Table of Contents

- Tip 1: Property investment in the UAE: Define your long-term goals first

- Tip 2: Maximise Property Investment ROI in Dubai: Understand the profits and risks

- Tip 3: What can influence the value of your property investment in the UAE

- Tip 4: Know the upfront and ongoing costs before you dive into property investment in Dubai

- Tip 5: Treat property investment in the UAE as a long-term asset, not a short term solution

Thinking of diving into the real estate market? For many investors, property investment in Dubai goes beyond a roof over their heads. They consider it a dream home, a powerful investment that can offer both immediate cash flow opportunities and long-term financial growth.

It’s a venture that requires a clear understanding of objectives, strategic decision-making, and careful planning. Let’s dive in.

Tip 1: Property investment in the UAE: Define your long-term goals first

Real estate investment in Dubai requires patience, research, and smart decision-making to achieve long-term success. Start by asking: What role will this property play in your life or investment journey?

Buyers typically fall into three categories. Which one resonates with you the most?

Property investment in the UAE: Owner-occupiers

Owner-occupiers are pure homeowners with no interest in rental gains (as they will not rent out their homes anyway). They are more focused on resale gains.

Dubai investment opportunities: Key considerations

- Lifestyle Alignment: Whether the property is close to workplaces, schools, healthcare facilities, and desired recreational areas.

- Emotional Investment: Whether the property is near their preferred neighbourhood, family members, etc. Personal attachment influences decisions beyond financial metrics.

- Long-Term Residency: They often intend to live their entire lives in the property and pass on the home to future generations.

Property investment in the UAE: Owner-investors

Owner investors plan to reside in the property while they view it as an investment asset. They see their property purchase as a “starting step” with an intention toward asset progression. It means they intend to sell it at some point and move to a better home.

Dubai investment opportunities: Key considerations

- Future Resale Potential: Choosing unique properties in emerging neighbourhoods will lead them towards value appreciation.

- Rental Opportunities: One of the standout offers is the possibility of renting out portions of the property for additional income.

Property investment in the UAE: Pure investors and landlords

Buying investment property in Dubai could be your smartest move. These individuals or entities are concerned only about the property’s rentability (if they want tenants), the rental yield, and capital gains when they resell. They usually purchase their second or third property and often don’t reside there.

Buying investment property in Dubai: Key considerations

- Rental yield: Investors must focus on rental yields or the long-term capital growth against a property’s purchase price.

- Capital appreciation: Evaluating the potential increase in property value over time.

- Market dynamics: To identify high-demand areas and emerging trends, it is necessary to comprehend market dynamics and develop bespoke investment strategies based on data-driven insights.

Tip 2: Maximise Property Investment ROI in Dubai: Understand the profits and risks

Ready to let your property pay you back? Capital gains and rental income are two primary ways to make money from your property in the tax-free, high-yield UAE market. Before buying investment property in Dubai, one must understand that each has its own set of considerations.

Property investment ROI: Capital gains

You make capital gains when you sell your property at a higher price than you bought it for, even after expenses. The UAE real estate market has grown remarkably in the last 12 months. While Ajman, Abu Dhabi, and Sharjah have seen an increase in transaction volumes, Dubai recorded record-breaking figures, with the Dubai Land Department reporting 180,900 transactions valued at over AED 522 billion, a 36% increase over the previous year.

A simple example:

If you bought an apartment in Dubai Marina for AED 2.5 million in 2019 and sold it for AED 3.2 million in 2024 after spending AED 200,000 on renovation and transaction fees, your net capital gain would be AED 500,000.

Note that if the property is not rented out, it is an overhead until you sell it.

Property investment ROI: Rental income

If you rent out the property to tenants, it can become a cash-generating asset. A standard metric used to estimate rental assets is the gross rental yield. This is the annual rental income divided by the total cost of the property.

What is the gross rental yield?

(Annual Rent ÷ Purchase Price) × 100

Example: AED 42,000 ÷ AED 1.5 million ≈ 2.8% gross yield

Serious investors also need to work out the net rental yield.

What is net rental yield?

Deduct mortgage interest, service charges, maintenance, and vacancy costs.

UAE yields

Prime areas often deliver 6% to 8% gross yields, outpacing many global cities.

Example: 2-Bedroom serviced apartment in a prime area with a purchase price of AED 2.2 million. Short term rental approximately AED 480 per night, collecting a cumulative annual rental of AED 176,000. Therefore AED 176,000 ÷ AED 2.2 million ≈ 8% gross yield.

