-

Podcast series: Market Updates

Turning market insights into actionable outcomes

Standard Chartered’s views on what to watch out for in today’s Financial Markets.

Global Outlook 2024 Podcast – A soft landing, with risks

As we enter 2024, we’re seeing a story of divergence across key economies. While the US has been surprisingly resilient, confidence in China’s economy is under pressure from property-sector woes and concerns about the labour market.

2024 Financial Market Surprises podcast

What financial-market surprises could 2024 have in store? In this podcast, Eric Robertsen shares a list of scenarios that we believe have a non-zero probability of occurring in the year ahead.

Global H2-23 Outlook podcast: Balancing on the summit

Growth hopes have shifted towards emerging markets, where India, ASEAN and the GCC are set to lead the way this year. What does this mean for the global growth story? What are the key challenges and opportunities in the second half of the year?

Midlife crisis meets coming of age: US-China economic divergence explained

What can we expect from the world’s two largest economies for the next 12 months? Eric Robertsen, Global Head of Research and Chief Strategist compares where the US and China stand both in the current business cycle and more structurally.

Global Q2-23 Outlook podcast: What lies beneath

Beneath an overall story of declining growth, other independent narratives are emerging. China’s economy roars back to life after COVID-19, but are the benefits of that growth equal across all sectors and markets?

Is King Dollar at risk of being dethroned?

Recent market movements have sparked a flurry of theories about the world’s most widely used currency. Is the USD losing its reserve currency status? Are countries looking to circumvent the USD in their trading relationships?

Global 2023 Outlook podcast: A year of two halves

Whilst economic growth is expected to slow in the first half of the year, the second half could see a recovery taking hold. Are emerging markets poised for a recovery this year? And if they are how should investors and businesses navigate them?

2023 Financial Market Surprises podcast

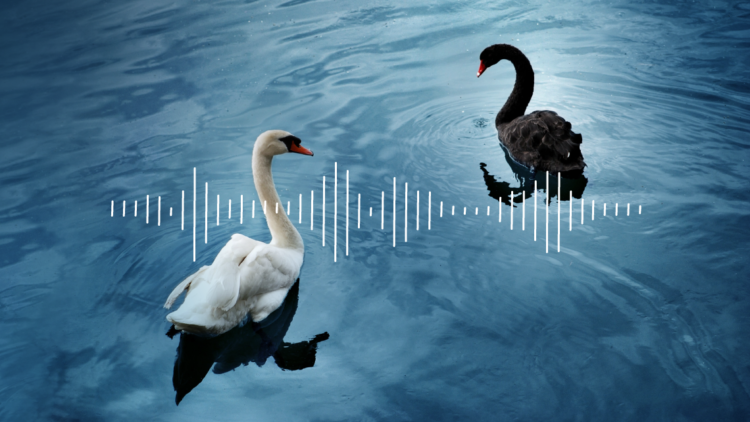

As we look at the year ahead, what are the potential surprises – or black swan events – that may be under-priced by the markets? In this podcast, Eric Robertsen shares some possible scenarios that the financial markets may have missed.

Global H2-22 Outlook podcast: Near the tipping point

In the first half of the year, markets focused on upside risks to inflation. This is now shifting to include downside risks to growth and recession forecasts. How do investors and businesses navigate the almost conflicting narratives?

Global Q2-22 Outlook podast: recovery, disrupted

If 2021’s expectations were influenced by a new world attitude due to the pandemic, then 2022 may end up being about a new world order. The conflict between Ukraine and Russia and the longevity of China’s zero COVID plans.

Executive spotlight: leading towards net zero

A passion for purpose. Listen to the inspiring stories of Henrik Raber and Eila Kreivi as they share their personal journeys into Financial Markets and how they combine industry experience with a deep desire to make a positive impact.

2022 Financial Market Surprises podcast

The business of research spends a lot of time looking at forecasts. But the question that always comes up is, what are the surprises? What are the black swans? In this podcast, Eric Robertsen takes a look at possible scenarios.

Global 2022 Outlook: Still battling headwinds (Part 2)

What’s in store for the global economy over the next 12 months? In part 2 of this 2-part series, Eric Robertsen, Razia Khan and Edward Lee share insights on the inflation story and growth opportunities in 2022.

Global 2022 Outlook: Still battling headwinds (Part 1)

The global economy continues to recover thanks to aggressive policy support and as vaccine coverage improves. But the recovery, like vaccine distribution, remains uneven. What’s in store for investors over the next 12 months?

Unlocking capital for sustainable infrastructure development in Asia

To close the sustainable development gap in Asia, public and private infrastructure project owners have to tap into new sources of funding.

Scaling up the inescapable opportunity in carbon trading

In this podcast, learn more about overcoming the challenges, identifying the opportunities, and scaling up carbon markets so that they can support climate action, on a large scale.

Innovative financing: a powerful tool to unlock investments as a force for good

More and more investors and companies are incorporating ESG metrics into their capital allocation decisions, and this trend shows no sign of slowing down.

H2 Global Research Outlook: Navigating the uneven road to recovery

Economists have started using the term normalisation to describe what might be on the horizon for the global economy. However, countries emerging from various lockdowns and restrictions find themselves on different points along the growth curve.

Assessing US exceptionalism and economic recovery

Much talk lately has focused on the idea of US exceptionalism leading global recovery. At the same time, there are other economies that are also picking up across emerging markets, while some are falling behind.

Forecasting economic growth, inflation and the impact on emerging markets

Overall growth prospects for 2021 are bright, but the unevenness of the global vaccine rollout has complex implications for different economies.