-

Global Banking

Global financing and advisory solutions

We leverage our unique network capabilities to provide you with comprehensive solutions that grow with you.

What we offer

We offer a broad suite of solutions and expertise in Mergers & Acquisitions, Leveraged & Acquisition Finance, Infrastructure & Development Finance, Fund Finance, Transportation and Sustainable Finance solutions.

Capital Markets

Tap into our origination, structuring, underwriting and distribution of conventional and Islamic bonds (Sukuk), private placements and liability management solutions. We provide our clients across Asia, Africa, the Middle East with strong access to global liquidity pools and deliver best-in-class execution across currencies, formats and maturities.

Corporate Real Estate (CRE) Financing

Explore our real estate and hospitality financing services which includes financing solutions across:

- Investment / Acquisition loans

- Property development loans

- Financing for private credit providers

- Corporate / bridge funding for CRE and hospitality activities

We provide you with in-depth local expertise across Asia, Africa and the Middle East, coupled with best-in-class execution.

Financing solutions

Capitalise on our integrated loan offering focusing on origination and structuring, supporting distribution and accelerating deal velocity. We provide a comprehensive suite of solutions, including flow and with-recourse event and acquisition financing with balance of payments support.

Fund Finance

Fund Finance is a cornerstone offering for our financial and strategic sponsor clients, delivering tailored fund-level solutions such as:

- Subscription Financing

- Net Asset Value (NAV) Financing

- Hybrid Financing

- General Partner (GP) Financing

Our solutions empower GPs with flexible access to liquidity, enabling them to seize investment opportunities and meet working capital needs with confidence.

Infrastructure & Development Finance

Partner with us to access limited / non-resource financing with a focus on sustainable finance, origination, structuring and distribution of deals while tapping multiple liquidity pools across Private Credit, Export Credit Agencies, Development Finance Institutions and Multilateral Development Banks.

Leveraged & Acquisition Finance

Access our holistic solutions across leverage loan, high yield bonds and private credit to financial sponsors and leveraged corporate clients across the entire capital structure on highly structured, complex and event-driven transactions.

Mergers & Acquisitions (M&A) Advisory

Partner with us to access sector led, cross-border focused global M&A advisory across regions and client groups, including advisory on corporate acquisitions and disposals, private equity placement, and equity advisory.

Together with our integrated offering as a bank, we are well positioned to support our clients in optimising their business operations and valuation.

Supporting our clients

Our Advisory team provides corporate and investor clients with specialist investment, divestment and capital raising advice across the Power and Diversified Industries.

Learn more about some of the deals our team supported clients on.

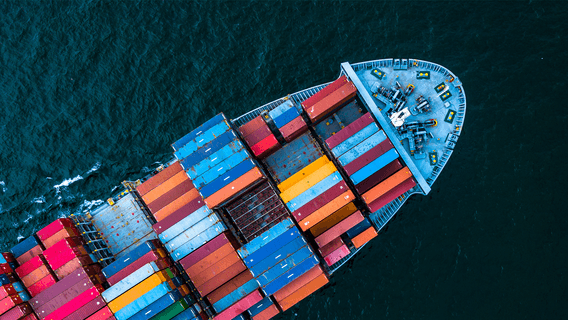

Transportation Finance

Harness our comprehensive suite of construction and post-delivery financing, structured debt, and financial advisory services across the maritime and aviation sectors.

We leverage our deep sector expertise, well curated industry network and global footprint to originate, structure and deliver a full spectrum of financing solutions tailored to clients’ specific needs.

Client stories

Case study: USD280 mn green loan for AI-ready data centre

The rapid growth of artificial intelligence (AI) and Machine Learning (M…

Case Study: Project Finance Green Loan provider to India’s G…

Helping finance low carbon transformation of transportation.

Case study: Mandated lead arranger for Melbourne’s Rangebank…

Helping boost Victoria’s capacity to host renewable energy.

Explore our insights

Case study: USD560 million debt financing for True IDC’s dat…

A greenfield development backed by BlackRock’s GIP and by CP Group in Thailand’s Eastern Economic Corridor

Standard Chartered has an important role to play in supporting our clients, sectors and markets to deliver net zero, but to do so in a manner that supports livelihoods and promotes sustainable economic growth. We currently provide financial services to clients, sectors and markets that contribute to greenhouse gas emissions however we’re committed to net zero in our own operations by 2025 and in our financed emissions by 2050.