Table of Contents

- Mutual fund maze: How to grow your wealth?

- Stock picking vs. smart delegation: How to select mutual funds

- Mutual fund, an investment vehicle that works while you sleep

- Mutual fund: Your gateway to the best investment in UAE

- How do you make money with mutual funds

- What owning a mutual fund in the UAE really means

- Types of mutual funds

- How mutual funds make money: Two proven ways

- Open vs closed: Mutual funds distinction based on trading style

- Active vs passive: Choosing a mutual fund

- Guide on how to select mutual funds

In a rush? Read this summary:

- Mutual funds in the UAE offer diversified investment options, such as equity, fixed income, balanced, and speciality funds, managed by professionals to help investors grow wealth through income distribution and capital appreciation.

- Investors can choose between open-ended and closed-ended mutual funds, as well as active or passive management styles, depending on their goals, risk appetite, and trading preferences.

- Standard Chartered’s Fund Select platform provides users with a handpicked selection of mutual funds based on performance, process, and people, with ongoing monitoring and risk management to maintain portfolio quality.

Did you know that, according to the Khaleej Times, 60% of Dubai’s millionaires are also self-made? In short, they are not unicorns; they’re planners.

Remember, financial independence isn’t reserved for the lucky; it’s engineered by those who know the right steps to follow.

Think long-term, invest wisely, avoid guesswork, and let your money do the heavy lifting.

Mutual fund maze: How to grow your wealth?

If you are interested in diversified growth potential, choosing a mutual fund can be a smart decision. However, finding the best mutual fund to invest in can feel like navigating a maze due to the constantly expanding list of mutual funds with similar sounding styles.

Stock picking vs. smart delegation: How to select mutual funds

Many investors hope to invest in the next high-performing stock, which can yield them good returns. However, making that dream a reality requires considerable time, effort, and a certain level of knowledge to evaluate key factors such as price-to-earnings (P/E) ratios, revenue, net income, the management team, and more.

Therefore, you can easily understand that not everyone has the time or expertise to master stock picking, and that’s okay. For those who find such research a challenge, a mutual fund is an excellent investment option to consider.

Mutual fund, an investment vehicle that works while you sleep

Mutual fund aggregates funds from various retail investors and invests in bonds, stocks, and other fixed-income securities. A fund manager and their team professionally manage a mutual fund to achieve returns (capital gains or regular income) in line with its investment objectives. Different types of funds can provide diversification across asset classes, sectors, and geographical regions.

Mutual fund: Your gateway to the best investment in UAE

As a retail investor, instead of purchasing stocks, you can buy shares in mutual funds. Get exposure to all the assets held by the fund.

Let’s understand this with an example. You buy a share of stock (equity) mutual fund that has 50 stocks. Without the stress of handpicking individual stocks or bonds, you’ll get exposure to all 50 underlying stocks.

How do you make money with mutual funds

There are two ways your investment can grow with a mutual fund.

1. Choosing a mutual fund with income payouts

Certain mutual fund categories generate income from their underlying securities and distribute it to fundholders at least once a year. The income earned on underlying securities must be distributed to fund holders based on the number of shares they have in the fund.

2. Choosing a mutual fund for capital gains

The second option is quite interesting! Sell your mutual fund shares to make a profit. Keep in mind the below points.

- You cannot sell mutual fund shares during trading hours, unlike equities.

- You will need to hold off on selling your shares depending on the current net asset value (NAV) until the end of trading hours. Suppose you own units of a mutual fund and you submit a sell request before the fund’s cut off time. If at the close of the day the price per unit of the mutual fund is AED20.35 per unit, then this is the price your sell request will be executed at.

- The trading hours in the UAE are between 10 am and 2:44 pm.

What owning a mutual fund in the UAE really means

You already know that when you invest in a mutual fund you own a slice of the mutual fund, not individual stocks or bonds. In other words, the shareowner doesn’t own the stocks or bonds; instead, they own the mutual fund itself.

