Table of Contents

In a rush? Read this summary:

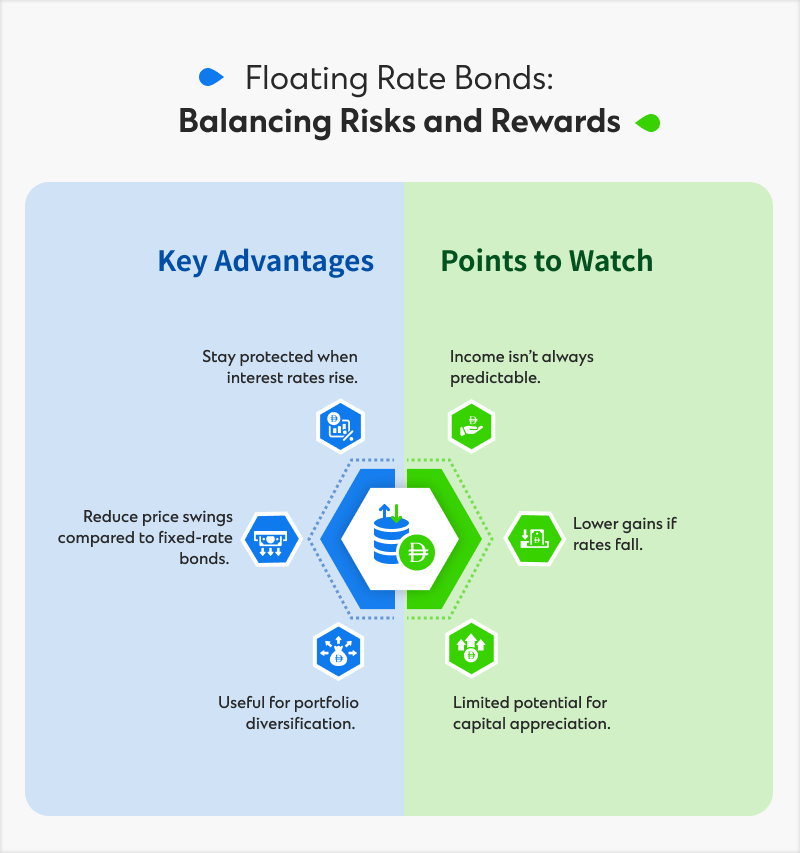

- Floating rate bonds adjust their coupon payments with benchmark rates, offering protection during rising interest rate environments.

- These investment vehicles can enhance portfolio diversification by offering a distinct risk-return profile compared to traditional fixed-income securities.

- They come with trade-offs, including income uncertainty, lower returns when rates fall, and limited potential for capital appreciation.

A floating rate bond is a fixed-income instrument whose interest rate changes based on market rates or a specific external measure. These debt instruments are also known as variable rate notes typically stay in line with a benchmark interest rate that often includes the London Interbank Offered Rate (LIBOR) replacement rates like Secured Overnight Financing Rate (SOFR) for USD-denominated bonds and UAE Dirham Interbank Offered Rate (UAEDibor). The coupon rates are reset at regular intervals, usually every three to six months, based on the prevailing level of the reference rate plus a fixed margin.

Unlike fixed rate bonds, where the coupon payment remains unchanged throughout the bond’s life, floating rate bonds have a dynamic structure that adjusts to market conditions. While the fixed rate bonds offer predictable income, floating rate bonds adjust to market conditions providing a degree of insulation from rate volatility.

Potential rewards of investing in floating rate bonds

- Rising interest rates benefits: During periods of rising interest rates, non-floating rate bonds have fixed coupon rates. In contrast, floating rate bonds’ coupon rates adjust to reflect these changes, helping to hedge against inflation. While non-floating rate bonds can lead to opportunity loss, floating rate bonds allow investors to hedge against market risks, as coupon rates are adjusted with the changes in the market interest rates.

- Bond prices and lower volatility: Fixed coupon rates of non-floating rate bonds have an inverse relationship with the interest rate regimes. If interest rates fall, fixed-rate bond prices tend to increase or vice versa. However, floating rate bonds’ interest rates are usually aligned with the market rates. Therefore, these bonds have lower volatility in prices compared to other bonds with similar maturities. This makes them a suitable choice for investors who prioritise stable bond prices.

- Portfolio diversification: Adding floating rate bonds to an investment portfolio can enhance diversification by providing a different risk-return profile than traditional fixed-income securities, mitigating risks and potentially achieving more stable returns.

Potential risks of investing in floating rate bonds

- Higher return uncertainty: Lower income certainty due to their floating interest rates is one of the most significant drawbacks of floating rate bonds.

- Lower coupon rates: Compared to the fixed counterparts, with similar credit profile and maturity, floating rate bonds carry a lower interest rate. At the same time, while investors benefit from the rising interest rate regime, they usually receive a lower interest rate during a falling rate cycle. Investors who invest in fixed-rate bonds continue to receive the same interest rates during this time, while investing in floating rate bonds offers a reduction in the coupon rates.

- Lower scope of capital appreciation: Bonds usually have an inverse relationship with market interest rates. That is why fixed-rate bond prices are appreciated during an easing interest rate cycle, while floating rate bond coupons have a low potential for capital appreciation during an easing rate cycle compared to the fixed-rate bonds. This is the reason why, sometimes, investors aiming at capital gains during a falling interest rate regime are less attracted to floating rate bonds.

Floating rate bonds: Who should consider them?

Before adding floating rate bonds to an investment portfolio, investors should consider a few factors, such as interest rate regime, capital appreciation, and interest income. An investor who expects lower volatility in bond prices or seeks market-aligned interest income can consider floating rate bonds, while investors seeking a high scope of capital appreciation during falling interest rate regimes or seeking higher income stability can consider fixed rate bonds.

Speak to Standard Chartered’s relationship managers or contact us to learn more about floating rate bonds.