Table of Contents

In a rush? Read this summary:

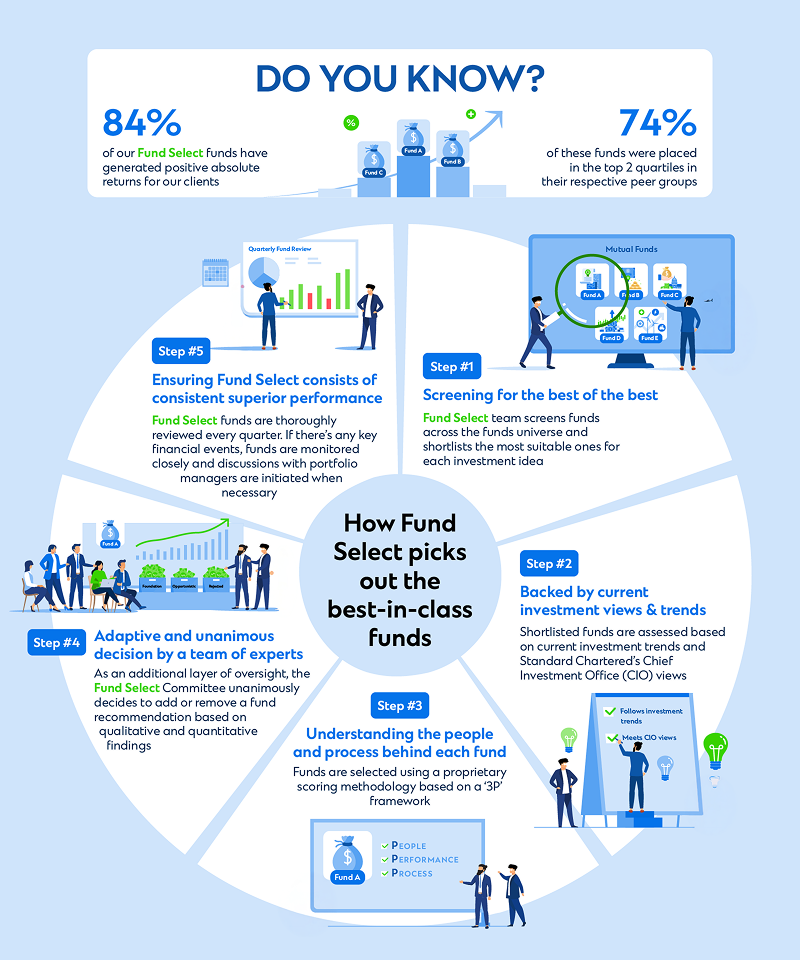

- Standard Chartered’s Fund Select simplifies mutual fund investing by curating top-performing funds through a rigorous, expert-driven process.

- Backed by CIO (Chief Investment Officer) insights and a proprietary 5-step framework, it helps align investments with your goals, risk appetite, and market trends.

- With 77% of funds ranking in the top two quartiles, Standard Chartered’s Fund Select offers a smarter way to invest with confidence and clarity.

Finding the best-in-class mutual fund has become increasingly challenging with an ever-growing list of similar-sounding funds. If you are still wondering, as an investor, how to shift the odds in your favour, then you are in the right place.

Standard Chartered Fund Select is a proprietary fund selection process refined over more than a decade to give investors access to funds with the greatest potential to add value to their portfolios. These are supported by solid fundamentals, a CIO alliance strategy, and a credible team of experts.

Why do Fund Select's top-performing funds matter

As an investor, conducting a deep analysis of each fund isn't a realistic option. It's simply not possible to dedicate enough time to thoroughly examine every single fund. Without sufficient analysis, you risk exposing yourself to insufficient insights, which could lead to missing profitable opportunities.

Hence, analysing mutual funds with diligence is a more challenging task than analysing stocks as it involves evaluating all underlying holdings within each mutual fund. This level of in-depth analysis is often not feasible for individual investors and Standard Chartered Fund Select is here to help.

How does Fund Select help you choose funds

Standard Chartered’s Fund Select team selects the best-in-class funds, then further narrows down the selection to choose the top-performing funds and creates a fund selection list for you.

Investing in funds becomes easy as this list is reviewed on a quarterly or monthly basis whenever needed by the experts and is formulated in close alignment with the Chief Investment Officers' (CIO) latest views.

Choosing investments: Asset allocation

While certain funds invest solely in debt or equity, others adopt a balanced approach by investing in both debt and equity. Additionally, the fact sheet also highlights the top 10 holdings of the fund and provides an industry-wise breakdown of where your money is being invested.

Professionally selected funds to help you meet your goals

- SC Fund Select helps you achieve your savings goal.

- The curated list simplifies the process of choosing mutual funds for both beginner and experienced investors.

- If you want to balance global exposure with local priorities, this feature serves as a helpful guide.

How does Fund Select pick out the best-in-class top-performing funds

Fund Select follows a proprietary five-step framework to assess, curate, and consistently monitor market trends and the performance of carefully selected funds. This framework also ensures adherence to the regulatory requirements and best practices set forth by the relevant financial authorities in the UAE, including Shariah-compliant investment options.