Within a mutual fund, there are fixed-income funds, also known as debt funds, equity funds, balanced or hybrid funds, and specialty funds.

Are you still wondering how mutual funds make money? Check out the details below.

Types of mutual funds

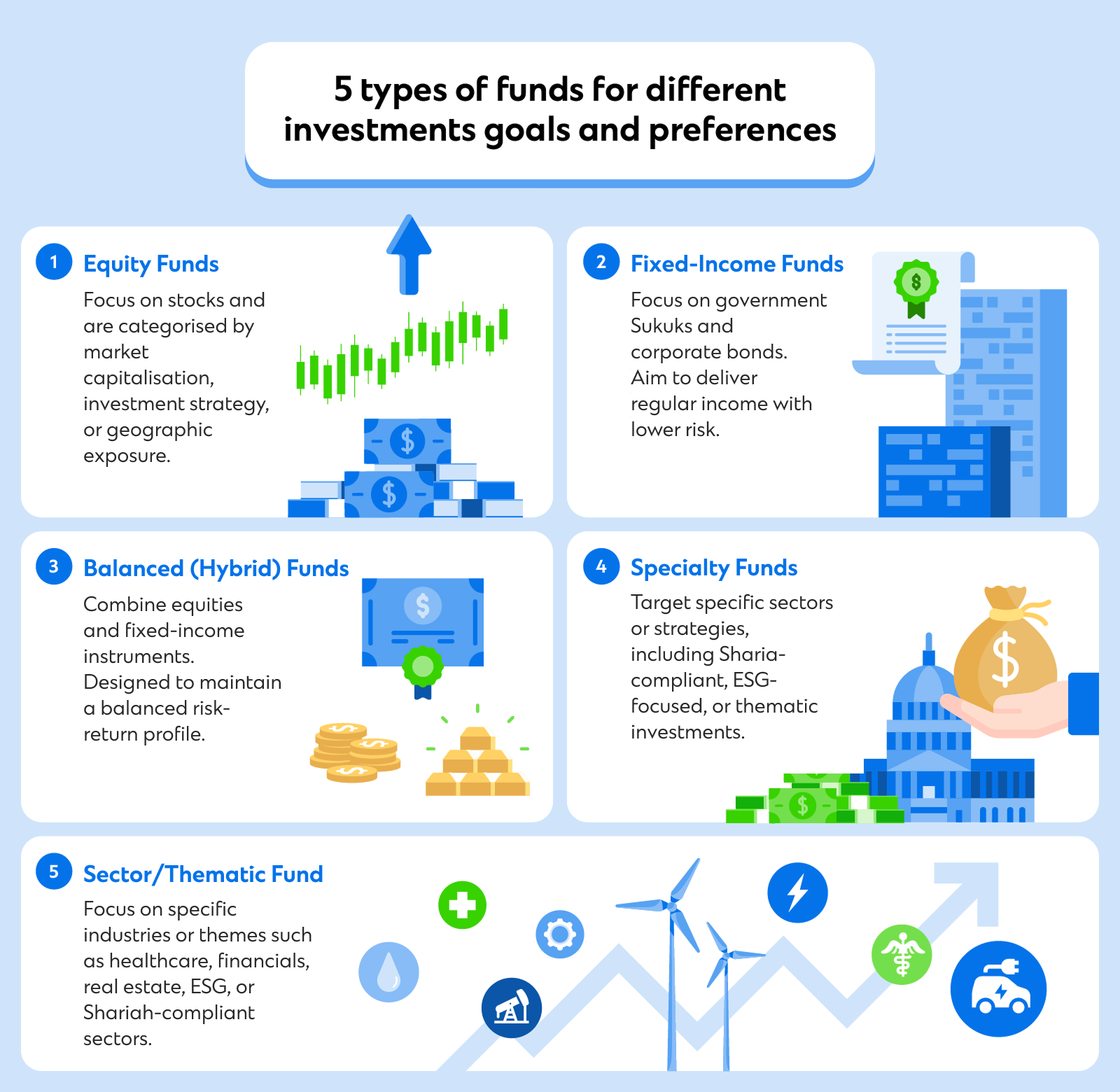

The UAE market is comprised of various types of mutual funds. However, selecting mutual funds is crucial. Depending on their goals and preferences, you can choose one.

