Table of Contents

In a rush? Read this summary:

- Insurance today goes beyond protection, serving as a strategic tool for income continuity, wealth accumulation, and diversification.

- Various insurance products, such as critical illness cover, Unit-linked insurance lans (ULIPs), whole life plans, and annuities, support goals ranging from income replacement and retirement security to legacy planning.

- Integrating insurance into financial planning allows individuals to manage risk and ensure smoother estate distribution across generations.

Amidst an ever-evolving and globally connected financial landscape, insurance has emerged as a cornerstone of wealth planning. While it was traditionally seen only as a tool for protection, today, it plays a far more strategic role. That is to enable you to build and preserve your wealth, as well as pass it on across generations with conviction.

As a result, insurance is also being used to diversify investor portfolios, provide tax benefits, and enhance estate planning, in addition to risk mitigation.

And if you’re looking to leverage Insurance products in the long run to bolster your wealth planning, we’ve put together this guide with four strategies to do so.

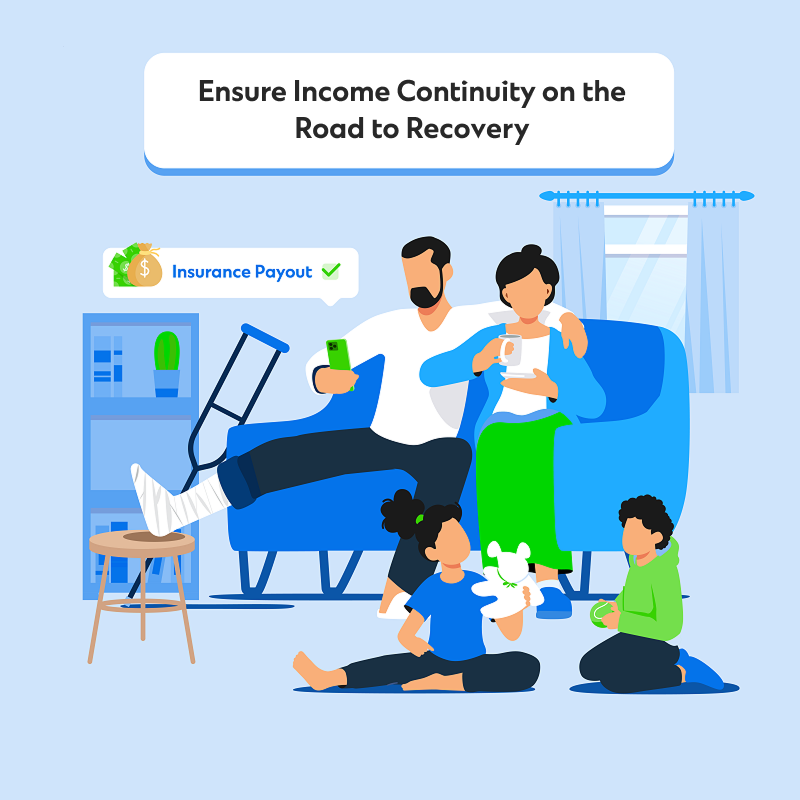

Ensure income continuity

Insurance is essential for covering medical expenses arising from serious illnesses or injuries. What it also helps with, however, is the impact of lost income during recovery. This gap can pose significant challenges. It is, therefore, essential to ensure provisions for income replacement on the road to recovery.

For the same, one can invest in several insurance products, some of which are as follows:

Critical illness insurance

Critical illness insurance products are policies under which insurers provide policyholders with a pre-determined lump sum amount to a policyholder diagnosed with a critical illness specified within the policy. The term “critical illness” typically encompasses several serious diseases, such as cancers and strokes, end-stage renal failures, Parkinson’s, multiple sclerosis, and more. Diseases which, if left untreated, result in eventual death.

Treating most of these illnesses almost always results in a loss of income due to medical expenses and an inability to work.

The advantage of these insurance policies is that the payouts go directly to you. You’re free to use the funds as you see fit, whether for medical expenses or other expenses such as rent, food, transportation, and/or childcare.

Hospital cash insurance

Hospital cash insurance is yet another means of financial support during illness, specifically during hospital stays. It entails a daily cash benefit for every day you spend in the hospital, typically covered for between 30 and 45 days in a policy year. However, remember that it usually applies only if the policyholder is hospitalised for at least 48 hours.

Like critical illness insurance , this lump sum payment can be used to cover hospital expenses and offset lost income used for other purposes. Moreover, if one is hospitalised in the Intensive Care Unit (ICU), the amount is often doubled for up to seven days.

Speaking of hospital expenses, this fee can be used to cover inpatient hospitalisation, pre- and post-hospitalisation care, ambulance service costs, and more.

