Table of Contents

- Make your money work: Tailored investment options in the UAE

- Types of traditional investment options in the UAE

- Stocks vs bonds: Discover what aligns with your investment goals

- Alternative passive income investments in the UAE

- Mutual funds: A strategic approach to diversified growth

- Explore investment options based on your financial goals

In a rush? Read this summary:

- The UAE investment landscape spans stocks, bonds, ETFs (Exchange-Traded Funds), REITs (Real Estate Investment Trusts), and commodities, offering both traditional and alternative avenues.

- Stocks present potential for capital gains and dividends, while bonds provide more stable, fixed returns with lower risk.

- ETFs and REITs offer diversified, passive exposure to markets and real estate, without requiring direct asset management.

Is your money working hard for you, or is it still sitting idle in your savings account? The UAE has become a global investment hub due to its strategic geographic location and dynamic, fast-evolving economy. With a broad spectrum of investment options available in the market today, it’s no wonder the UAE is hailed as an attractive destination for creating wealth over the years.

Make your money work: Tailored investment options in the UAE

Whether you are planning for retirement or interested in growing your savings, it’s best to make your money work in the market.

Depending on your financial goals, investments can be picked to align with those goals. Apart from stocks and bonds, there are alternative investment vehicles, such as ETFs, REITs, sukuk, or Islamic bonds.

While the theory is sound, its application can be complicated due to the numerous investment options available.

This article breaks down the major investment options available in the UAE, helping investors grow their wealth with confidence by navigating the best-suited path.

Types of traditional investment options in the UAE

There are several traditional investment options available in the UAE. The right ones can power your financial journey. Here’s a quick breakdown.

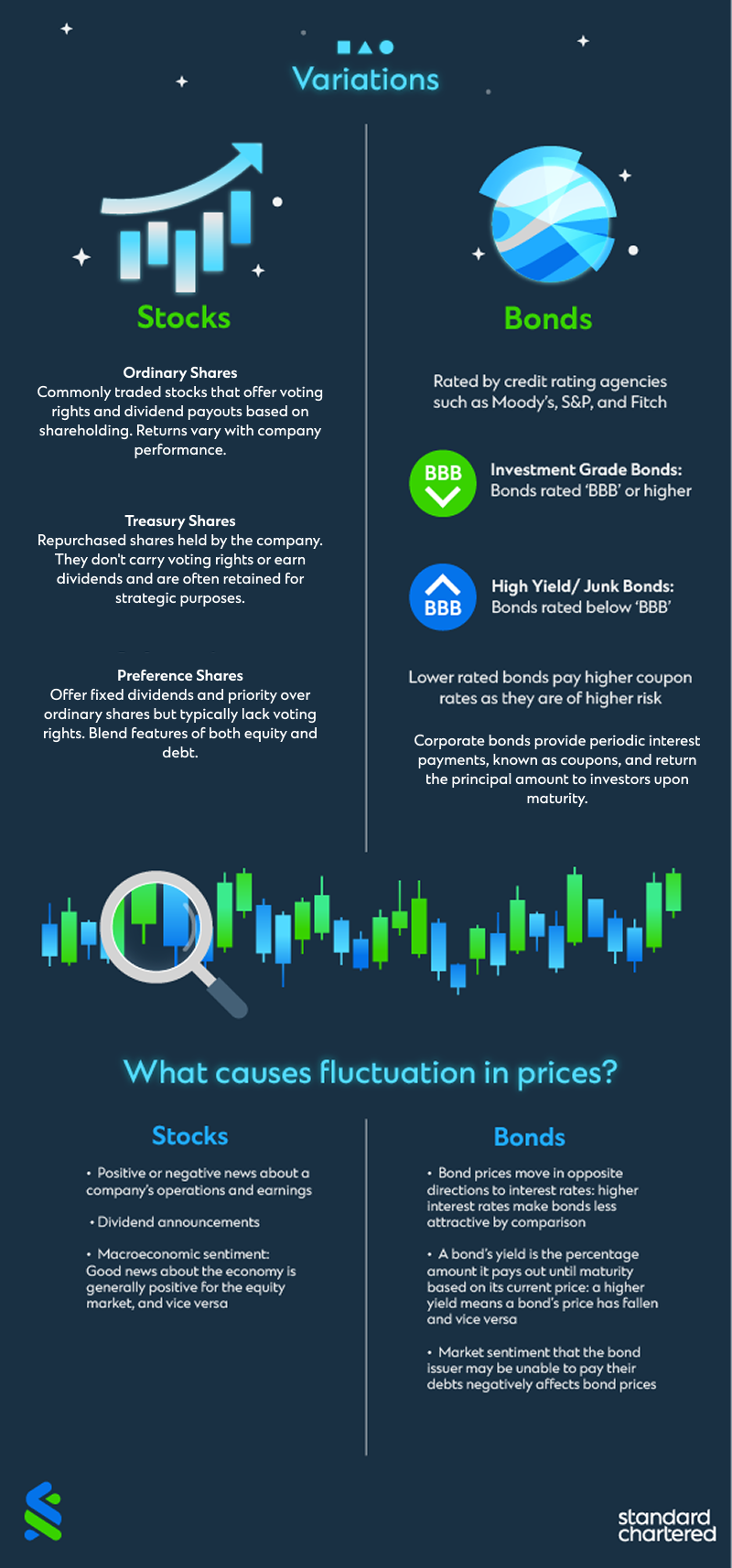

Investment options with potential: Understanding stocks

You can invest in the local market, such as the Abu Dhabi Securities Exchange (ADX) and the Dubai Financial Market (DFM). The partial ownership of a company’s capital is known as stocks.

