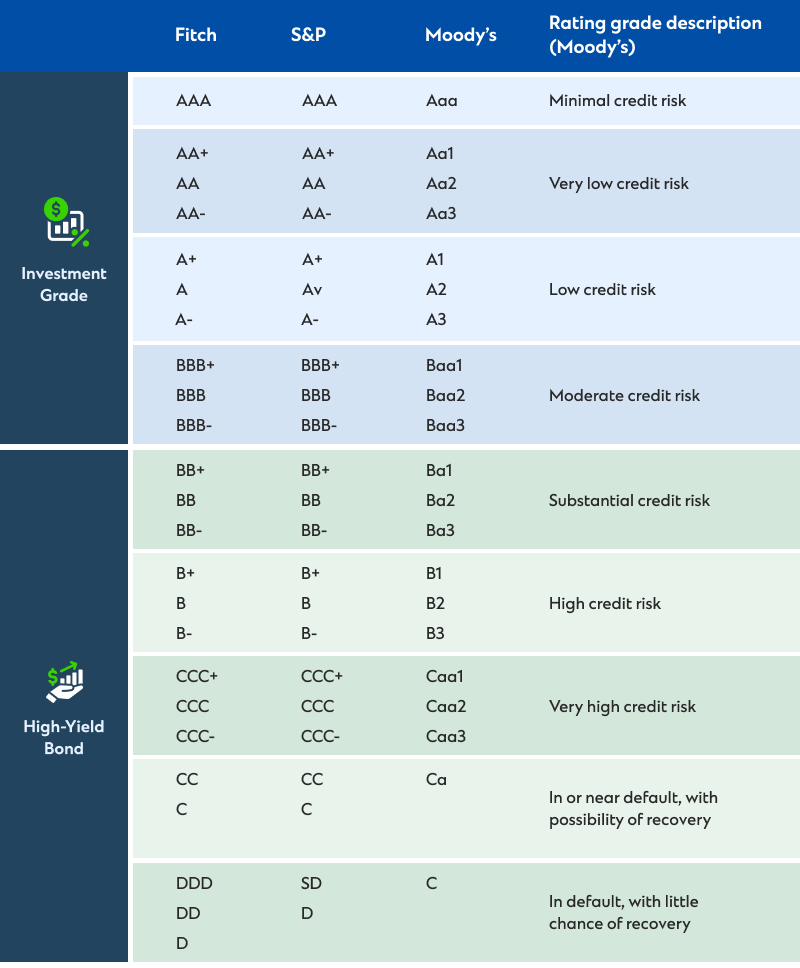

The good news for investors is that it is relatively straightforward to assess the risk profile of a bond, with much of the detailed research carried out by external credit rating agencies. The three most significant firms in the market are Standard & Poor’s (S&P), Moody’s and Fitch, which screen the bond universe to decide which are investment grade or high yield instruments.

Credit ratings explained from highest possible credit quality to Junk

If we take S&P’s classification system as an example, it assigns different credit ratings based on how much risk is attached to the repayment of capital. These comprise one to three letters such as ‘AAA’,’ BB’ or ‘C’ (with ‘+’ or ‘–’ signs providing further differentiation).

There is a dividing line: bonds with good credit ratings of at least ‘BBB –’ are classed as investment grade bonds, while those below ‘BBB–’ are treated as high yield bonds (speculative or junk bonds).

Moody’s rating scale is slightly different but broadly similar to that of Fitch and S&P.

Government bonds investment grade

As an aside, government bonds are usually classified in the same way. Government bonds with strong credit fundamentals are generally rated as investment grade, making them attractive to global investors.

Some institutional investors, such as pension funds, are scale-bound when selecting bonds for their portfolios: they must differentiate between investment-grade bonds and high-yield instruments. For example, with strong credit standing from prominent international rating agencies, the federal government has introduced dirham-denominated Treasury Bonds (T-bonds) for local, regional, and global investors as a stable option to diversify their investment portfolio. On the other hand, high-yield instruments offer potentially higher returns but come with increased risk and volatility.

- Lower-risk assets typically include government bonds, UAE T-Bonds, and investment-grade international bonds.

- Higher-risk assets may include equities and high-yield corporate bonds.

Corporate bond risk classification: Fallen angels in focus

Bonds’ credit ratings may also be upgraded or downgraded over time. Therefore, investment-grade bonds could become high-yield bonds – the so-called ‘fallen angels’.

Investing in UAE Government bonds: Economic insights

Investment-grade bonds are usually favoured when economic conditions deteriorate. However, under buoyant conditions, demand for high-yield bonds increases. Amid stronger global growth, higher-yielding bonds have generally outperformed lower-yielding ones.

The benefits of adding high-yield bonds in a diversified portfolio

Higher income for income-focused investors

High-yield bonds are an effective vehicle for income-focused investors who seek high current income. However, you must understand the risks associated with it. Investors who prefer expert guidance in selecting and monitoring their portfolios can delegate the responsibility to professional managers e.g. fund managers and portfolio managers. Either way, keep in mind that rigorous credit analysis is essential for success.

Diversification advantage – Low correlation with other assets

High-yield bonds offer valuable diversification benefits to a portfolio due to their low correlation with other assets, such as stocks and investment-grade bonds. It means if you add high-yield bonds to a broad fixed-income portfolio, you can enhance overall diversification.

Remember, diversification does not eliminate risks or insure you against loss. However, it can help improve the consistency of returns by decreasing overall portfolio risk. Over the long term, high-yield bonds can help stabilise your performance with shifting economic cycles and changing interest rates.

Capital appreciation opportunities with improving creditworthiness

An economic upturn significantly impacts the price of a high-yield bond. Stronger performance at the issuing company also plays a significant role. Capital appreciation is a crucial component of a total return investment approach. Different events can increase the price of a bond. For example, improved earnings reports, rating upgrades, mergers and acquisitions, market-related events, positive product developments, etc. Conversely, if an issuer’s financial health deteriorates, rating agencies may downgrade the bonds, which can result in a reduction in their value.

Investment grade vs high yield: Rate impact

Investment-grade bonds usually have higher durations because proportionately more of their total income stream is received via the repayment of principal at maturity. The most attractive investment grade bonds are similar to high quality government bonds (which also tend to have above-average durations).

With high yield bonds, proportionately more of the payments are received by way of coupons, and their maturities are typically shorter. Therefore, when interest rates rise or are expected to, they tend to be less affected than investment grade bonds. However, when interest rates fall or are expected to, the prices of high yield bonds will likely rise by less than those of investment grade bonds.

Speak to Standard Chartered’s relationship managers or contact us to learn more about bonds as an investment option.

This is an updated version of an article that was published on Standard Chartered Singapore.