Personal accident coverage

As the name suggests, personal accident insurance helps cover any treatment expenses arising from accidental injuries. It also provides compensation for any permanent disabilities arising from them. Keep in mind, however, this compensation amount differs according to the disability one has. For example, losing one limb in an accident may entitle you to 50% of the total compensation amount, whereas losing both limbs may allow you to claim the full amount.

Additionally, personal accident covers may also include riders for death, the amount of which is disbursed to one’s dependents after their passing. Depending on the plan one opts for, it may also cover other expenses, such as funeral and repatriation costs.

Term insurance

Term insurance is a form of life insurance that provides coverage for the expenses of the policyholder’s beneficiaries in case of the policyholder’s death. Depending on the plan, these payments are disbursed to them in lump sums or monthly instalments. Bear in mind, however, that benefits are offered only if the insured passes away during the policy term.

Certain Emirates within the UAE offer citizens access to government-sponsored insurance schemes as well. These schemes are meant to alleviate the financial burden associated with treatment for both acute and chronic health conditions.

Diversify your assets and instil discipline

Smart life insurance strategies can help business owners and salaried individuals achieve their financial goals. One strategy is to use insurance plans to diversify their investment portfolio, driving up returns while mitigating risk. Some insurance plans that can be used to do this include whole-life, fixed-term endowment, and investment-linked plans. Here’s how they can work for you.

Whole life insurance plans

Whole life insurance beneficiaries with coverage for the entire duration of the policyholder’s lifetime as long as premiums are paid. Unlike term insurance plans, the policy pays a death benefit to your beneficiaries when you pass away and includes a cash value component that grows over time. This is built up through a portion of premium payments and interest at a fixed rate. In essence, whole life insurance plans serve as both – a protection plan for your loved ones and a financial asset that grows in value over time.

What’s more, whole life insurance plan premiums are typically fixed, meaning they remain the same throughout the policy’s life. This provides investors with ease of predictability and budgeting.

Fixed-term endowment insurance plans

Fixed-term endowment plans are, in essence, a combination of term insurance and savings plans with a fixed maturity term. They provide policyholders’ dependents with death benefits during the policy term (in case the former passes away) and/or a survival benefit paid out if the policyholder survives until the plan matures.

The payout for both survival and death benefits is generally higher than for term plans. Life insurance policies are also a lower-risk investment than, say, mutual funds, since funds aren’t invested directly in the stock market.

Unit-linked investment plans

Unit-Linked Insurance Plans (or ULIPS) combine the benefits of investments and insurance into a single plan. They allow you to invest in several market-linked assets, such as equities or bonds, while offering life insurance. This allows you to grow your money on one side while using the same money to protect your loved ones in case of unforeseen circumstances. ULIPs allow you to invest in multiple funds, ranging from equity and debt to balanced funds. They offer you the flexibility to invest depending on your financial goals and risk tolerance.

Investments can be tailored to long-term goals, such as establishing a retirement fund or funding your children’s education, or short-term goals, such as buying a vehicle or going abroad. ULIPs allow you to not only leverage the power of compounding and fulfil your financial goals but also protect your loved ones while doing so.

Boost and secure your retirement income

Retirement is often considered daunting. This is because you need to ensure a steady income stream, allowing you to meet both your routine expenses and unforeseen accidents or illnesses without worry. One surefire way of ensuring this is via lifetime annuity plans.

Annuities are a type of insurance policy wherein you pay a lump sum or a monthly premium for a fixed timeframe. When you reach your desired retirement age, you are entitled to receive annuity payouts at a frequency of your choosing. Annuity plans are very different from life insurance. They provide a fixed lifetime income for you, so you don’t exhaust your savings. Life insurance plans protect policyholders’ loved ones in case of the former’s untimely demise.

Fund your legacy

Balancing your long-term financial goals may often bring you to two junctures simultaneously: retirement and legacy planning. Each may seem like a trade-off, wherein one may have to be given precedence over the other. It doesn’t necessarily have to be that way, though. There are insurance solutions that can grow your legacy and help you navigate retirement comfortably.

For instance, a whole life policy provides you with a retirement fund to be kept safe until you reach your desired retirement age. And in the unforeseen event of your demise, the payout from the plan helps keep your loved ones afloat.

Life insurance also helps in asset distribution after the policyholders’ deaths. When beneficiaries are required to take tough calls in splitting properties following policyholders’ deaths, which would otherwise require liquidation for fair distribution, life insurance payouts help. One beneficiary may opt for assets, while the other claims the same cash value.

Choosing the right insurance solution is paramount

Much as choosing the right mix of insurance policies is crucial, working with a qualified financial expert plays an integral role in helping you leverage insurance policies to grow, preserve, and pass on your wealth.

Speak to Standard Chartered’s relationship managers or contact us to learn more about our various insurance products and understand how to build and manage your portfolio and protect your wealth to pass it on to future generations.