Table of Contents

- Gold as an investment: The year gold proved its power again

- Mastering how to invest in gold in UAE like a seasoned pro

- Tip 1: How to invest in gold: Purchasing physical gold

- Tip 2: How to invest in gold stocks

- How to invest in gold: physical gold vs gold stocks

- Tip 3: How to invest in gold mutual funds

- Tip 4: How to invest in gold exchange-traded products

- Ensure you invest only in what you understand

In a rush? Read this summary:

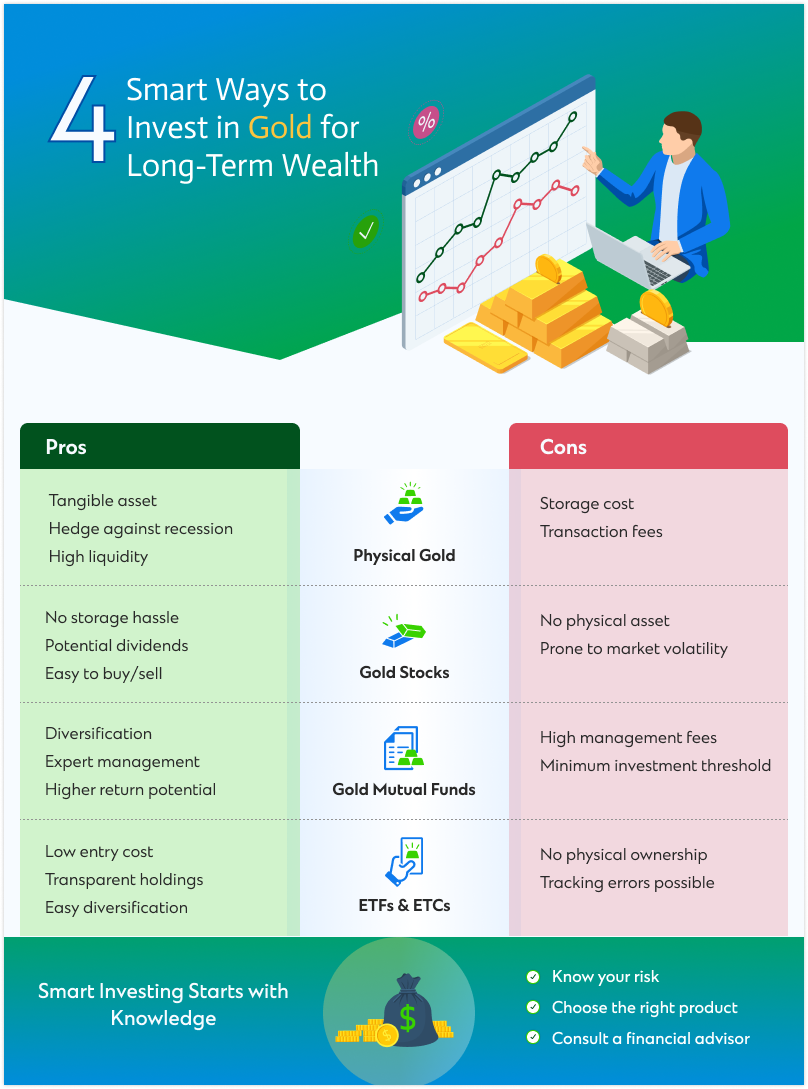

- Investors can own physical gold as bars or coins, a tangible asset with high liquidity but also requiring secure storage and incurring transaction costs.

- Indirect options like gold stocks and mutual funds gives investors access to the gold market without physical ownership, offering potential for passive income and diversification.

- Each investment vehicle has a different risk-return profile. While physical gold acts as a direct hedge against economic shifts, stocks and funds are subject to market volatility but can offer a more diversified approach.

When uncertainties shake the stock market, one timeless glittering metal always shines. That is gold. Investors turn to gold as it has always served as a hedge during economic downturns when the markets show uncertainties. Therefore, learning how to invest in gold can be useful for most investors.

Gold as an investment: The year gold proved its power again

It’s no surprise that in 2025, investors across the globe once again have gravitated back to gold. Why? Well, gold hit a record-breaking $2900 per ounce on February 10, 2025, and broke its own record by hitting the $3000 mark on March 18. In April, this precious metal managed to hit its all-time high of $3163.25. These milestones have contributed to gold’s impressive run this year.

