Table of Contents

In a rush? Read this summary:

- Bonds balance security, income, and liquidity for resilient UAE portfolios.

- Mix government, corporate, and sukuk bonds to manage risk and capture opportunity.

- Picking the right bond route and timing helps preserve wealth through market shifts.

In a world of uncertainty, bonds offer clarity. For UAE-based investors, they provide a reliable foundation, balancing capital protection, income, and liquidity. This guide explores how different types of bonds, including sukuk (also known as Islamic bonds), can help you navigate market cycles with precision and purpose., can help you navigate market cycles with precision and purpose.

Understanding the bond advantage in wealth portfolios

For discerning investors in the UAE, bonds represent more than just fixed income, offering capital stability, predictable returns, and strategic diversification amid market volatility. These benefits are characteristic of a wider range of fixed income securities that can complement even the most sophisticated portfolios. Whether you’re adjusting risk exposure or seeking good income abroad, investing in bonds can align liquidity, yield, and credit risk to suit both short-term needs and long-term ambitions.

With the right blend of bond types and durations, investors can align liquidity, yield, and credit risk to suit both short-term needs and long-term ambitions.

Different types of bonds available for investment

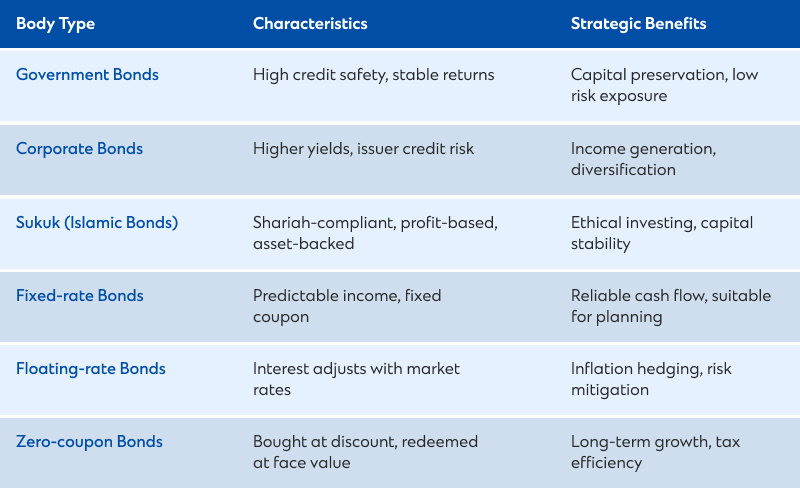

Bonds come in various forms, each serving a different purpose depending on the issuer, duration, and interest structure. Understanding these classifications is critical to making informed allocation choices.

Government bonds

Issued by sovereign bodies, these offer high credit safety and stable, if modest, returns. In the UAE, this includes Federal Government Treasury Bonds and Sukuk instruments.

Corporate bonds

These are issued by private or public corporations to raise capital. While they offer higher yields, they come with credit risk based on the issuer’s financial health.

Sukuk

Structured to comply with Shariah principles, sukuk offer profit-based returns and asset-backing, making them a preferred option for Islamic finance clients.

Fixed vs. floating-rate bonds

Fixed-rate bonds provide predictable income, whereas floating-rate instruments adjust with market interest rates—often used to hedge inflation.

Zero-coupon bonds

Purchased at a discount and redeemed at face value; these provide no interim income but suit long-term, tax-efficient strategies.

For UAE investors seeking a balanced approach, a well-constructed bond ladder blending tenors and types can create both security and opportunity.

Types of Bonds and Their Strategic Role in UAE Wealth Portfolios

Why UAE bonds are gaining traction

The UAE bond market has grown rapidly in recent years, according to Arab news. Sovereign and quasi-sovereign issuances are increasingly popular with institutional and retail investors alike. Factors driving interest include:

- Attractive yields versus developed market bonds

- Strong sovereign ratings and stable macroeconomic outlook

- Expanding Shariah-compliant offerings, including USD-denominated sukuk

- No capital gains tax, enhancing after-tax returns

As regional exchanges like Abu Dhabi Securities Exchange (ADX) and Dubai Financial Market (DFM) increase bond listings, UAE bonds are becoming more accessible, transparent, and liquid—an important evolution for private clients managing large allocations.

How to buy bonds as an investor in the UAE

There are several routes to buy bonds in or from the UAE, depending on your investment experience and goals.

- Through banks or wealth management firms

Most private banks offer direct access to primary issuances and secondary markets, with guidance on bond selection and portfolio fit.

- Via brokerage firms

Licensed brokerages provide access to local and global bonds, including government securities, corporate paper, and sukuk.

- Through pooled investment vehicles like Bond Mutual Funds or ETFs

These pooled instruments offer access to a wide array of global bonds, diversifying your investment and thereby reducing reliance on any single bond issuer’s performance, making them ideal for passive exposure or diversification.

- Via structured products linked to an underlying bond

For more advanced investors, regulated private bank platforms offer structured products linked to bond performance, providing customised return profiles.

Regardless of the route, due diligence remains critical. Evaluate credit ratings, maturity profiles, yield curves, and macroeconomic conditions—especially when investing in emerging-market or high-yield instruments.

Strategic positioning: When and why to prioritise bonds

While bonds may not offer high growth opportunities like stocks, they serve distinct strategic functions:

- Capital preservation during equity drawdowns

- Stable income for retirement or reinvestment

- Diversification across asset classes

- Currency hedging when investing in foreign-denominated bonds

- Shariah alignment through sukuk for ethical portfolios

For high-net-worth individuals (HNWIs), bonds are often used alongside equities, real estate, and alternatives to create a multi-asset structure that adapts to market cycles and lifestyle needs.

Bonds remain essential in the intelligent investor’s toolkit

Whether you’re seeking to maintain a defensive investing strategy, predictable income, or ethical compliance through sukuk, investing in bonds offers UAE-based investors a powerful tool for long-term resilience. With maturing local markets and broader global access, bonds can now be tailored more precisely than ever—fitting seamlessly into diversified portfolios built for both protection and growth.

Speak to Standard Chartered’s relationship managers or contact us to learn more about investing in equities.