Table of Contents

In a rush? Read this summary:

- Smart retirement planning in the UAE starts early. Consider using equities, Exchange-Traded Funds (ETFs), and diversification to build long-term wealth.

- As you age, shift from high-growth assets to capital preservation with bonds, stable income strategies, and risk-aware portfolio rebalancing.

- Withdrawal strategies such as the 4% rule or income-only approaches can be applied to maintain financial stability post-retirement.

No matter where you are in the world, your investments evolve with each stage of your life , owing to ever-changing goals and risk tolerance. Central to a robust financial future is a clearly laid out and well-planned investment strategy that balances capital appreciation, a stable income, and capital preservation.

Now, the UAE enjoys a unique position as a global hub that offers investors access to several investment options across asset classes, sectors, and geographies. Therefore, devising a structured, long-term approach to retirement planning to ensure your wealth lasts you in a sustainable manner, even after you hit your retirement age (60), becomes all the easier.

And so, we’ve put together this little guide to help enhance your investment journey.

Retirement planning: Investment strategies secure yourself at every stage

The key to building long-term financial security lies in choosing the right asset mix for your investment portfolio, making adjustments as you go through life. Your financial goals, obligations, and risk tolerance—as with income potential—may change at each stage.

Below, we’ve listed out the different approaches you can take to retirement planning, each tailored to these stages, to assist you in making informed choices with conviction every step of the way.

Retirement planning in your 20s-30s

Your 20s and 30s bring several significant milestones with them. Some of these include your first job, pursuing higher education, and, in a few cases, even getting married or buying a home.

While this age brings several new financial responsibilities, it also offers an opportunity to build a solid financial foundation.

Since age is on your side at this time, you can afford to be aggressive with your investments, allocating a higher percentage of your capital to high-risk, high-return assets such as equities.

Moreover, one of our five guiding wealth principles is “time in the market.” The longer you stay invested, the better your probability of successful investments, as more time allows you to recover from any unforeseen losses or expenses. Staying invested for longer also gives you the added ability to benefit more from the power of compounding.

Considering the same, here are a few investment strategies to employ at this age.

Diversify your portfolio

Maintain a diversified portfolio, allocating capital to equities (and in a smaller measure, other instruments) across sectors, market capitalisations and geographies to ensure your portfolio isn’t exposed to concentrated risks.

Consider low-cost options for investment

Consider low-cost options such as index funds and Exchange Traded Funds (ETFs). These aim to track and replicate the performance of an underlying benchmark index in the market and invest in its constituents in the same proportion. Since they are passively managed, lower expense ratios could result in potentially higher returns for you in the long term.

Stay disciplined and informed

A blend of disciplined investing, continuous learning about global capital markets, and periodically reviewing and rebalancing your portfolio as required helps you build a resilient portfolio, protected against any downside risks in the short and long run. This helps you more effectively secure your financial future.

Retirement planning in your 40s-50s

One’s 40s and 50s are often marked by peak earnings but also growing financial goals and responsibilities. Some of these could be to fund their children’s education, their ageing parents’ / their own living and medical expenses, and, with their retirement on the horizon, to bolster their retirement corpus.

Navigating investments at this stage is a balancing act. One which aims at capital appreciation but, at the same time, also shifts focus to risk mitigation and capital preservation. In such a scenario, it is prudent for an investor to transition from high-growth assets (albeit not completely) and balance them with debt-backed securities, as well as commodities and/or real estate assets to provide them with a stable income.

With that, here are a few key strategies to align your investments with your immediate, short and long-term financial goals during this period.

Maintain growth potential in your 40s

At this stage, focus on a stronger allocation to equities to help you make the most of the benefits of compounding. While market volatility in the short run may affect your portfolio to some extent, your long-term investment horizon still gives you adequate room to take risks.

Increase capital preservation in your 50s

In your 50s, your focus should shift from growing capital to preserving it. Retirement is generally right around the corner at this age, and capital appreciation must, therefore, be balanced with a stable income.

Your portfolio, therefore, should lean more towards safer fixed-income assets such as government bonds and corporate bonds, treasury bills , and certificates of deposit, as well as commercial papers.

In retirement

Retirement can bring about significant new challenges, making it crucial to adapt your investment strategy accordingly. Healthcare expenses, and potential long-term care costs are one such challenge. Another challenge is also to simply maintain your lifestyle as desired, whether it involves travelling, pursuing other hobbies, or spending time with your family.

These challenges, amongst others, come into sharp focus with the shift from a steady paycheck to living off one’s savings and investments. Consistent financial stability during these years, therefore, requires careful planning. As a result, capital preservation takes precedence above all to sustain one’s lifestyle — a period that can potentially span decades.

Here’s how you can optimise your savings, investments, and expenditure during retirement.

Rebalance your portfolio

Safeguard your savings by rebalancing your portfolio from equity-focused instruments to cash and fixed income instrument focused. This helps reduce your exposure to risk by helping preserve your capital and ensuring consistent, unfettered access to it, to sustain your lifestyle.

Selective risk-taking

While increased average life expectancies do bode well for you, there is a risk of you outliving your savings after hitting your retirement age as well. Shying away from risks, therefore, isn’t a sustainable option in the long run.

The key here is to be selective with high-risk, high-return investments. Ensure you research and invest in high-quality assets that have historically grown and provided good returns and are preferably professionally managed. This should, to a certain extent, boost your portfolio’s robustness without taking excessive risks.

Stay diversified, globally

Lastly, as is true of pretty much any stage in life, diversify your investments not just across assets, but also different sectors and geographies to capitalise on emerging regional opportunities, and to protect your portfolio against any downside risks from the underperformance of any one asset.