Tip 3: What can influence the value of your property investment in the UAE

Is real estate always a safe bet? Some of the main factors that affect property prices include:

Navigating Supply and Demand in Dubai’s Property Investment Market

Before buying investment property in Dubai, you must understand that home prices tend to rise when there is a shortage of homes and high demand. Conversely, prices tend to fall if many vacant homes are available but few interested buyers.

The National Association of Realtors (NAR) is a trade organisation for realty brokers and is considered an excellent resource for housing market data. They publish monthly data and analyses, and the association’s economists typically provide insightful information about the state of supply and demand in the housing markets.

Dubai investment opportunities: Accessibility and infrastructure

Property values are greatly influenced by good connectivity. Due to convenient access to the rest of the city, properties along major roads are in greater demand. Business professionals or frequent travellers usually prefer properties close to the international airport.

Buying investment property in Dubai: Public facilities

Real estate values are typically greater in areas with well-developed infrastructure, such as parks, shopping centres, hospitals, and schools. For example, communities with excellent community amenities draw professionals and families seeking a full range of lifestyle options, which raises real estate values.

Property investment in the UAE: Government initiatives and policies

The government has rolled out a number of initiatives to promote real estate appeal, including tax incentives, property law reforms, and relaxed visa rules. In particular, issuing long-term visas has promoted foreign ownership, increased real estate transactions, and made it a more alluring destination for investors.

Property investment in the UAE: Market risks and stability

Although the real estate market has a lot of promise, there are risks associated with it, such as changes in the price of oil and the world economy. Nonetheless, initiatives to draw in foreign investment and diversify the economy offer a strong basis for long-term resilience.

Investment property in Dubai: Holding power

During economic slowdowns, property values may decline. Properties that need to be sold quickly, often referred to as fire sales, can end up being sold at a loss due to limited negotiation time. Buyers might agree to complete a transaction in a few days, but only at a steep discount. Hence, holding power, or the capacity to withstand downturns or rental vacancies, significantly contributes to resale value.

These are just some of the many factors that can impact your property value. It is better not to take the term “safe as houses” too literally. While property prices may not be as volatile as other assets, keep in mind that real estate is not free of fluctuations.

Tip 4: Know the upfront and ongoing costs before you dive into property investment in Dubai

We have looked at the factors affecting property value. Before embarking on the exciting journey of property investment, don’t forget to evaluate both upfront and ongoing costs to ensure financial preparedness. Let’s understand the costs (and hidden ones) of buying a property.

Buy investment property in Dubai: Minimum down payment guide

Upfront Costs

Minimum down payment

- For first-time expatriate buyers, the Central Bank in the UAE mandates a minimum down payment of 20%, while for UAE nationals, it’s 15%.

- For instance, if an expatriate wants to purchase a property valued at AED 1 million, they require a down payment of AED 200,000.

Property registration fees

- The Dubai Land Department (DLD) charges a 4% registration fee on the property’s purchase price.

- Don’t forget the additional administrative fees that are typically around AED 580.

Legal fees

- Hiring a legal practitioner for conveyancing services will cost you between AED 5,000 and AED 10,000. It depends on the complexity of the transaction.

Real estate agent commission

- Standard commission rates for real estate agents in the UAE are around 2% of the property’s purchase price.

Property transfer & registration fees

There are a few mandatory government fees payable during the property purchase process in the UAE. They are usually paid at or close to the time of completing the transaction.

Dubai Land Department (DLD) transfer fee

4% of the property value is payable at the time of the transaction.

Title Deed Issuance

It is charged separately for the title deed.

Mortgage Registration

0.25% of the loan amount (if applicable), plus an AED 290 admin fee.

Commissions to realtors

Real estate agents registered with RERA (Real Estate Regulatory Agency) hold a valid broker ID. They charge a commission. Always ask for a detailed invoice and official receipt.

Commission Rate: Typically, 2% of the purchase price, payable by the buyer (sometimes negotiable).

Renovation, furnishing & other recurring costs

Older homes tend to require more renovation and refurnishing. However, the overall cost of renovations will depend on how elaborate your plans are.

Besides the initial costs, there are some recurring costs to consider. These include monthly loan repayment, maintenance fees, property taxes, and any required insurance premiums.

