Table of Contents

- Empowering your children for financial adulthood while safeguarding your own retirement

- Helping the next generation navigate a more expensive world

- Financial literacy begins at home

- How to guide your children towards financial confidence

- Investing early: laying the foundation for long-term growth

- Preventing the cycle: don’t make your children the next Sandwich Generation

- Cultivating your children’s financial savviness starts at home

In a rush? Read this summary:

- Early exposure to the concept of budgeting, emergency savings, and insurance helps children build long-term financial confidence and independence.

- Consider the use of Regular Savings Plans and equity exposure, while reinforcing smart risk management, to kickstart their financial journey

- As children mature and grow, it is important for parents to plan for their own retirement to avoid them becoming the next Sandwich Generation

Empowering your children for financial adulthood while safeguarding your own retirement

For many parents, ensuring their children are financially secure is just as important as building their own wealth. As young adults transition into the working world, this shift comes with unfamiliar financial responsibilities—budgets, savings, insurance, and investment decisions. And while you may have planned for their needs when they were younger, now is the time to pass on the reins and help them shape a financial future of their own.

Helping the next generation navigate a more expensive world

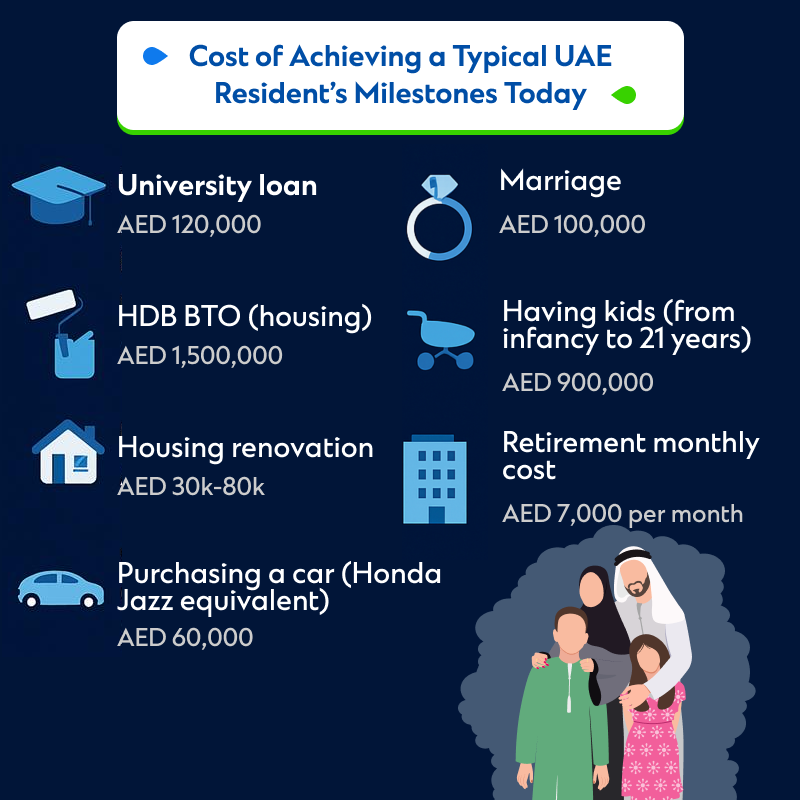

The cost of living has risen significantly in recent years—not just for essentials like housing or education, but also for long-term goals such as retirement, marriage, or starting a business. For many young professionals, these rising costs can feel overwhelming, especially when combined with the pressures of early career growth and the perception that financial planning is something to be done “later.”

But time is one of the greatest advantages young people have. The earlier they begin, the greater the power of compounding and long-term planning. As a parent, you play a pivotal role in shaping this mindset—starting with small conversations and practical steps.

Financial literacy begins at home

The foundation of long-term financial wellness is built in early habits. Conversations around budgeting, saving, and planning for future needs can begin well before your child receives their first salary. From their first school allowance to their first internship paycheck, your guidance and early intervention helps shape how they manage their finances well into adulthood.

How to guide your children towards financial confidence

Here are key strategies to help your children build a strong financial base as they prepare for their next life stage.

Budgeting: Prioritise saving before spending

Help your child reframe their approach to money. Rather than spending first and saving what’s left, encourage the reverse—save first, then spend what remains. This mindset, when adopted early, reinforces financial discipline and long-term thinking.

Encourage your children to think long-term about saving and the power of delayed gratification when it comes to growing wealth over time.

Building an emergency fund

Encourage your children to set aside at least three to six months’ worth of essential living expenses as a contingency fund. Placing this in a high-interest savings account ensures their emergency funds remain accessible while earning a better return than traditional accounts.

To visualise the funds needed for future studies—whether in the UAE or overseas—use our Education Calculator to help you plan and save systematically towards your child’s goals.