Why does gold as an investment continue to shine

If you want to diversify your portfolio , you can buy gold, as it usually increases in value when paper investments like bonds and stocks decline.

Therefore, whether you are a full-on wealth builder or a cautious saver learning how to invest in gold, especially in UAE, where both digital and physical gold options are booming, gold can offer you the incredible protection your portfolio requires during economic downturns.

Let’s dig deep and understand how to confidently invest in gold without picking a hole in your pocket.

Mastering how to invest in gold in UAE like a seasoned pro

If you want to increase downside protection for your portfolio just like global investors, buying gold is one of the crucial options. It’s important to remember that there are two basic ways to invest in gold: direct and indirect.

You can directly purchase and store physical gold, such as coins or bullion. On the other hand, indirect investments involve buying funds or gold-related funds and securities .

If you are still wondering how to invest in gold in the UAE, consider these options.

- Purchasing physical gold

- Gold-linked currency investments

- Gold Exchange-Traded Funds ETFs or unit trusts

- Gold mining stocks

Tip 1: How to invest in gold: Purchasing physical gold

Gold bullion refers to pure gold. According to Investopedia’s report, gold bullion is considered tangible gold and officially recognized as 99.5% to 99.9% pure. Investors value gold bullion for its metal content rather than artistic quality.

Before considering gold as an investment, remember that gold bullion refers to investment-grade gold commonly available in the form of bars, ingots, or coins.

- Gold bars come with the manufacturer’s name. You must check its certification for weight and purity. Gold bars typically range from 1/10 troy ounce (one troy ounce = 31.1 grams) to one kilogram

- Gold coins, another form of pure gold, vary in shape and size. These are nationally minted, and they come in smaller denominations. It’s easier to buy and sell. Please note that you may have to pay extra for design elements such as engravings or collector value.

Pros of purchasing physical gold as an investment

- Tangibility: Are you an investor who prefers real estate assets over stocks just because of their tangibility while stocks still provide higher returns? Well, you are the kind of investor who should purchase gold bullion as you can have direct access to the asset. It’s a safe haven for investors as it serves as a hedge against recession.

- Liquidity: If you want to sell your gold coins or gold bars, you can easily find a counterparty, as gold is in global demand. On the other hand, to preserve your wealth gold will prove to be an excellent investment as the price of this precious metal appreciates over time.

Cons of purchasing physical gold as an investment

- Storage fee: Physical gold comes with security issues if not properly stored. Therefore, you must bear the extra security fee.

- Transactional cost: Dealers usually bring buyers and sellers together and charge a transaction fee, which investors usually add to the cost of owning physical gold.

How to invest in gold through gold bullion

If you are still wondering how to invest in gold in the UAE through physical gold, then you have the following options below.

Dubai Gold Souk

Gold enthusiasts cannot miss Dubai Gold Souk, a trading house in AI Ras.

- Dubai Gold Souk includes over 350 retailers and showcases a wide range of precious metals including gold, platinum, silver along with precious stones and strings of pearls.

- Traders offer tax-free gold in different weights, designs, and carats.

Jewelry Stores

If you want to explore gold as an investment, you can visit gold jewelry stores where they sell gold bullion. Otherwise, some of these stores have e-commerce websites where you can purchase physical gold online.

Tip 2: How to invest in gold stocks

Explore gold as an investment through gold stocks. These are involved in mining, producing, and selling gold. Hence, their stock price performance is correlated with gold spot prices. It’s a great option for those investors looking for indirect exposure to gold without investing in physical gold.

- Buying gold stocks is similar to investing in a real estate investment trust that lets you invest in gold-focused companies instead of purchasing physical gold.

- UAE gold companies are usually privately owned. They are generally unavailable to retail investors. However, high-net-worth individuals (HNWIs) with over $1 million in investable assets can gain access to gold stocks, both locally and globally.

- Retail investors, meanwhile, can access gold-related stocks via licensed UAE brokers with access to global markets.

Pros of purchasing gold stocks as an investment

- Forget security issues: You do not have to purchase a lock or worry about the security issues of your financial assets.

