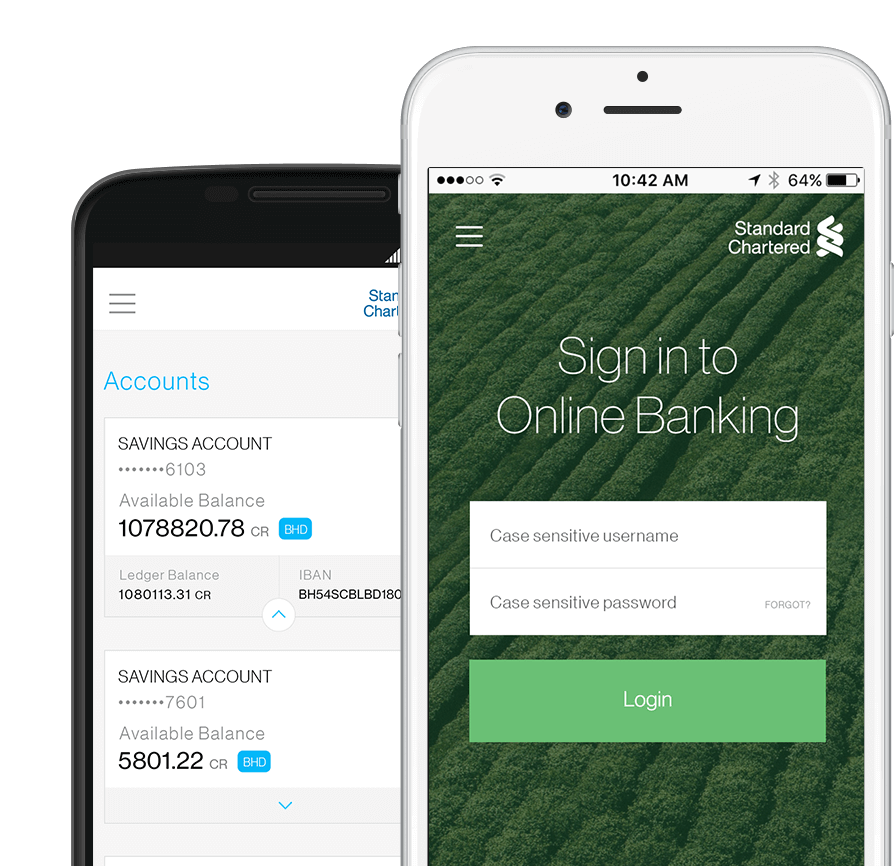

You can now receive an array of benefits while managing your accounts and credit cards through Mobile Banking anytime, anywhere. All you need to do is register for Mobile Banking.

The biometric service makes mobile banking even faster. With a single touch or your Face ID, logging in now happens in one natural motion. Best of all, your fingerprint/Face ID is the perfect password. No one can ever guess what it is and you always have it with you.

Download app now

Touch Login is a fingerprint recognition feature available to access Standard Chartered’s Mobile Banking App without having to entering your User ID and password. Touch Login is available for iPhone or select Samsung devices (Android).

Yes. You need to register for this Touch Login service. If you don’t want to use this service, you can use the existing login by entering your User ID and password.

Step 1: Tap on the fingerprint icon in the mobile banking login screen.

Step 2: Activate touch login service by logging in with your online banking username and password.

Step 3: Set up complete! Log in now with a single touch.

Yes. You can immediately login using your fingerprint after successful registration

Yes. But on select Samsung devices only.

Yes. On select Apple Devices with ISO version 9.0 and above.

Yes. You can disable this service from the dropdown menu on the Standard Chartered Mobile Banking App. This menu is available before you login as well.

In such case, you can still download the application but Touch Login service will not be available and you can login by entering User ID & password.

If you click on the Touch Login icon, the application will prompt you to setup your fingerprint for that device.

Standard Chartered Mobile App will accept all fingerprints stored on the device. Any of these stored fingerprints can be used to register for the Standard Chartered Mobile App.

No, the Standard Chartered mobile banking app only accesses fingerprints from the device and does not store them in the app.

Your fingerprints data stored in your device is encrypted and will remain protected. The device doesn’t store any images of your fingerprints, it stores only a mathematical representation of your fingerprints which is impossible to replicate. As an additional security measure, in case your device is lost or stolen, we recommend that you contact the service provider to deactivate the SIM immediately and inform Standard Chartered immediately.

Standard Chartered Mobile App will automatically disable the Touch Login feature. The next time you attempt to login using the Touch Login feature, the application will prompt you to re-register your fingerprint(s).

Once another client logs in to Standard Chartered Mobile App on your device using their own User ID and password, the Standard Chartered Mobile App will automatically disable the Touch Login feature. The next time you attempt to login using the Touch Login feature, the application will prompt you to re-register your fingerprint(s).

You can register the Touch Login service on a maximum of 5 devices.

Specific IOS and Android smart phone devices with touch capabilities

Steps on how to register for Online Banking or SC Mobile app

Step 1: Visit Online Banking or SC Mobile app and click on “Login”.

Step 2: Click on “New to Online Banking” or “Register here” on either Online Banking or SC Mobile respectively.

Step 3: Register with either your:

Step 4: Verify your details and click ‘Next’.

Step 5: If you are registering using your Debit/Credit Card, enter the Electronic Transaction Authorization code (eTAC) sent to your registered mobile number.

Step 6: Create Login user ID and password.

Step 7: You are now registered for Online Banking.

*To bank with your mobile, simply visit the App or Play Store and search for “SC Mobile Bahrain”.

If you wish to do this now, click here. For more information, Please call our Phone Banking on +973 17531 532.

This is to inform that by clicking on the hyperlink, you will be leaving www.sc.com/bh and entering a website operated by other parties:

Such links are only provided on our website for the convenience of the Client and Standard Chartered Bank does not control or endorse such websites, and is not responsible for their contents.

The use of such website is also subject to the terms of use and other terms and guidelines, if any, contained within each such website. In the event that any of the terms contained herein conflict with the terms of use or other terms and guidelines contained within any such website, then the terms of use and other terms and guidelines for such website shall prevail.

Thank you for visiting www.sc.com/bh