- Equity funds: Are you a growth-oriented investor? Then equity funds are ideal for you since they primarily invest in stocks.

- Fixed-income funds: Are you looking for a fixed return on investment? Then, consider this option, as it focuses on government or corporate bonds.

- Balanced (hybrid) funds: These funds combine stocks and bonds to achieve a balanced risk-return profile.

- Specialty funds: These funds target specific sectors or strategies, such as Sharia-compliant investing.

You can easily determine how a mutual fund generates income by reviewing the different types of mutual funds available in the UAE.

How mutual funds make money: Two proven ways

Mutual funds can generate money by following two different proven paths.

Dividends/Interest income: Depending on the number of shares, the mutual fund’s shareholders receive dividends or interest from the equities or bonds held by the fund.

Capital appreciation: A mutual fund’s Net Asset Value (NAV) grows in tandem with the value of the equities and bonds it owns. Over time, this results in a rise in the value of your investment.

The value of the shares increases with mutual funds.

Open vs closed: Mutual funds distinction based on trading style

Before choosing a mutual fund, it is essential to understand the key distinctions among mutual funds based on their trading styles.

- You can buy or sell open-ended mutual funds at any time throughout the year. Depending on the fund’s daily NAV, you can sell the units you have or buy more units.

- You can sell closed-end mutual funds based on their net asset value (NAV) at a specific maturity date. You can also hold it until you reach maturity.

Active vs passive: Choosing a mutual fund

Investors must have an excellent strategy for choosing a mutual fund. There are two dominant styles. Check the details below.

Passively managed funds, commonly known as index funds, are designed to mirror the performance of a specific market index. They consist of a diversified basket of securities. These cost-effective and transparent funds do not try to outperform the market either. They buy or sell only when the index changes.

Actively managed funds actively purchase and sell to beat the market. They rely on expert analysis. Instead of tracking the index, which serves as a benchmark for their performance, they aim for a higher return. Therefore, it’s a risky adventure for investors. While they offer flexibility, it’s essential to note that they often come with higher fees and inconsistent returns.

Guide on how to select mutual funds

With a plethora of mutual funds available on the market, selecting the right fund can seem like a daunting task for investors.

When reviewing funds such as those available on Standard Chartered’s Fund Select, it’s important to understand your investment objectives and risk appetite and analyse if it is in line to the risk profiles of the funds and review the qualitative and quantitative assessment of these funds based on its past performance.

Key features:

- Achieve your goal: The funds are chosen based on different risk profiles and customized in line with your investment goals. It aims to provide a bouquet of best fund ideas aligned with your risk appetite and investment objectives.

- Fund selection: The three pillars of Fund Select are quantitative and qualitative assessment of people, processes and performance. The selection of the funds happens after thorough due diligence by the Fund Select team.

- Expert-led strategy: A seasoned portfolio manager and his team work on robust idea generation, in-depth research, strategic portfolio construction, and comprehensive risk management. They aim to identify mutual funds and ETFs that outperform their peers and benchmarks.

- Proven path: Over the course of more than a decade, this process has been refined to provide investors with access to funds that have the greatest potential to add value to their portfolios.

- Performance monitoring: This pool of chosen quality funds is monitored from time to time, where the underperforming funds are swiftly replaced to protect portfolio integrity.

- Transparency: Investors gain insight into what the fund is, its performance since inception, core risks, and the assets it has invested in, enabling you to make informed decisions with clarity and confidence.

Learn more from our beginner’s guide and discover the latest fund ideas with Standard Chartered’s online mutual fund platform. Speak to Standard Chartered’s relationship managers or contact us to learn more about investing in mutual funds.