Tip 5: Treat property investment in the UAE as a long-term asset, not a short term solution

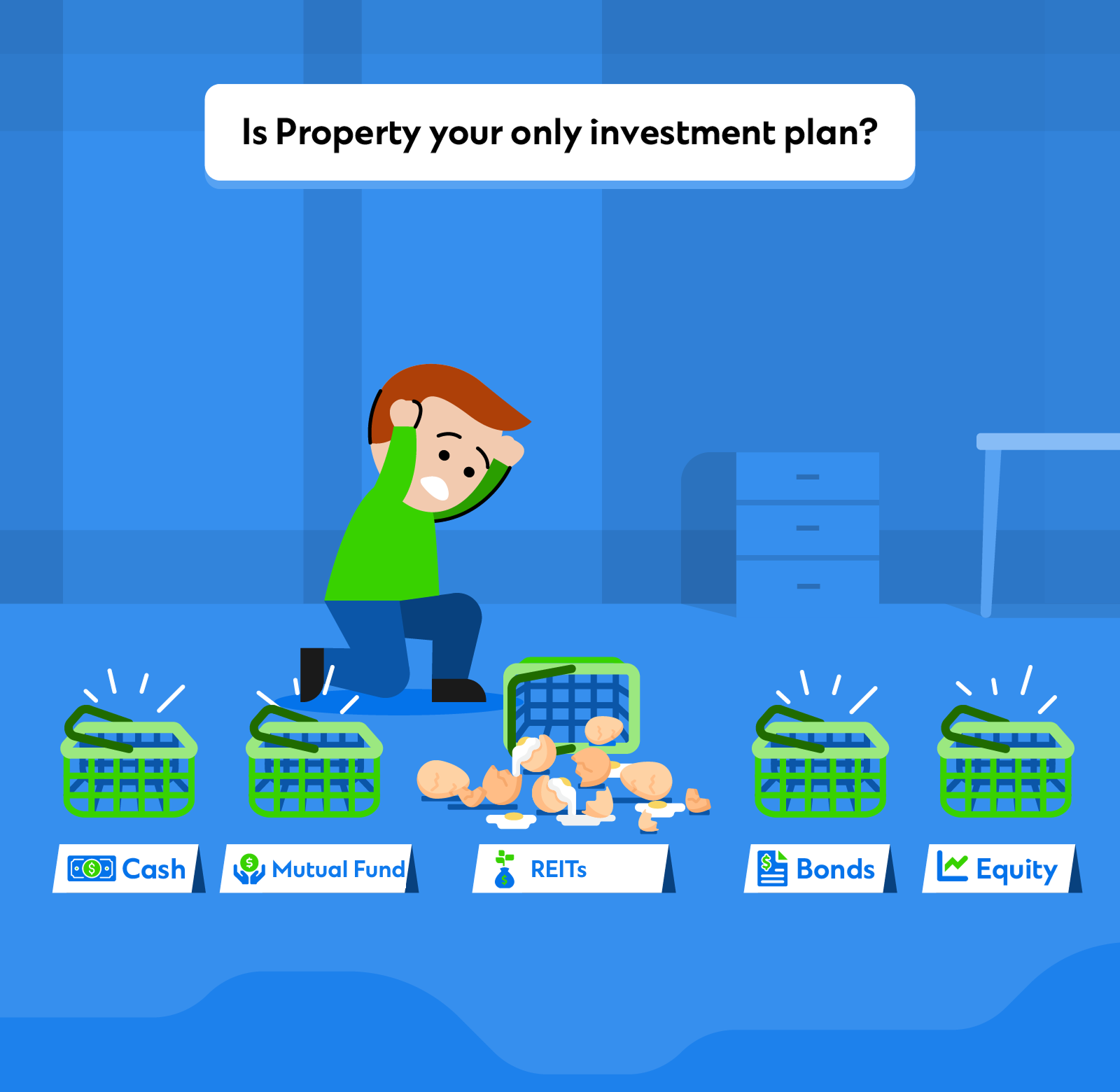

As the saying goes: Do not put all your eggs in one basket. Don’t solely rely on bricks and mortar to stabilise your financial future. Real estate should be a strategic component, not the cornerstone of your investment portfolio. You cannot predict the eventual resale gains of your property in advance or count on perpetually strong rental demand.

Diversify your portfolio

Considering property as just one part of a diversified and well-balanced portfolio is more prudent. Complement your property returns with other assets, such as unit trusts, insurance savings plans, or equities, that can bring higher returns.

REIT, an alternative to physical property

If you want to avoid the high capital costs and complexities of buying property, you may wish to consider Real Estate Investment Trusts (REITs) such as these available on Standard Chartered Online Trading as another alternative.

- REITs are funds that invest in a portfolio of properties, usually with some specialisation (e.g., office REITs, retail REITs, hotel REITs, and others).

- The rental returns of these properties are paid as dividends to investors, and units in REITs can be bought or sold on a stock exchange.

- This is much less capital-intensive and liquid than buying physical property.

Speak to Standard Chartered’s relationship managers or contact us to find the best way to save and budget for your new property or find alternative, affordable ways to invest in real estate.