| 1. |

What is the IBAN?

| IBAN stands for International Bank Account Number. It is the ISO 13616 international standard for bank account numbers. The IBAN facilitates the communication and processing of payment transactions. |

|

| The IBAN is an international standard for identifying bank accounts (excluding credit cards). The main purpose of IBAN is to facilitate the automatic processing of money transfers, to improve the speed and accuracy of your payment transactions. |

|

| As per circular no 4305/2011, the UAE Central Bank is introducing the IBAN in the UAE with effect from 19 November 2011. This is a major initiative benefiting clients of all banks in the UAE. |

|

|

|

| 2. |

Can you briefly explain the UAE IBAN?

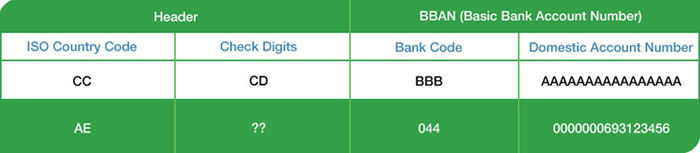

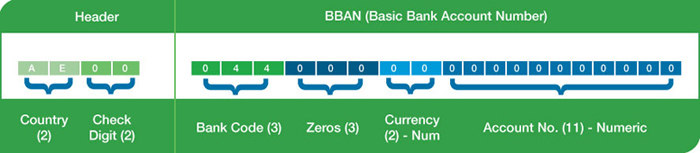

Based on the above the IBAN for the UAE will be 23 characters. The diagram below shows the various components of the UAE IBAN.

The IBAN has two main components, the header and the Basic Bank Account Number (BBAN). |

|

|

| 3. |

How is the IBAN formed for Standard Chartered Bank UAE?

Header – 4 Characters

- Country Code (Two Characters) – The country code for UAE is "AE".

- Check Digits (Two characters) - System generated.

|

|

BBAN – 19 Characters

- Bank Code (Three Characters) - Standard Chartered Bank UAE institution identifier is "044".

- Zeros (Three Characters) – Preceding zeros to keep the length of BBAN constant.

- Currency code (Two Characters) – Numeric characters representing the ISO currency codes in Standard Chartered Banking System.

- Account number (11 Characters) – Your 11-digit account number with Standard Chartered UAE

|

|

|

| 4. |

How would IBAN benefit me?

| The main benefit is that IBAN should provide you with quicker processing of your funds transfer. Since banks are required to check the accuracy of the IBAN at the point of initiating a fund transfer , they can only make the funds transfer which carry the correct IBAN. |

|

|

| 5. |

Do I need an IBAN?

| All bank customers, who receive or make fund transfers through the UAE, will require an IBAN. If you have multiple bank accounts, you will require an IBAN for each one. |

|

|

| 6. |

When can I use IBAN in the UAE?

| You can start using IBAN for your local and international fund transfers from 19 November 2011. |

|

|

| 7. |

How can I get my IBAN?

We will send you the equivalent IBAN for every account you hold with us by 01 November 2011. You will also see your equivalent ΙΒΑΝ on your bank statement.

Standard Chartered is unable to provide you with IBAN details for accounts held with another Bank. Please contact that respective bank for details regarding your IBAN. |

|

|

| 8. |

What can I use IBAN for?

IBAN can be used for the following local and international payments:

- Making a fund transfer (through a bank) to an account at a bank in the UAE;

- Making a payment (through a bank) to an account in a country that has adopted IBAN;

- Making a fund transfer (through a bank) to an account in a country that has not adopted IBAN.

- Receiving a fund transfer (through a bank) from an account at a bank in the UAE;

- Receiving a fund transfer (through a bank) from an account in a country that has adopted IBAN; and

- Receiving a fund transfer (through a bank) from an account in a country that has not adopted IBAN.

|

|

|

| 9. |

What is the difference between an IBAN and a normal account number?

An IBAN can always be distinguished from a normal customer account number by the following:

- Two letters at the beginning of the IBAN, which refer to the country code where the account resides; and

- The length of the IBAN is 23 characters.

|

For example, an IBAN of a normal account number of AED 01123456701 is:

AE47 0440 0000 0112 3456 701 |

And it comprises of:

- "AE" - the country code

- "47" - the two check digits

- "044" - Standard Chartered UAE bank identifier

- "000" - preceding zeros

- "00" - the currency code

- "01123456701" - normal account number

|

|

|

| 10. |

Do my existing account number(s) become invalid with the introduction of IBAN?

| No, your existing account number(s) will continue to be valid. IBAN is not a new account number. It simply represents the existing account number in a recognisable ISO standard format. The adoption of IBAN in UAE does not require changing or replacing the existing account numbers. |

|

|

| 11. |

Will the IBAN only be used for international funds transfer ?

| No, the IBAN must be used for sending and receiving local and international funds transfer . |

|

|

| 12. |

How will the IBAN appear on my Online Banking account?

| You will not be able to see your IBAN on Online Banking. However, you will be able to see your IBAN on your statements and balance reports. |

|

|

| 13. |

Will there be any additional charges associated with using IBAN?

| Presently, there is no additional charge for using IBAN other than our normal transaction processing fees.

We will communicate to you any changes to the fees and charges.

|

|

|

| 14. |

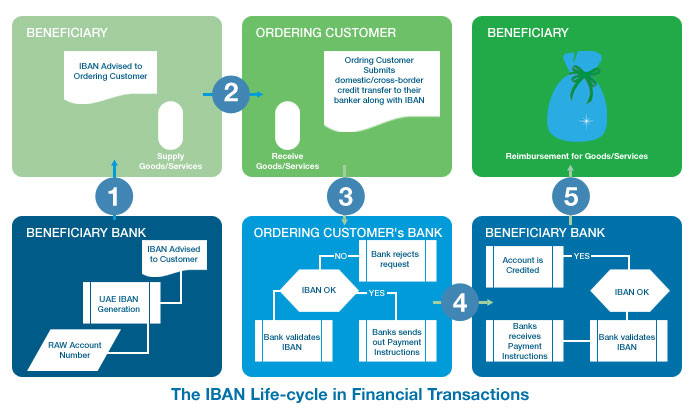

Can you explain the procedure involved in making a fund transfer using IBAN?

The bank of a beneficiary makes the IBAN available to the beneficiary. The beneficiary's IBAN is forwarded to the ordering customer by means such as invoice, letterhead, International funds transfer Instruction, Domestic Funds Transfer Instruction (UAEFTS), Domestic Salary Funds Transfer System (UAEWPS), etc…

The ordering customer submits a local or international credit transfer, which includes the beneficiary's IBAN that has been validated by the customer's ordering bank. After receipt of the message by the beneficiary's bank the beneficiary's account will be credited.

|

|

|

| 15. |

Which countries are currently using IBAN?

| As of May – 2011, 54 countries in total are currently using IBAN (mainly member countries of the European Union). In the Gulf region, Saudi Arabia, Kuwait and Bahrain are using IBAN. Details of IBAN in those countries can be obtained from the IBAN Registry at the SWIFT website: http://www.swift.com/dsp/resources/documents/IBAN_Registry.pdf |

|

|

Here for good

standardchartered.ae |