-

Global Markets

Commodities

With a wider footprint than any other bank, we can support your commodities needs across the world.

What we offer

Commodities markets are notoriously cyclical, which makes it difficult to find a partner you can rely on for the long term. We have trading centres across the world – in Shanghai, Hong Kong, Singapore, London, and New York, providing unrivalled access to on-the-ground market news and a follow-the-sun model for all your hedging and yield-seeking needs.

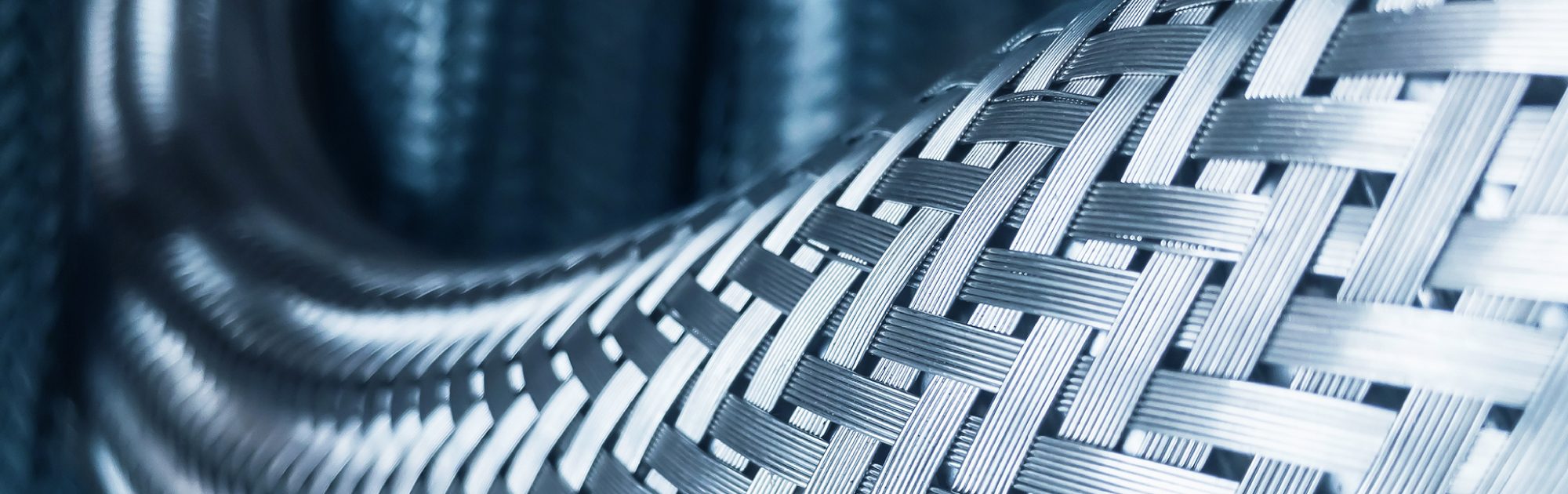

Base and precious metals

Trade in a full range of metals, with cash-derivatives, and complex products all available. With our import-export licenses in high-barrier markets like China, you can access trading opportunities in the future’s most promising commodities markets.

Energy and agriculture

We offer linear and derivative products across energy and agriculture markets. And in trading with us, you gain access to a broader geographical reach than any other bank for these commodities.

Why choose us?

Understand local sentiment

Know the latest market developments first, from our trading desks around the world

Rely on one global partner

Achieve all your goals with us, with a full product suite across more jurisdictions than anyone else

Secure long-term assurance

Regardless of commodities market cycles, we’re committed to trading across our footprint for good

Transition to a sustainable future

We offer carbon trading and ESG-targeted structuring to enable your transition

Locally-produced research, from a global partner

Access the analysis you need to thrive in high-barrier markets, with research produced on the ground by experts across Asia, Africa and the Middle East.

Latest insights

Programmable payment workflow creates new industry standard

We worked with Trafigura to transform the way payments are processed, es…

What it takes to build a low-carbon steel corridor

The Middle East and Europe are shaping a low-carbon steel corridor. Expl…

Critical minerals for the energy transition

More investment in critical minerals mining is needed to ensure the worl…

Standard Chartered has an important role to play in supporting our clients, sectors and markets to deliver net zero, but to do so in a manner that supports livelihoods and promotes sustainable economic growth. We currently provide financial services to clients, sectors and markets that contribute to greenhouse gas emissions however we’re committed to net zero in our own operations by 2025 and in our financed emissions by 2050.