Starting with insurance savings plans

Insurance savings plans can serve as a safety net while also generating long-term returns. You could consider purchasing one early and transferring ownership when your child reaches adulthood. These plans can provide a guaranteed cash benefit that helps support key life events—further education, marriage, or even property purchases.

If they are already earning, guide them in selecting a plan suited to their income. Many such plans start at modest monthly contributions and may offer capital protection at maturity, supporting their financial growth while safeguarding their savings.

Begin preparing now— many financial institutions offer expert insights on how to finance your child’s education in the UAE and beyond. You can also learn more via Standard Chartered’s specialist resources.

Investing early: laying the foundation for long-term growth

Regular savings into mutual funds

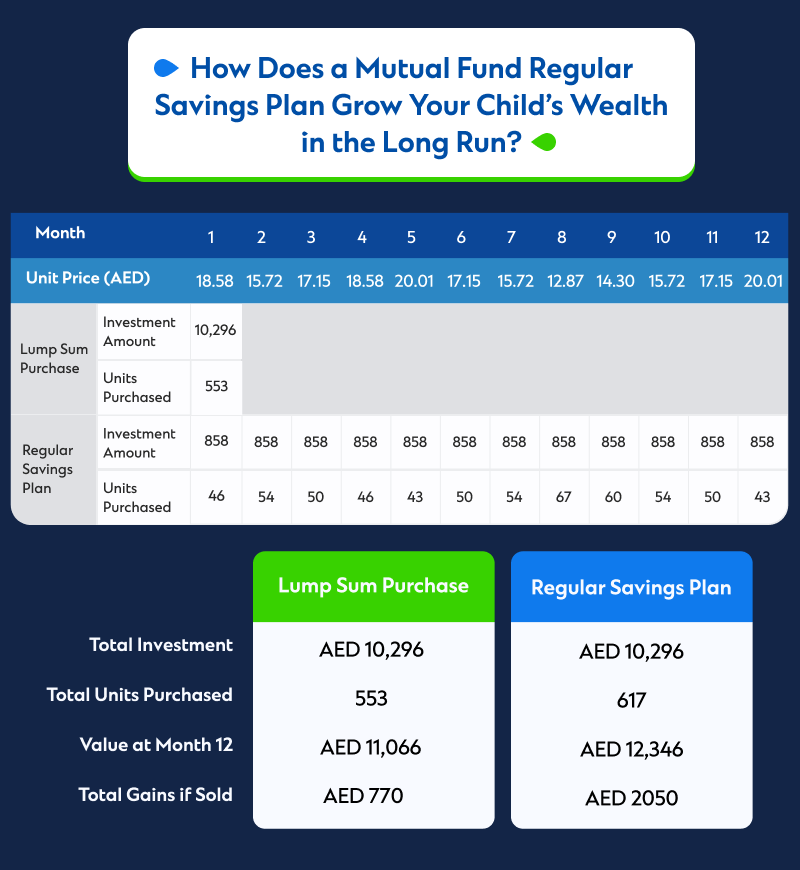

One of the simplest and most effective ways to help your child grow their wealth is through a Regular Savings Plan (RSP) into mutual funds. With minimum contributions starting at AED 300–400 per month (or currency equivalent), RSPs offer a structured way to invest regularly into diversified funds managed by professional asset managers.

Through a concept known as dirham-cost averaging, regular investing helps reduce the risk of market timing and smooths out purchase prices over time—ideal for young adults who are starting small and want to scale up gradually.

Exposure to equities for higher growth potential

For young investors who can tolerate more risk, introducing them to equities may be a logical next step. Investing in blue-chip stocks—established companies with stable earnings and dividend history—offers capital appreciation and income potential.

Remind your children about diversification: no single investment should dominate their portfolio. Many financial institutions and platforms do offer investors access to global markets and options to invest across sectors, geographics, like Standard Chartered’s Online Trading platform..

Preventing the cycle: don’t make your children the next Sandwich Generation

Without your own retirement planning in place, your children could face the dual burden of supporting both their families and ageing parents—a situation often referred to as the “Sandwich Generation.” Breaking this cycle requires thoughtful preparation: building your retirement reserves now gives your children the freedom to pursue their financial goals without additional stress.

Speak to your adviser about retirement income strategies that ensure your future is taken care of—so your children are free to focus on theirs.

Cultivating your children’s financial savviness starts at home

Preparing your children for financial independence isn’t just about giving them money—it’s about giving them the tools, knowledge, and confidence to manage it well. Whether it’s starting with budgeting, introducing them to insurance, or guiding them towards long-term investments, every step matters.

At Standard Chartered, we’re here to support your family through each stage of your financial journey. Speak to your Relationship Manager or contact us to learn how our solutions can help you and your children build towards a confident financial future.