-

26 – 29 October, 2025 | Boston, MA

Standard Chartered at AFP 2025

Use code AFP2025PARTNER to get USD100 off registration

Practical information

Location

Date

Register

Boston Convention and Exhibition Center, 415 Summer St, Boston, MA 02210

26 – 29 October, 2025

Register to attend AFP. Use discount code AFP2025PARTNER to get USD100 off AFP 2025 Boston through 24 October 2025.

Join us at AFP 2025

Join Standard Chartered at AFP 2025 in Boston, where over 7,000 treasury and finance professionals will gather. Connect with us at our booth #1814 to meet a true Liverpool Football Club (LFC) legend and grab exciting co-branded LFC giveaways.

Don’t miss our insightful sessions on ‘ISO 20022 Migration: Implications for Corporate Treasury’, ‘Integrating AI into Your Treasury Function’, and ‘Treasury Leadership in Mergers, Acquisitions, and Spin-Offs’, featuring Standard Chartered experts and industry-leading panellists. Elevate your treasury expertise with Standard Chartered at AFP 2025!

Event itinerary

2:30 – 3:30 PM ET | War Room: Treasury Leadership in Mergers, Acquisitions, and Spin-Offs

Location: Room 210A, Panel Discussion

In the dynamic environment of mergers, acquisitions, and spin-offs, Treasury teams are at the forefront, balancing the critical task of managing ongoing processes while preparing for the significant transitions across investments, hedging, financing, and banking relationships. This discussion brings together experienced treasurers, each sharing invaluable firsthand insights into how they effectively strategised, prioritised, and steered their organisations through the complexities of M&A. Attendees will leave with a practical checklist for seamlessly bridging current and integrating processes along with key lessons learned from an “almost” acquisition that ultimately reverted to business as usual.

Panel discussion

War Room: Treasury Leadership in Mergers, Acquisitions, and Spin-Offs

- Tai Carr-Fraser, CTP, Vice President & Treasurer, Capri Holdings Limited

- Wacef Chowdhury, Director, Transaction Banking, Cash Management Sales, Standard Chartered

- Peter Claus-Landi, Assistant Treasurer – Global Treasury Operations, GE HealthCare

- Connie Miner, CTP, SVP, Global Head of Treasury, News Corp

08:30 – 9:30 AM ET | Incorporating AI Into Your Treasury Function

Location: Room 257 AB, Panel Discussion

AI is transforming cash and liquidity management, making it critical for treasury teams to build a strong data strategy and align technology with core workflows. In this conversation, speakers who are actively adopting AI in their global cash operations share how they’re defining clear roadmaps for AI integration, addressing common implementation hurdles, and mitigating risks related to data quality, governance and transparency. Attendees gain practical insight into the current state of AI in cash management to prepare their organisations for change and discover what the next wave of AI-powered treasury solutions may bring.

Panel Discussion

Incorporating AI Into Your Treasury Function

- Larry Brehmer, Senior Advisor, TPG Angelo Gordon

- Arlene Cummings, Senior Director Banking Services, GE Vernova

- Timothy Kane, Corporate Sales Head, Transaction Banking – Technology, Media & Telecom, Standard Chartered

8:30 – 9:30 AM ET | ISO 20022 Migration: Implication for Corporate Treasury

Location: Room 157ABC, Panel Discussion

SWIFT, CHIPS, Fedwire, and other market infrastructures are transitioning to the ISO 20022 standard, which encompasses payments and account statements. While migration is currently mandatory for banks, corporations in many countries can choose to adopt it voluntarily. Implementing ISO 20022 offers corporations the opportunity to automate and standardise treasury operations processes, such as payment initiation and reconciliation. However, upcoming clearing requirements for messaging, data, interoperability and implementation must be considered before these changes take effect in 2026.

This session provides an overview of ISO 20022 standards for corporations, focusing on payments and account reporting, the benefits of implementation, and experiences from implementation projects.

Panel discussion

ISO 20022 Migration: Implication for Corporate Treasury

- Larry Brehmer, Senior Advisor, TPG Angelo Gordon

- Jonathan Paquette, Chief Product Officer, Treasury Intelligence Solutions

- Sebastian Hindelang, Director, Digital Channels Solutions, Standard Chartered

Network with us

Meet us at AFP 2025 in Boston, MA at Booth #1814.

Please note: Schedules may change at any time.

Win a signed LFC Jersey

Monday, 27 October and Tuesday, 28 October from 3:30 PM to 3:45 PM.

Q&A with LFC Legend

Monday, 27 October at 3:00 PM with LFC Legend Vladimir Smicer.

Meet & Greet with an LFC Legend

Stop by for an appearance and autograph session on Monday, 27 October between 10:00 AM to 4:00 PM.

Our delegates

Visit Standard Chartered Booth #1814 and connect directly with our delegates.

For media inquiries, please contact Sammi He at +1 862 448 8488, or Sammi.He@sc.com

A new era of payments brings strategic opportunities

Evolving consumer expectations, technological innovation and new regulatory frameworks are pushing financial institutions (FIs) to reimagine not just how they process payments – those that adapt quickly and strategically will gain a competitive edge.

Insights

Explore some of our latest insights on key topics.

Real time treasury

Digital assets for next-gen treasury

Corporate treasurers must act now to harness the full potential of digit…

Modernising treasury towards Web3

A new innovation blueprint is reshaping the role of treasury. How can tr…

Unlocking trapped cash and the rise of AI in treasury

Discover the opportunities and challenges treasury professionals see in …

Treasury solutions

Trade Track-It

Looking for a faster, smarter and easier way to check the status of your trade transactions? With Trade Track-It, you can – anytime, anywhere. A digital tool that gives you real-time end-to-end visibility.

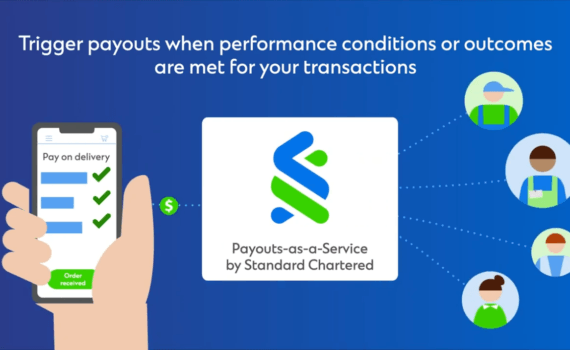

Payouts-as-a-Service

Introducing Payouts-as-a-Service, a bank-grade fintech solution by Standard Chartered that allows digital businesses to seamlessly manage one-to-many payments to parties in their ecosystem.

Sustainable finance

What Chint did in improving renewable energy in Portugal

How we supported Chint with EUR420m financing, securing 5.5GW new solar capacity in Portugal and China-Europe cr…

Digital innovation

Three possible futures for digital assets trading – wh…

Where do we trade tomorrow? Exchanges, peer-to-peer, and the quest for a…

The future of stablecoin

Clear regulations will pave the way for enhanced collaboration between b…

Data unleashed: AI and ISO20022 as engines for growth

The ISO 20022 migration is not just a compliance exercise; it is a catal…

Digital Assets

Seamless, secure access to digital asset markets for institutional investors.

Stablecoins

Enhancing cross-border FX payments with real-time settlements.

ISO 20022

ISO 20022 brings faster, more transparent transactions. Understand the implications and benefits.