Aligned with Standard Chartered's investment framework, this approach incorporates both foundational and opportunistic investment strategies, enabling UAE-based investors to build resilient portfolios for long-term growth.

Step 1: Investing in a fund: Global screening for optimal fund selection

Standard Chartered's Fund Select team actively screens funds from the vast global fund universe accessible within the UAE market and shortlists the most suitable for each investment idea.

Step 2: Aligning with CIO views: How to choose the right investment

All funds are assessed in accordance with current investment trends and the views of Standard Chartered's Chief Investment Office (CIO). Only those aligned with the latest investment views and trends are moved to the next stage.

Step 3: Choosing investments: Assessing people and process

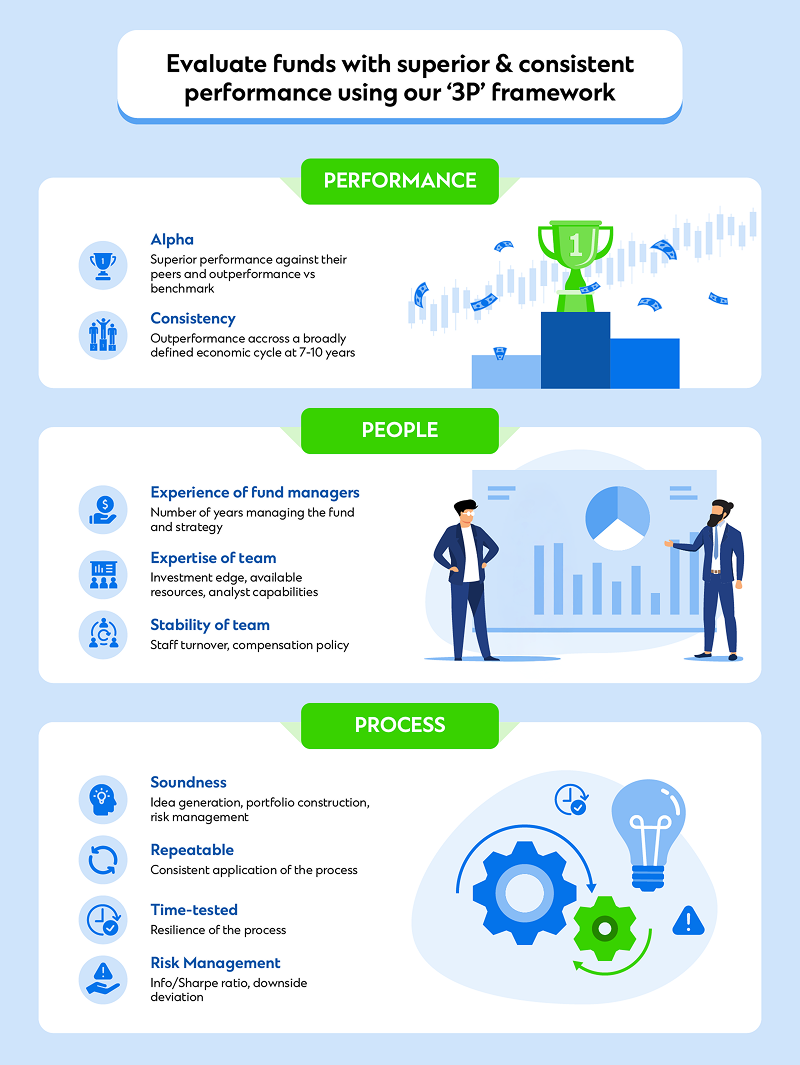

Regular interviews are conducted directly with the fund managers to assess the relevance and merit of their fund strategies. Funds are then scored according to Standard Chartered's proprietary '3P' framework, which encompasses Performance, People, and Process, before being further selected for approval.

Step 4: The Foundation of fund selection: Unanimous expert approval

Fund analysts present the fund's qualitative and quantitative findings to the Fund Select Committee. The Fund Select Committee assesses and debates the findings before coming to a vote, with opposing viewpoints strongly encouraged for discussion. The Fund Select Committee unanimously agrees to accept or reject the fund recommendation.

Step 5: Top-performing funds: Proactive monitoring for long-term returns

Approved funds are thoroughly reviewed quarterly, with key financial events monitored and discussions with portfolio managers initiated as necessary.

While we prioritise accountability for our clients and will not hesitate to make changes to our Fund Select funds, when necessary, it is essential to note that, like any investment, past performance is not indicative of future or likely performance. The past performance of the fund manager or sub-manager is not necessarily indicative of its future performance, either.

For those seeking clarity on fund performance, here are the latest statistics as of Q1 2025: 77% of our Fund Select funds rank in the top two quartiles relative to their peers, with approximately 40% achieving top-quartile performance. The Standard Chartered UAE fund library also serves as an excellent resource for those looking to understand the investment options available.

Speak to Standard Chartered’s relationship managers or contact us to learn more about Fund Select and explore funds aligned with your financial goals.