Table of Contents

In a rush? Read this summary:

- Insurance coverage is essential to protect your health, home, travels, and loved ones, especially when unexpected situations happen.

- In the UAE, it is mandatory to have health insurance and employers who fail to provide their employees with it may be subjected to penalties.

- While life insurance is not mandatory, it helps with financial planning and providing your family with the financial security they need.

If you are all set to build your future, whether it’s buying your dream home or starting a family, it’s easy to let life insurance slip through the cracks, especially for the younger generation. However, remember that protecting your family isn’t a task for tomorrow; it’s a priority for today.

The indisputable importance of insurance: Protecting your future

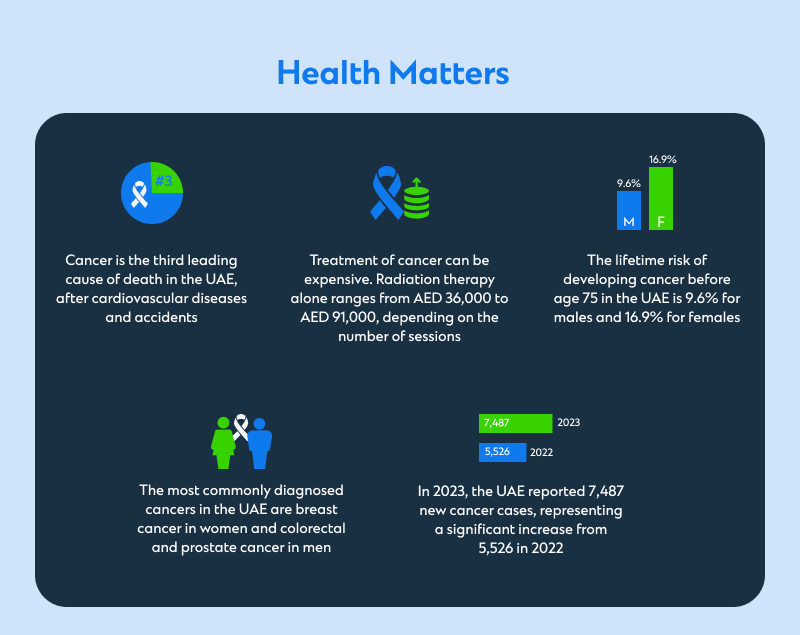

The importance of insurance is undeniable especially when unexpected life events happen. Some events are pleasant, such as winning a lucky draw, while others can be difficult and life-altering. Our household income and expenses can be affected by a family member’s illness or, in a severe situation, by the loss of the breadwinner of a family.

Perhaps no experience is more emotionally jarring than losing a loved one unexpectedly. Outstanding loans still need to be repaid, and large sums of money may be required for our children’s education.

While we cannot prevent such situations, remember that protection is not as complicated as it may seem once you get down to it.

Here’s a quick look at the precautions you can take to protect yourself and your loved ones.

Types of insurance: Health insurance

Health insurance is obligatory in the UAE. Residents without valid coverage may face serious medical,legal, and financial consequences. Here’s what you need to know if you do not have health insurance in the UAE:

- In Dubai and Abu Dhabi, if you do not have health insurance, you may be subject to a monthly fine of AED 500 per person, as per government regulations.

- Employers who fail to provide employee insurance may be subject to substantial penalties.

- Without health insurance, accessing even basic medical care can be extremely costly.

- Visa processing in many UAE Emirates also depends on health insurance . If you don’t have one, you may struggle to obtain your residency visa, which can lead to legal complications. Additionally, you may encounter visa renewal delays.

Types of insurance that matter: Essential health plans

Starting January 1, 2025, you must have basic health insurance coverage if you are working in the private sector or a domestic worker in the UAE. Employers must comply with the new health insurance scheme approved by the UAE Cabinet and implemented by the Ministry of Human Resources and Emiratisation. It’s a mandatory condition for issuing or renewing a residency permit.

Employers can purchase these plans through the Dubai Care network. They can also buy it from other accredited insurance providers.

On the other hand, employees who already have a valid work permit issued before January 1, 2025, are exempt from this requirement. If the permit needs to be renewed, it must be done without delay. Remember that the policy is mandatory for renewing residency permits.

The importance of life insurance in the UAE

Life insurance in the UAE is not mandatory like health insurance. But if you have financial dependents, it is necessary to understand the value of life insurance. Keep in mind that, even in your absence, your family will still need to manage major expenses, such as school fees, rent, and daily living costs, considering the high cost of living in the UAE.

Take a look at a quick breakdown of different types of insurance below.

Term insurance benefits

Term insurance is an affordable option. It offers reliable financial security to your loved ones.

- Term insurance is designed for a fixed period. You are often covered until retirement.

- It can include benefits like life cover, critical illness protection, and other add-ons based on your specific needs.

- You will have a fixed sum assured and a fixed premium from day one. It is perfectly suited for short- to medium-term financial liabilities.

Decreasing term plans

These plans match declining financial obligations. Just like term insurance, decreasing term plan offers financial protection in the event of critical illness, disability, and death. The main difference is that the sum assured decreases over time, aligning with reducing liabilities such as mortgage payments. You may have to pay lower costs than standard life insurance, and the premiums will be fixed and predictable, allowing you to make comfortable financial planning.

Whole life insurance benefits

It’s another form of life insurance in UAE that offers lifelong protection and peace of mind for your estate planning.

- No matter when the policyholder leaves this world, this life insurance guarantees a payout.

- It’s a solid option for long-term planning as this policy includes an investment component that builds your cash value over time.

- Premiums can be adjusted to suit evolving needs and budgets. Inheritance tax planning is crucial, particularly if you wish to preserve your wealth for future generations.

Types of insurance: Property insurance

You likely already understand the importance of insurance. In that case, affordable property insurance plans are available to protect your home from risks like earthquakes, fire, theft, floods, and vandalism.

Importance of property insurance

- Protects your home and belongings from natural disasters and household accidents.

- Covers damage to electronics and household equipment.

- Offers peace of mind against unforeseen monetary loss.

Types of insurance: Travel insurance

The UAE has already become a travel hub with excellent international connections. Travel insurance protects you against various unforeseen expenses, including trips, overseas medical expenses, cancelled flights, emergency accommodation, and even lost baggage.

- If you are planning an international trip, travel insurance can help protect against out-of-pocket expenses.

- Remember, if you have to make a sudden expense in a strange, unfamiliar country, it won’t be easy for you all the time.

- Some countries require tourists to get travel insurance.

Maximise your insurance benefits with expert guidance

UAE residents usually prefer to adopt a combination of different insurance policies. While life insurance is not mandatory in the UAE, many also opt for life insurance to safeguard their families’ well-being. On the other hand, property and travel insurance depend on your individual needs.

Now, you are familiar with the different types of insurance and the importance of insurance policies. Create a list of important questions to ask before purchasing an insurance policy in the UAE.

Speak to Standard Chartered’s relationship managers or contact us to learn more about our various insurance products and understand how it can help safeguard your future.