Table of Contents

In a rush? Read this summary:

- Regular Savings Plans (RSPs) enable UAE residents to build long-term wealth systematically through consistent contributions and Dollar-Cost Averaging (DCA).

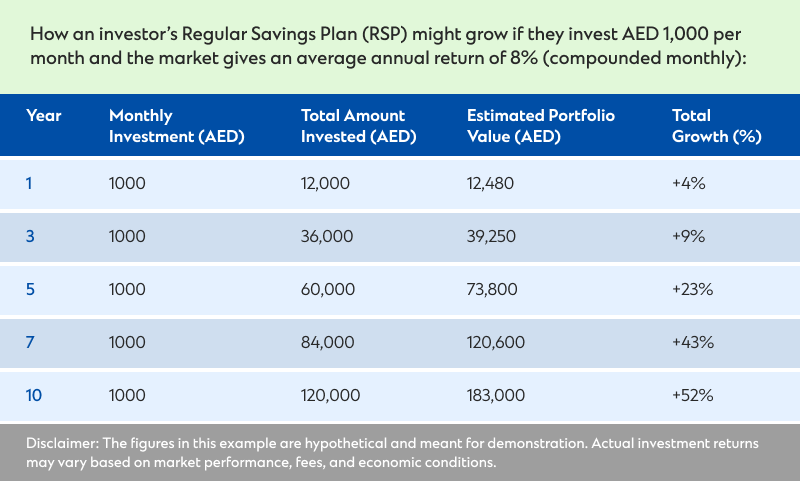

- Compounding and reinvestment of interest, dividends, or returns accelerates growth and can generate passive income over time.

- RSPs help achieve financial goals while reducing market timing risks and allowing investments to grow steadily.

A Regular Savings Plan (RSP) is a structured investment approach that is considered one of the most effective tools for long-term wealth accumulation.

In the early stages of wealth building , patience and discipline are essential. Many investors find it challenging to stay consistent until their accumulated savings start compounding noticeably in their favour. Once money starts compounding, over time, the investment begins growing faster than the contributions.

One of the most practical ways to turn extra income into wealth is to invest in a medium-to-long-term, regular savings approach, such as dollar cost averaging (or DCA). Setting aside a small amount of money every month may help the investment grow in value over time. This approach aligns with the UAE’s growing focus on financial preparedness, reflected in initiatives such as employee savings schemes and innovative retirement-oriented products.

However, short-term savers still face challenges. Even after investing money every month, they often withdraw funds to cover short-term expenses. As a result, savings may not reach the level of growth seen when contributions remain undisturbed over longer periods. Moreover, charges such as fund fees, withdrawal penalties, and fluctuating returns can limit the overall compounding potential of investments.

Build up a portfolio with long-term wealth

Investors usually prefer DCA because investing a large amount of money at once is not required. Instead, committing regular amounts monthly is an effective way to build a portfolio. Even though small contributions may seem insignificant at first, compound interest over time can help regular investments grow substantially throughout a lifetime.

One can benefit from compounding through savings accounts such as Standard Chartered XtraSaver, which accumulates interest over time. Additionally, investors can also gain from compounding when any interest or dividends earned from the investment are invested consistently. In this manner, the investment return grows over time as the reinvested amounts continue to generate additional earnings.

Reinvesting in passive income-generating assets

Investors can reinvest funds accumulated through an RSP into passive income generating assets, such as bonds, dividend-paying stocks, real estate, or real estate investment trusts. The rate of capital growth accelerates due to reinvested income and compounding returns. Investors seeking financial independence to maintain a lifestyle without relying on active income can benefit from reinvesting in passive-income-generating assets.

For example, an investor who uses RSP savings as a down payment on a rental property can earn rental income while the property appreciates value. Over the course of 15–20 years, this can result in a portfolio of assets that generates consistent passive income.

Steady investing over market timing

Timing the market is challenging, even for seasoned investors. Regular Savings Plans typically follow the DCA approach, where a fixed amount is invested at regular intervals, regardless of market conditions. The approach of investors buying fewer units when the market price is high and more units when the price is low smooths out the impact of market volatility. As a result, investors can accumulate wealth at a lower average cost and reduce the risk of poor market timing, allowing their investments to grow steadily over the long term.

Achieve financial goals

A regular savings plan helps investors achieve their financial objectives, including purchasing a home, funding their children’s education, and planning for retirement. One can avoid panic selling and contribute regularly to stay on track.

Long-term wealth building requires not just a high income but a structured, disciplined approach to investing and saving. Through an RSP, investors can systematically build long-term wealth and benefit from the UAE’s capital gains tax exemption while working toward financial independence.

Speak to your Standard Chartered relationship manager or contact us to learn more about investing in Regular Savings Plans (RSPs).