Investors can generate profits from stocks in two distinct ways.

- Capital appreciation: The appeal of stocks as a long-term investment lies in their price rise over the years. For example, a share of Google was sold for $28.23 ten years ago, while in July 2025, the stock is trading online at approximately $175.84 per share, reflecting a substantial increase over a decade.

- Dividends: Companies usually share a portion of their net income as dividends. Depending on the number of shares investors hold, dividends are typically paid quarterly or annually, but some may be paid monthly, bi-annually, or as special dividends when declared.

If you are considering investing in stocks, keep in mind that higher returns often come with higher risks or volatility.

Bonds: A great way to grow passive income in the UAE

Government-backed entities and corporations usually issue bonds in the UAE. Among the most trusted fixed-income products are capital investment bonds, which offer steady returns over time.

- Bonds issued by the corporation are known as corporate bonds.

- Federal government-issued bonds are popularly known as national bonds or treasury bonds.

- Local government bonds, such as those issued by cities, states, or local municipalities, are commonly referred to as municipal bonds.

Investors can generate profits in two distinct ways.

- Bond value growth: Investors can generate returns when the bond value increases. Usually, when the stock market is down, investors turn to bonds.

- Interest payment: Bondholders usually receive interest payments twice a year. Unlike stocks, there is a fixed interest rate.

Stocks vs bonds: Discover what aligns with your investment goals

Bonds are considered less risky than stocks and other investments. Why? Let’s understand this below.

- Higher uncertainty: Bonds have fixed maturity dates and offer coupon payments at regular intervals until the bond’s maturity. On the other hand, stock returns depend on a company’s performance.

- Payment priority: In the event of default, a company’s remaining assets are sold, and the proceeds are first distributed to bondholders or debt holders. On the other hand, shareholders receive payment at last when all the obligations have been met.

Alternative passive income investments in the UAE

Explore smarter ways to earn alternative passive income investments in the UAE.

