-

Sustainable account

Embedding sustainability into cash management

Contribute to sustainable development while maintaining daily access to your cash

Contributing to sustainable development whilst maintaining your liquidity

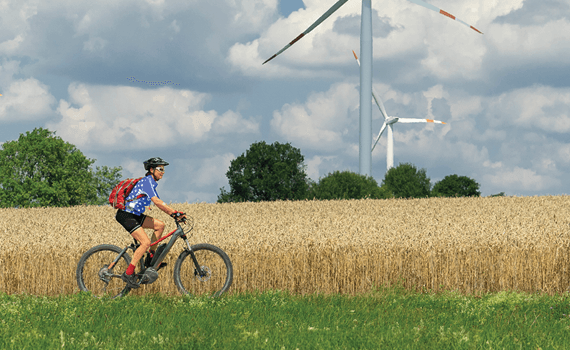

We all need and want to do more to address climate change and accelerate sustainable development.

At Standard Chartered, we recognise the pressures of balancing critical organisational liquidity needs with a desire to contribute to addressing the world’s most pressing challenges.

This is why we created the Sustainable Account.

Here to help

The premise is simple. You retain intraday liquidity for business needs, while the cash in your Sustainable Account is referenced against sustainable projects based on our Green and Sustainable Product Framework.

Sustainable

Using surplus cash as a force for good.

Flexible

Retaining liquidity for your operational cash needs.

Transparent

Follows our independently-verified sustainability framework, giving you peace of mind.

Easy

Simple implementation and minimal effort required by you to upkeep.

Your reliable partner

Make a difference

Our Green and Sustainable Product Framework is aligned with the UN Sustainable Development Goals. It addresses some of the world’s biggest long-term threats, including climate change, financial exclusion and lack of access to healthcare and education.

By choosing this account, you can play a part in financing progress towards solving some of these challenges.

Trust a familiar service

Our account services solutions have long been providing clients with an easy way to manage their cash.

The same applies with our Sustainable Account – you can now contribute to sustainable development whilst maintaining access to daily cash for intraday liquidity needs.

Know your impact

Our Green and Sustainable Product Framework was co-authored by industry experts Sustainalytics. Following this saves you time – there’s no need to do your own benchmarking or assessments – and gives you peace of mind. You can view the independently-verified impact of the projects that your deposits are referenced against in our Sustainable Finance Impact Report.

Case study: Decathlon

Learn how Decathlon contributed to its sustainable development agenda while maintaining access to funds for daily liquidity requirements.

Case study: South32 Limited

Learn how South32 strengthened its commitment to the UN SDGs, while retaining flexibility in using buffer USD.

Learn more about transaction banking at Standard Chartered

Powering businesses for a transformative and sustainable future

Whatever business challenges come your way, your need for smooth, successful transactions will be constant. Alongside continuing operational requirements, you’ll need to balance enduring targets with emerging ones – including sustainability and digitialisation aspirations.

By combining international-bank stability with local-market knowledge, we can support your transaction banking needs across the world. From cash management solutions to bolster your treasury to financing solutions to sustainably fund your supply chain, we have the solutions to help you prepare for future opportunities.