Now’s your time for financial wellness

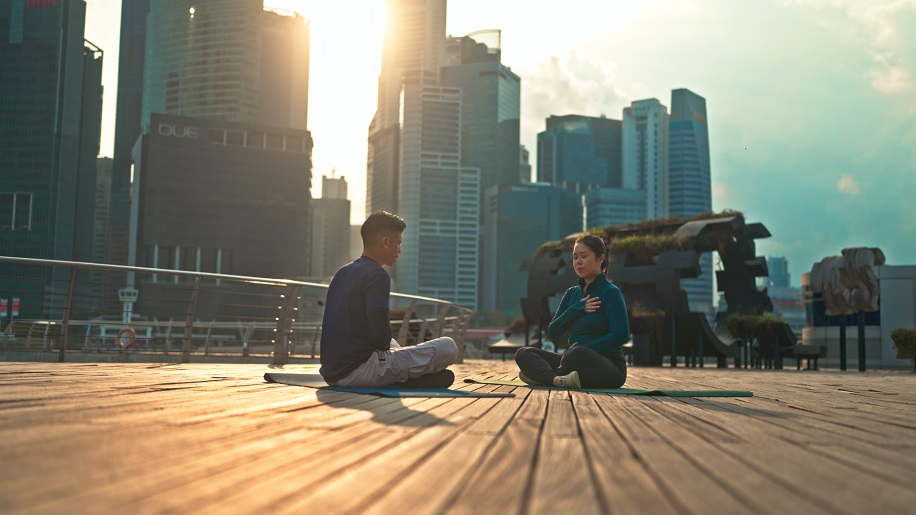

We believe true wealth is financial wellness and personal well-being. Catch our content series WellnessNOW to learn more.

We believe true wealth is financial wellness and personal well-being. Catch our content series WellnessNOW to learn more.

Through our content series WellnessNOW, we explore the best-kept secrets across the world that help bring calm, clarity, and rejuvenation, so you can focus on what matters to you.

In this episode, discover how resilience isn’t about pushing ourselves harder but learning how to restore and renew, enabling you to protect what matters to you.

In this episode, find out how working on your breathwork can help boost your immunity. When you take better care of yourself, you can take better care of the next generation.

In this episode, can ancient Indian practices help sharpen your focus for global success? Watch the video to find out.

| Products | Eligibility Criteria | Minimum Relationship Amount AED |

|---|---|---|

| Current and Savings Accounts, Term Deposits and Investments | Accounts Balance (per month average balance across one or all accounts) | 370,000 or equivalent in other currencies |

| Mortgage | Mortgage Balance | 2,500,000 |

| Salary Transfer* | Salary (per month for 12 months) | 30,000 |

Investments: This document does not constitute an offer, recommendation or solicitation of an offer to enter into a transaction or adopt any hedging, trading or investment strategy. It has not been prepared for any particular person or class of persons and does not constitute and should not be construed as investment advice nor an investment recommendation. It has been prepared without regards to the specific investment objectives, financial situation or particular needs of any person. You should seek advice from a financial adviser on the suitability of an investment for you, taking into account these factors before making a commitment to invest in an investment.

Insurance: Standard Chartered Bank does not offer insurance advice, nor does it underwrite or issue insurance policies. Insurance products are underwritten by third party insurance providers. Standard Chartered Bank shall not be responsible for insurance provider’s actions or decisions, nor shall Standard Chartered Bank be liable regarding payment of claims or services under the policy/insurance contract.

Deposits: Interest rates are subject to change from time to time at the sole discretion of Standard Chartered Bank. For further details on fees and charges, please refer to our Service & Price Guide available on www.sc.com/ae. (https://www.sc.com/ae/help-centre/service-charges/)

SCB UAE is licensed by the Central Bank of the UAE.