- Passive income: You can generate passive income through dividends if you invest in gold stocks . On the other hand, you can also receive higher returns than the spot price of gold.

- Lower transaction cost: You do not have to worry about storage fees if you invest in gold stocks. On the other hand, the transaction cost tends to be lower than the price gold dealers charge.

Cons of purchasing gold stocks as an investment

- Lack of physical ownership: Many investors get attracted towards gold because of its tangibility. The biggest drawback of gold stocks is that they don’t offer the satisfaction of holding or seeing precious metals.

- Market fluctuation: Gold stocks are also subject to market volatility. Risk-averse investors sometimes get deterred by sudden price swings that make these investments less predictable.

How to invest in gold: physical gold vs gold stocks

While stocks are volatile, they are not necessarily more volatile than physical gold. Why? That is because gold prices experience sharp swings, making them comparably unpredictable at times.

- Industry-specific risks: Gold companies face certain risks like geopolitical tensions, regulatory issues, environmental concerns, high operational costs, etc. It can lead to sudden drops in value.

- Limited diversification: Diversifying across multiple gold stocks is a complex job. On the other hand, building a well-diversed portfolio requires good capital with a high transactional fee.

Tip 3: How to invest in gold mutual funds

If you want to reduce the risk through diversification, you can choose mutual funds. Retail investorsowning shares in mutual funds will have many gold stocks. They can even invest in gold bullion. A single share of a mutual fund represents hundreds of gold stocks correlated with the value of gold.

Pros of gold as an investment: mutual funds

- Cost-effective diversification: Gain access to a diversified portfolio of gold-related stocks with just one gold mutual fund. These funds often prove to be more cost-effective than purchasing multiple stocks and paying separate transactional costs.

- Expert management: Seasoned professionals manage gold mutual funds. They make informed decisions by actively monitoring market trends and aiming to maximize returns.

- Enhanced returns: The primary reason for investing in gold mutual funds is to get a chance to earn enhanced returns. Compared to passive investing, you can receive higher returns backed by strategic decisions and professional fund managers.

Cons of gold as an investment: mutual funds

- Performance lag: Gold investment prediction can be done by seasoned professionals only. Mutual funds sometimes fail to outperform their benchmarks when their success is compared to their returns.

- Maintenance cost: With higher operational expenses, investors have to pay management fees that sometimes exceed overall returns.

Tip 4: How to invest in gold exchange-traded products

Gold can be invested through exchange-traded products. One common option is exchange-traded funds (ETFs).

Digital gold investment in UAE: Exchange-traded funds (ETFs)

A gold Exchange Traded Fund (ETF) allows you to invest in gold without buying physical gold assets. It is a fund that holds a range of different gold-backed assets. Some gold ETFs track or mimic the price movements of physical gold, whereas others may include shares in gold miners or various gold-backed derivatives. The underlying asset dictates the value of the ETF and will, therefore, be the determining factor for its performance.

Key highlights:

- Gold ETFs can be traded like stocks, making them liquid and easy to sell off as and when required.

- They are also often cheaper for new investors to own, as you do not have to purchase actual gold, although investors must check the spot price with a qualified broker.

- It allows you to include gold in your portfolio with a smaller commitment to capital.

Pros of learning how to invest in gold ETFs

Accessibility: Fractional trading is possible for the majority of ETFs. In other words, you can purchase a fraction of a share if you are unable to pay for a single share. This is one of the significant ways for small-capital retail investors to invest in gold.

No minimum investment: No minimum capital needed to invest in ETFs. Additionally, this aspect makes it more accessible to individual investors.

Transparency: Most, Exchange-traded instruments are required to disclose their holdings . Investors are easily able to determine the underlying assets to which they are exposed.

Diversification: By offering a greater variety of diversification techniques, reduced expense ratios, and more asset availability, exchange-traded funds (ETFs) facilitate and reduce the cost of diversification.

Ensure you invest only in what you understand

Before buying a gold product, it’s best to seek guidance from a qualified financial expert. The correct amount of gold to invest in will vary based on your financial situation – factors like your investment horizon, risk profile, and current market conditions all play a role.

Aim for a balanced, well-diversified portfolio. Gold investments must play a clear and specific role in this. Remember, smart gold investments start with informed choices.