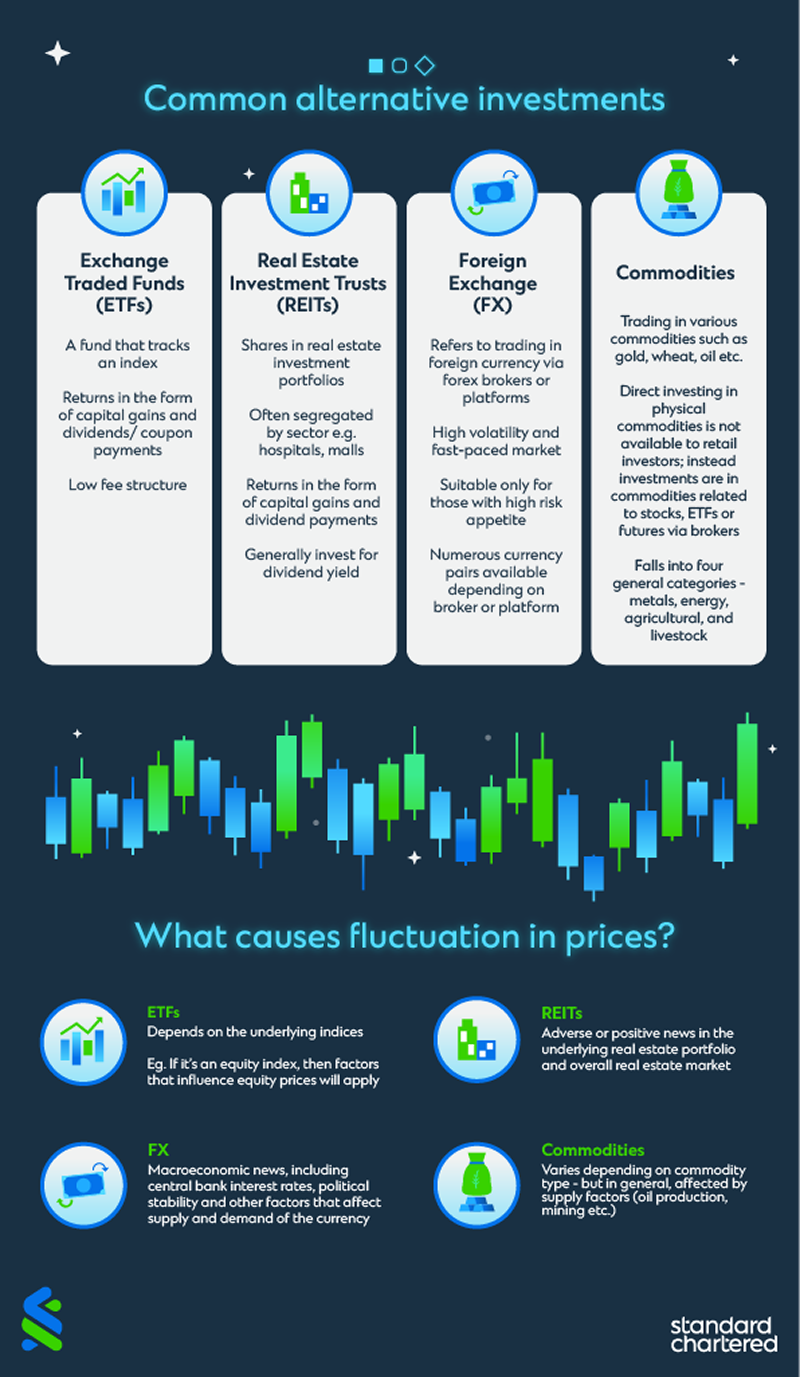

ETFs: A pathway to passive income with diversified portfolios

Exchange-traded funds (ETFs) are one of the best options for passive income investments. It is one of the go-to examples for investors to achieve diversification. You’ll gain exposure to a diverse range of stocks or bonds by owning a share of ETF.

- Investors can purchase a single ETF that offers extensive diversification. At the same time, you can buy many ETFs as well.

- You can buy international stocks ETFs and US stocks ETFs together, along with US bonds ETFs and global REIT ETFs.

- ETFs offer diversification along with reduced portfolio risk. You can combine various ETFs at a time that’s spread across different markets.

REITs: Earn from real estate without owning property

The booming real estate market in UAE is the reason why many wealthy investors from around the globe are attracted to it.

- Remember, real estate investment is not for beginners. It requires a considerable capital outlay.

- Diversification through different property types or locations is critical.

- Managing tenants is also part of your investment while selling properties quickly is not always easy.

This time-tested investment, REITs are stocks of companies that offer mortgage facilities to real estate investors or directly purchase real estate properties.

REITs earn money through rental income. At the same time, they pay regular dividends, which can prove to be a stable income for investors.

Without the risks associated with owning a property in the UAE, real estate can be a significant stream of passive income for you.

Passive income investment options: The power of Forex Trading

Forex trading or foreign exchange trading refers to exchanging and selling currencies to gain profit from fluctuations in exchange rates. It is one of the most active financial markets worldwide. High-net-worth individuals and experienced investors consider this one of the best passive income investments.

Why forex is considered one of the best passive income investments in the UAE?

- High liquidity: Forex markets are open 24/5. You can trade currencies such as EUR, USD, JPY, AED, and others without any hassle.

- Leverage opportunities: UAE brokers typically offer traders leverage. As a result, you can manage larger portions with smaller capital, though this also adds risk.

- Diverse strategies: Forex can be approached in both short-term and long-term perspectives, depending on microeconomic data and geographical events and developments.

Forex can be considered one of the best passive income investment possibilities for you, especially with the support of automated trading and copy trading services.

For investors seeking a hands-off approach, forex presents a dependable way to generate passive income with minimal day-to-day management.

Commodity: A popular choice for investors in the UAE

The UAE has a rich history of commodity trading, particularly in oil, natural gas, and gold. With exchanges like Dubai Gold and Commodities Exchange (DGCX), investing in commodities has become relatively straightforward.

- Tangible asset exposure: Tangible assets, such as gold, protect against market volatility and inflation.

- Profile diversification: Adding commodities brings diversification benefits to your portfolio due to their low correlation with traditional assets such as bonds and equities.

- Market Volatility Benefit: Both short and medium-term price movements in precious metals, agricultural products, and oil can generate significant returns.

Mutual funds: A strategic approach to diversified growth

A mutual fund pools money from different investors and invests it in other fixed-income securities, bonds, and stocks; it is usually overseen by an experienced fund manager who understands the market and has the skill to choose individual bonds and stocks to oversee the investment, making it more costly as opposed to ETFs.

- Mutual funds make money through dividends and appreciation in the fund’s value.

- Mutual fund shareowners receive dividends or interest, depending on the number of shares they hold. On the other hand, as the mutual fund price increases, the value of the stocks and bonds it holds also increases.

- If the mutual fund grows, the share price value also grows.

Explore investment options based on your financial goals

It is important to never rely on a single asset class and diversify your investment portfolio, consider a balanced approach to long-term wealth building by incorporating a mix of Sukuk, UAE stocks, REITs, ETFs etc. Regular reviews help ensure your portfolio stays aligned with your evolving goals and risk tolerance, allowing you to realign it with your current needs.

Before you embark on your investing journey, ensure you have a sufficient emergency fund as this will help you with your unplanned and unexpected expenses. Remember, if you begin your investment journey without an emergency fund, you may need to liquidate your investments in the event of an emergency.

Speak to Standard Chartered’s relationship managers or contact us to learn more about your investment options in the UAE.