Table of Contents

In today’s complex and often politically charged financial landscape, investors are asking a timely question: what happens if the US dollar begins to weaken after years of relative strength? For those in the UAE, where the dirham is directly pegged to the greenback, the answer carries specific implications.

From reserve status to valuation cycles, the dollar’s story is multi-dimensional. And while its structural role remains formidable, recent valuation indicators suggest that a shift may be underway.

The greenback’s global grip vs. its price tag

To form a clear view, it’s important to separate two themes: the dollar’s long-standing dominance in global finance and trade, and its market valuation, which is subject to cyclical forces. The US dollar continues to serve as the world’s anchor currency—heavily used in international trade, and comprising a major portion of central bank reserves. While its share has moderated slightly over time, it remains unmatched in liquidity, accessibility and depth of investible assets.

Investors across the globe gravitate towards the dollar for a variety of reasons—be it for allocating capital into risk assets like equities and high-yield bonds, or for preserving wealth in US Treasuries and other stable fixed income securities. The openness of US financial markets only amplifies this role. In short, the dollar’s functional supremacy is likely to persist.

However, that doesn’t preclude periods of meaningful valuation adjustment. And by some measures, such a period may be drawing closer.

How expensive is the dollar—and what does that mean?

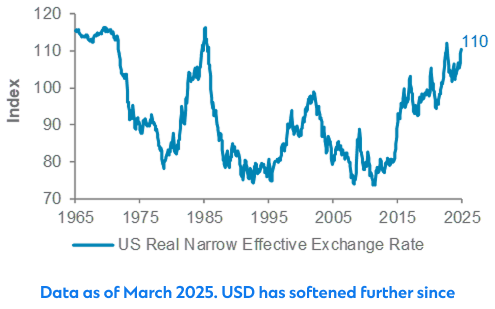

A recent index from the Bank for International Settlements (BIS) reveals that the dollar is currently trading at levels not seen since the mid-1980s or early 2000s—periods that historically preceded notable declines. Currency valuations alone don’t forecast short-term moves. But over a multi-year horizon, elevated levels often revert. In past instances—like the 1985 Plaza Accord—a coordinated push led to a more balanced exchange rate environment. In other cases, market forces corrected the imbalance organically as interest rate differentials and capital flows shifted.

Should we see US real yields decline while other regions gain momentum, that too could catalyse a dollar moderation. The macroeconomic backdrop—especially under a scenario of softer US growth or changing trade priorities—could amplify the effect.

For example, a more competitively valued dollar could reduce the US trade deficit by making American exports more attractive and imports costlier. The parallels to the 1980s are worth noting, even if today’s geopolitical landscape is more fragmented.

Why UAE investors need a currency-aware strategy

For investors in the UAE, the peg between the dirham and the US dollar has traditionally provided currency stability. But this very linkage means that any significant shifts in the dollar’s global value can indirectly affect purchasing power, investment returns, and the performance of internationally exposed portfolios. That’s why understanding the “real” currency exposure of your portfolio matters more than ever.

Take US equities as an example. On the surface, they’re priced in dollars. But dig deeper, and you’ll find that over 40% of revenue from S&P 500 companies is derived from non-US markets. This creates a built-in hedge against dollar strength or weakness.

Similarly, while many global bonds are denominated in US dollars, their underlying credit exposure may be tied to local economies—particularly in emerging markets. These nuances reinforce the value of a diversified approach, especially for serious investors seeking long-term resilience.

Rather than react impulsively to dollar volatility, the more strategic approach is to review your portfolio’s geographic and currency alignment and ensure it remains well-positioned for a world where the dollar’s value could evolve meaningfully.

Emerging markets: a lever tied to the dollar’s trajectory

One asset class that deserves particular attention in this context is Emerging Markets (EM). Historically, EM assets—especially equities and sovereign bonds —have tended to outperform when the dollar weakens, and underperform when it strengthens.

Currently, we continue to see strength in US assets, supported by firm economic data and resilient earnings. But should the dollar enter a prolonged phase of softening, the tide could turn in favour of EM assets, particularly in regions poised for cyclical recovery.

For UAE-based investors, this scenario highlights the potential benefit of maintaining balanced exposure—not just to US and developed markets, but also to select EM geographies that could benefit from a more benign dollar environment.