Private Banking

Your gateway to global wealth

Experiences and certified Relationship Managers and specialists around the world.

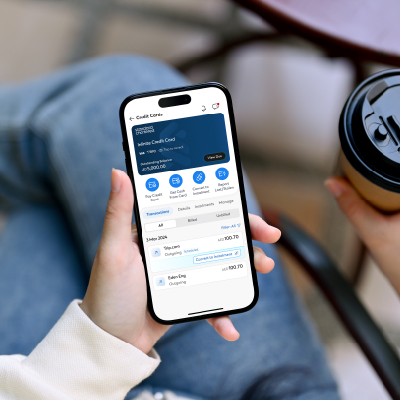

Banking that works your way

With one-bank capabilities and bespoke solutions.

Family wealth preservation

From wealth creation to generational succession.

Priority Banking

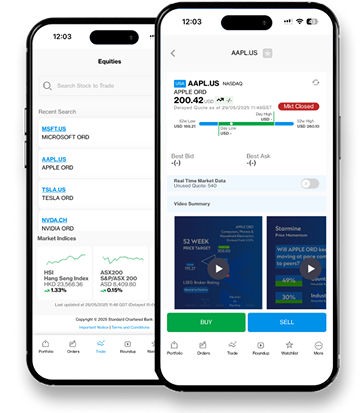

Wealth Management

Access bespoke wealth solutions and expert advice from our Chief Investment Office, plus strategic market insights to achieve your goals.

International Banking

Elevate your status globally with priority access to our global retail network for all your financial and cross-border needs.

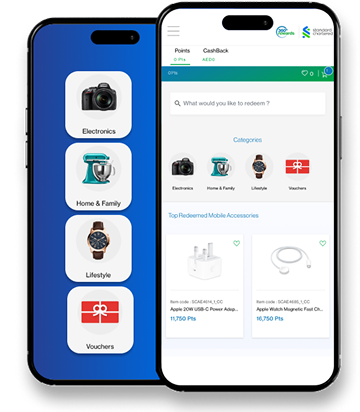

Priority Exclusives

Enjoy preferential rates, dedicated Relationship Managers, invites to investment seminars and much more.

Lifestyle Privileges

Enjoy an array of exclusive and curated lifestyle benefits across Singapore and globally.

International Banking

Pay like a local from anywhere

Secure and easy-to-use multi-currency account to transact locally, wherever you are.

Seamless interactions with your RM

Get a wider, deeper perspective of the markets with our diverse views and insights.

Global Priority Status for all your accounts

Enjoy the same priority status across over 30 markets in Asia, Africa and in the Middle East.

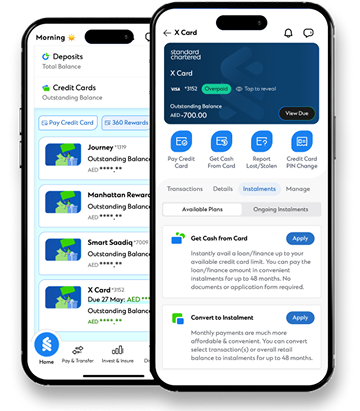

Single global account view

Link and view multiple accounts seamlessly in different markets in a single view.

Islamic Banking

Saadiq Home Finance

Own your dream home with Free Property Takaful (insurance) for life with financing of up to AED 18 million.

SaadiqOne Account

Your Current Account and Home Finance are linked, with profit calculated on the difference between the home finance balance and the funds in your account.

Online Mutual Funds

With Online Mutual Funds, you can buy or sell Islamic mutual funds online 24×7 on the SC Mobile app.

Islamic Fixed Income Securities (Sukuk)

Make a steady income and provide stability in unpredictable market conditions.