Choose the right withdrawal strategy

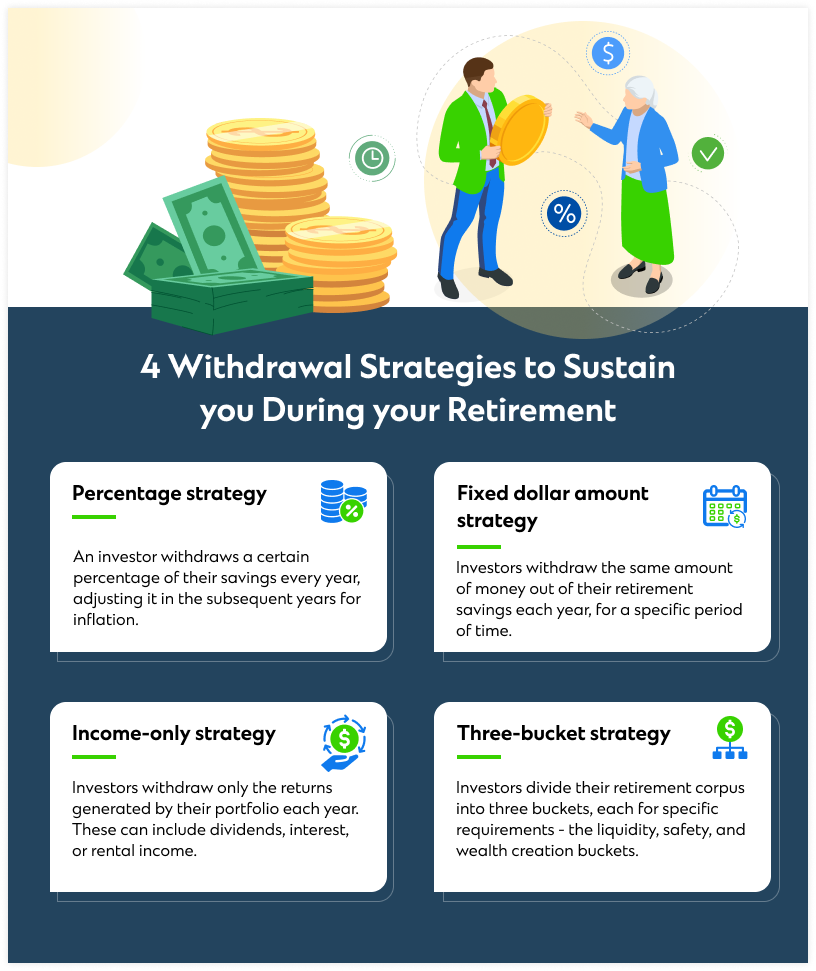

There is no guarantee as to just how long retirement may last. It is therefore important to ensure one withdraws money from their savings in a sustainable manner, which lasts them in the long run. A few common withdrawal strategies one can consider include the following:

Percentage strategy

This strategy refers to withdrawing a certain percentage of their savings every year, adjusting it in the subsequent years for inflation. Typically 4% for the first year, this amount increases with each subsequent year, and helps one maintain their purchasing power amidst inflation.

Bear in mind, however, withdrawals must be made according to one’s portfolio performance, as well as that of the broader market. If they do not review them and optimise their portfolio (and subsequent withdrawals) regularly, savings may end up diminishing very quickly.

Fixed dollar amount strategy

As the name suggests, the fixed-dollar strategy involves withdrawing the same amount of money out of one’s retirement savings each year, for a specific period of time. It provides them with a predictable income stream, which makes budgeting and expenses easier to manage. This approach, however, has been known to leave investors vulnerable to inflationary pressures and unforeseen expenses.

Income-only strategy

This refers to withdrawing only the returns generated by an investor’s portfolio each year. These returns can include but are not limited to dividends, interest, or rental income. By ensuring that one’s principal investment amount never diminishes, it allows their money to keep working and generate more money for them, which alongside stable income, also provides them with long-term capital appreciation.

Three-bucket strategy

The 3-bucket strategy was developed by American economist and Nobel Laureate James Tobin. It involves dividing your retirement corpus into three buckets. Each of these buckets addresses specific requirements during specific periods of an investor’s retirement years.

Liquidity bucket

The liquidity bucket takes care of immediate cash flow requirements in the short term, typically spanning two to three years. This includes regular monthly expenses, an emergency fund for unforeseen expenses, as well as other expenses such as healthcare.

This money can be maintained in a savings account or a debt fund, as well as short-term fixed deposits, and/or bonds. Monthly pensions or other regular income may be included in this bucket, along with dividend payouts, rental income, interest income on deposits, and more.

Safety bucket

Once immediate needs for funds are taken care of, next comes the safety bucket. This money is typically used to protect oneself against inflation in the slightly longer run, typically over the next five years or so.

This bucket should be used to maintain a balance between liquidity and returns in one’s portfolio and must therefore be invested in a mix of both – equity and debt instruments.

Wealth creation bucket

The wealth creation bucket holds money that one can use to benefit from the power of compounding to generate more wealth. It may therefore have money invested in wealth-generating instruments such as equity and debt mutual funds, gold, real estate, and more.

What’s more, it can also be used to address shortfalls in one’s safety and liquidity buckets in the short term as well.

Planning for one’s retirement is not simply a matter of saving enough — it’s about using your money in a strategic manner and leveraging your investments to support your lifestyle and provide you with financial security consistently. Optimal allocation of capital to different instruments, each tailored to different life stages, allows you to navigate shifting financial priorities with clarity and confidence.

Retirement then, isn’t the end of your financial journey, but a transition.

Speak to Standard Chartered’s relationship managers or contact us to learn more about how you can start planning for your retirement today.